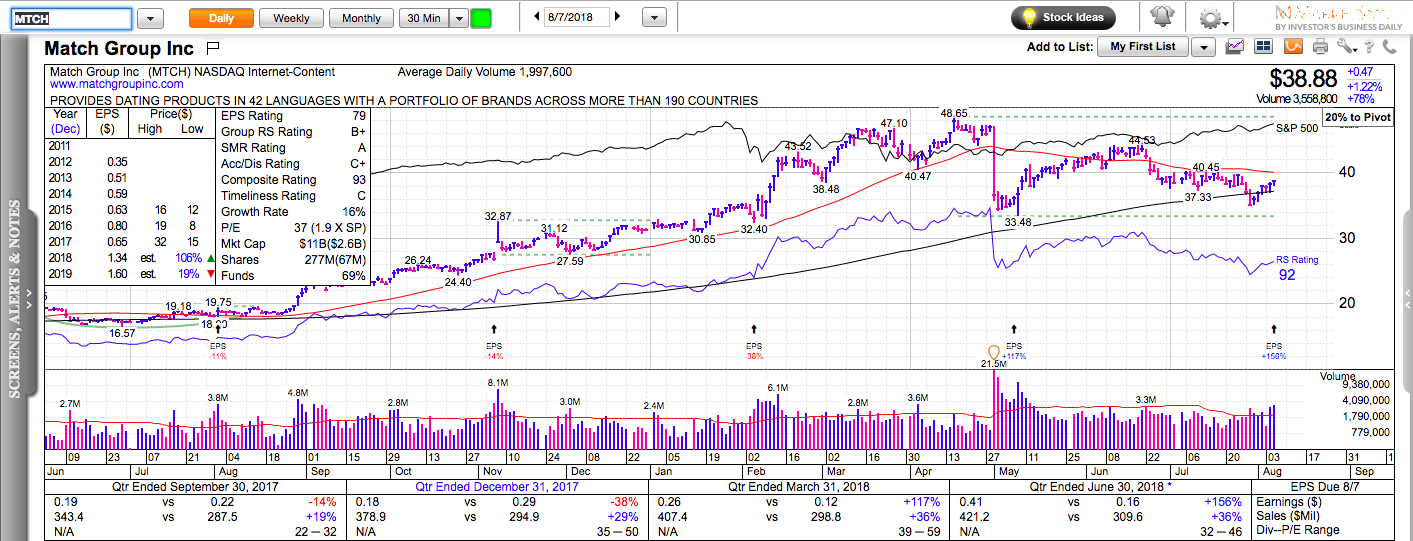

Charts in this post are powered by MarketSmith.

While most emerging markets are under pressure, U.S. stock indexes are still trading near all-time highs. How long can this decoupling persist?

Can the record corporate earnings and sales growth alleviate the fear of emerging markets’ contagion? So far the answer is a resounding Yes as dip buyers continue to be active on the slightest pullbacks.

It’s not all sunshine and rainbows in the U.S. markets either. While retailers and software stocks are crushing estimates and breaking out, homebuilders are near 52-week lows. Maybe rising interest rates are finally starting to matter for some sectors or at least the market believes they will matter for future earnings.

We also go over some new ideas.