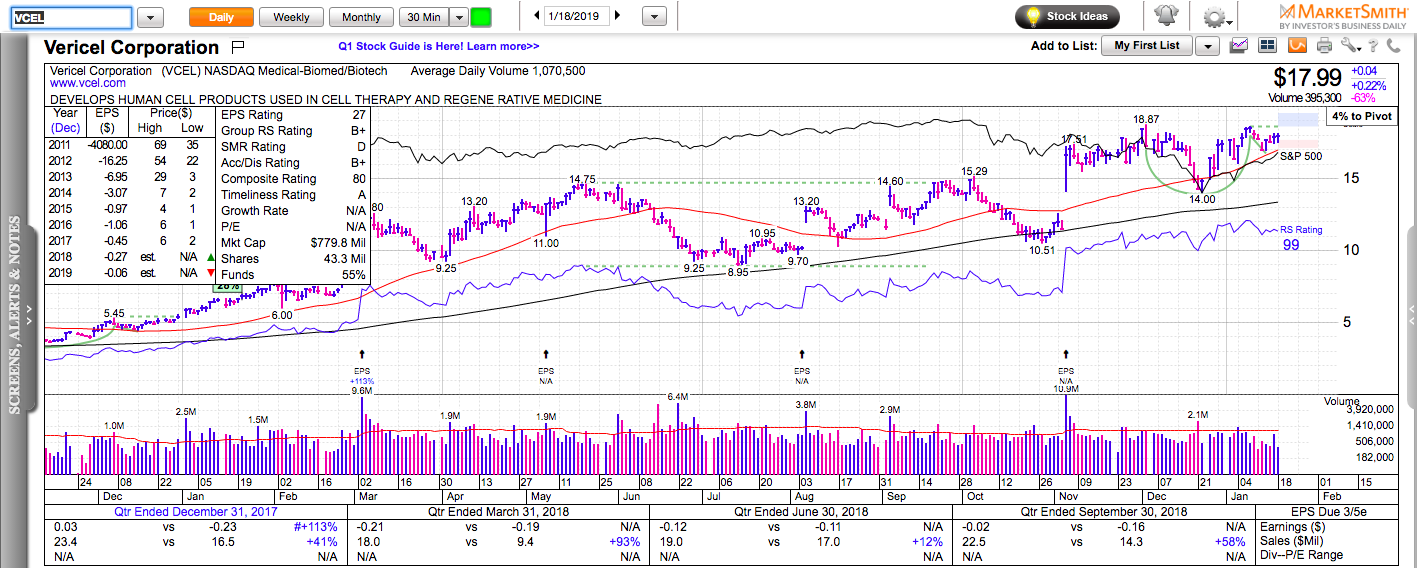

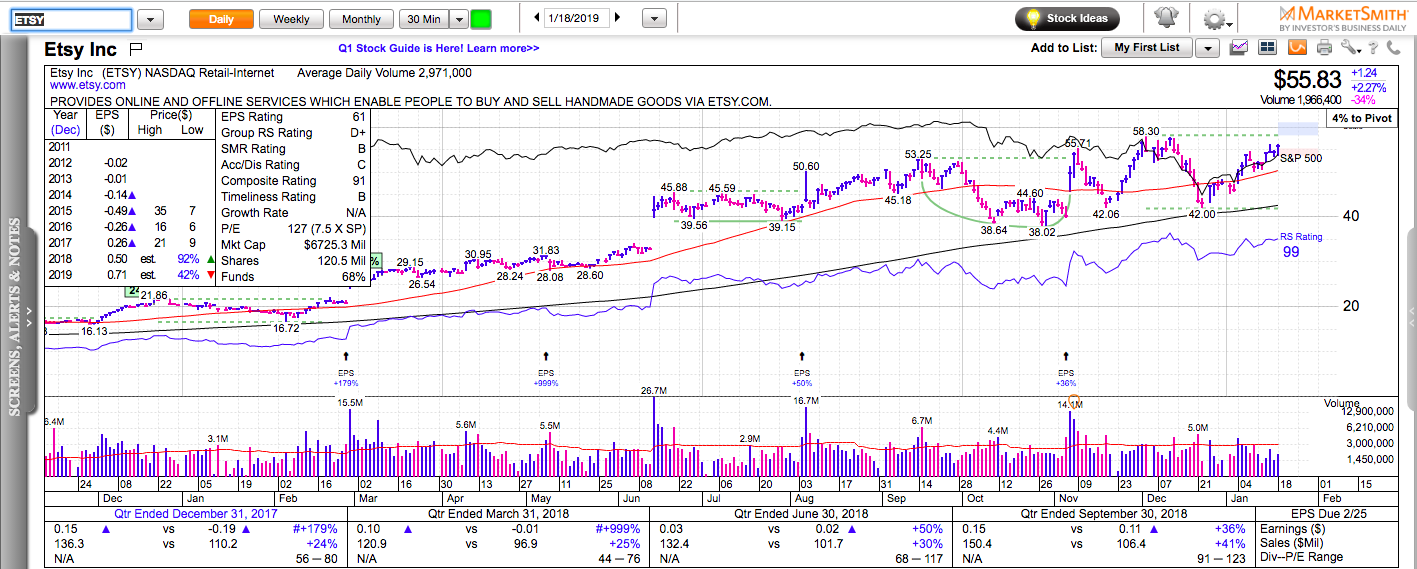

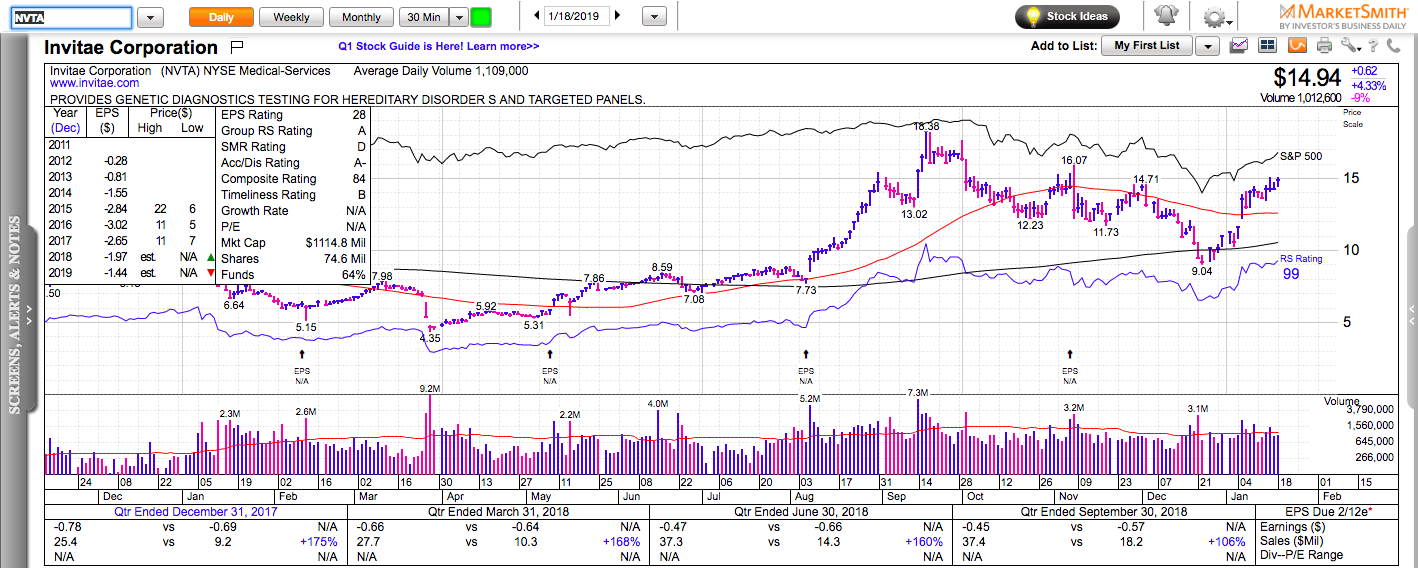

All charts on Momentum Monday are powered by MarketSmith

In the last quarter of 2018, the market priced in a potential recession at some point in 2019. Judging by the price action and earnings results we are seeing, the market is currently re-evaluating its thesis. Scars from violent corrections don’t heal fast. This is why there has been so much scepticism of the rally in the past few weeks. Now, we are at a point where the fear of missing out is starting to kick in.

There’s always a chance that this is just a bear market rally and everyone is being sucked in before another leg lower. Changes in sentiment don’t happen overnight. Before a major reversal, we will see an increasing number of failed breakouts and momentum stocks starting to underperform. There are not enough reasons to turn bearish.

In this Momentum Monday, we cover a few potential scenarios for the major stock indexes and go over some ideas in biotech and software.

Check out my latest book: Swing Trading with Options – How to trade big trends for big profits.