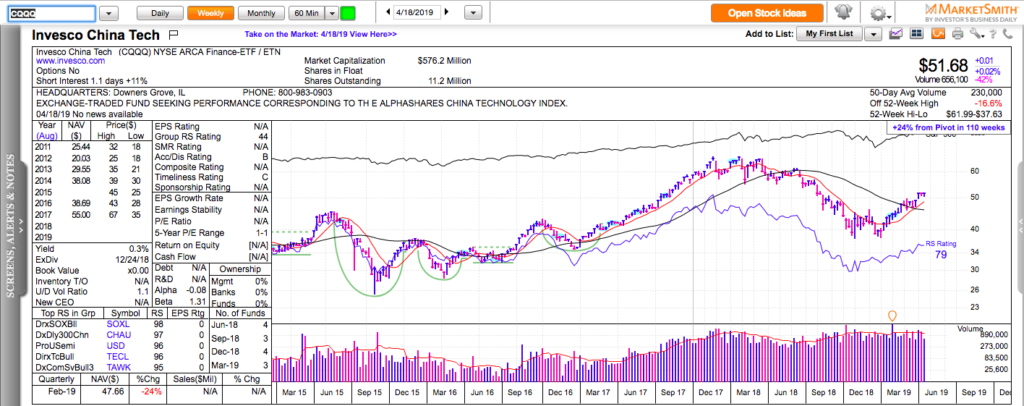

All charts on Momentum Monday are powered by MarketSmith

While biotech, healthcare, and some software stocks are under pressure, the so-called old-economy sectors – finance, manufacturing, and transportation, are shining. Money never sleeps, indeed. It just rotates from one sector to another.

The Nasdaq 100 is at all-time highs led by the enterprise software giant Microsoft. Google and Amazon are not too far behind – both of them are setting up for potential breakout and have earnings due soon. Apple is back to a trillion-dollar valuation.

Check out my two best trading books:

Swing Trading with options – How to Trade Big Trends for Big Profits

Top 10 Trading Setups – How to find them, hot to trade them, hot to make money with them.