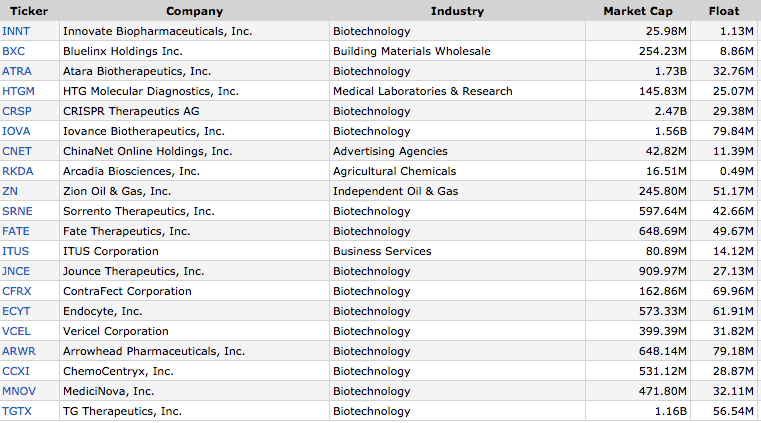

20 stocks have more than doubled year-to-date.

Many are biotech, but this is a cyclical, not a structural reason. A structural reason is one that persist; one that shows over and over again.

All of them had a market cap of under $1 Billion on January 1st.

All of them have a float of under 100 million shares. Most have a float of under 50 million shares.

Float is the difference between Outstanding Shares and Restricted Shares.

Restricted shares cannot be traded until certain conditions are met. They are usually employees compensation stocks that have not been vested yet. Founders’ stock that is locked up (the founders and private investors in new public companies are usually not allowed to sell their shares in the first 6 to 12 months after the IPO).

A small float can cause a major supply/demand disbalance and a substantial price appreciation or depreciation in a short period of time.

A small float is a double-edged sword. It can lead to fast moves but also liquidity can disappear suddenly and leave you hanging if you own a large number of shares.

Most of the best performers YTD were neglected. They did not have strong momentum going into 2018. Most were/are not profitable. None of them are fastest growing companies.

Most started their move with a huge-volume price expansion. Then, they consolidated and gave a decent secondary entry.

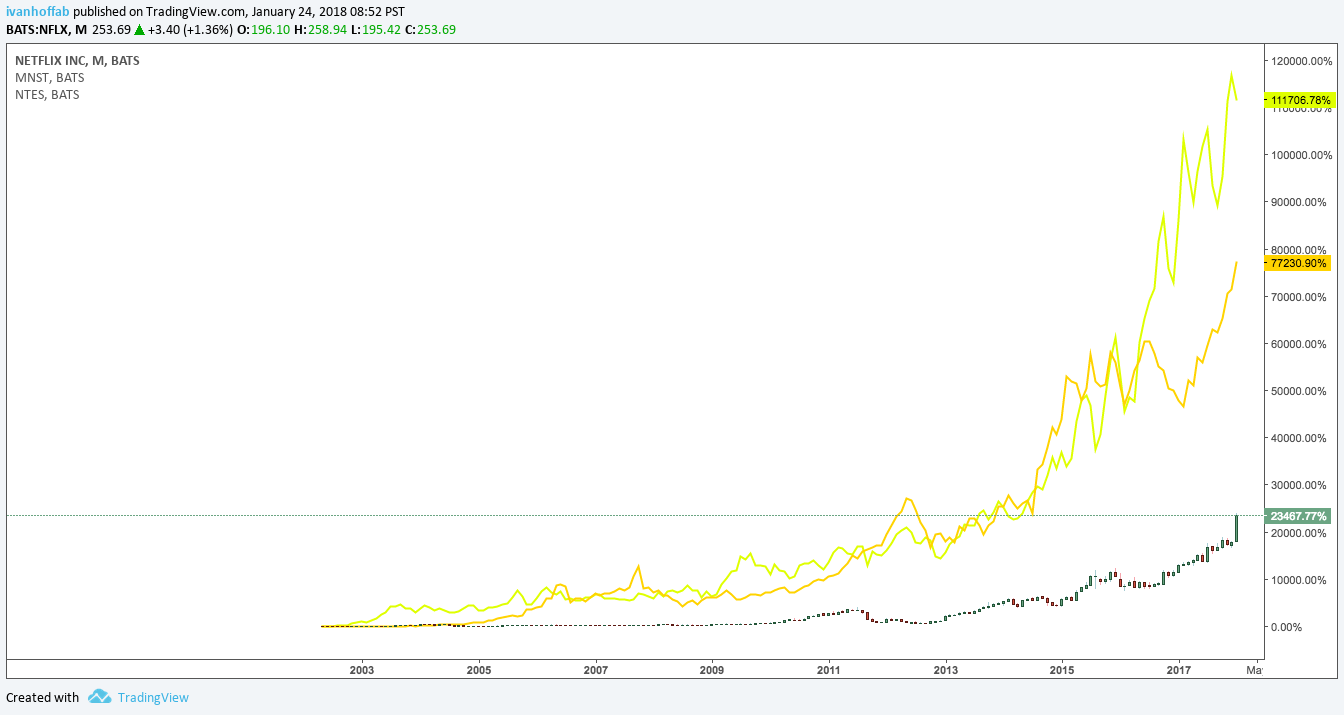

Keep in mind that this analysis is made on a really short time frame. Year-to-date means less than three months as of today. If you study the performing stocks for the past 3 years, you might find out entirely different reasons behind their moves.

Know your time frame and the catalysts that matter the most for it.