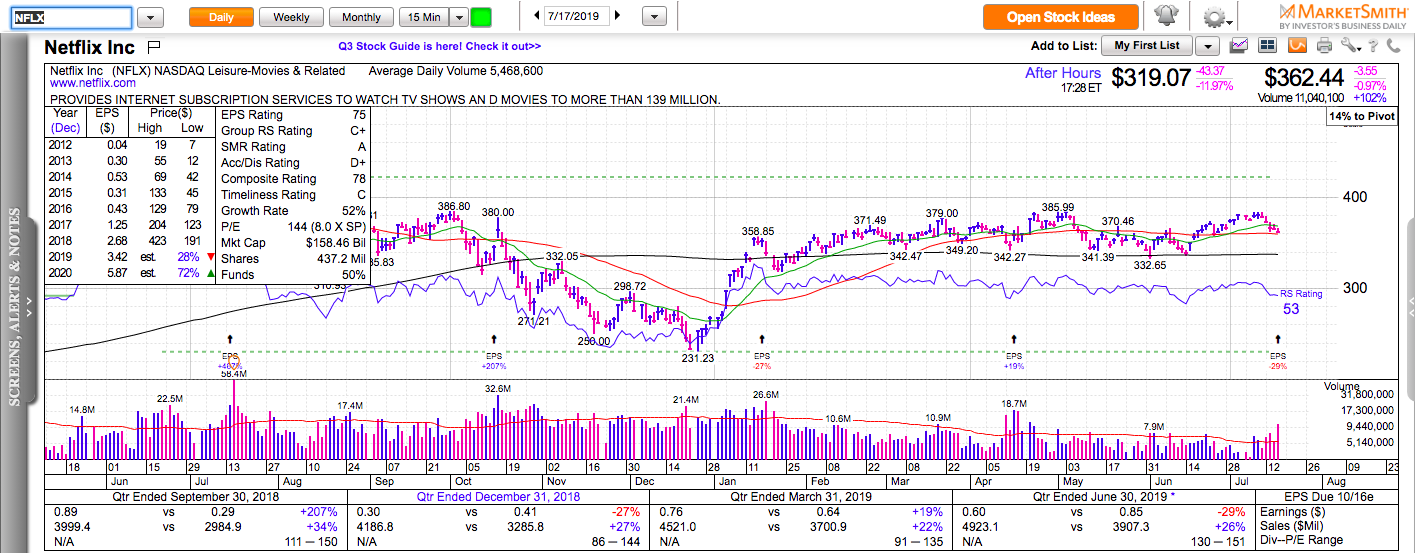

All charts in this post are powered by MarketSmith

After spending most of 2019 trading between 340 and 380, Netflix is trading under 320 after their latest earnings report. The area near 320 has major pivotal importance and I suspect there will be a war around that level tomorrow morning. The bulls will try to hold it and potentially push the stock towards NFLX’s 200-day moving average which is around 340. $340 is now very likely to act as resistance and it would be a good spot to initiate a short for a quick trade.

If $317-318 is lost, the next major area of potential support is 300.

P.S. Check out my last two trading books. Both are super practical, packed with actionable information that can be put to use right away:

Swing Trading with options – How to Trade Big Trends for Big Profits

Top 10 Trading Setups – How to find them, how to trade them, how to make money with them.