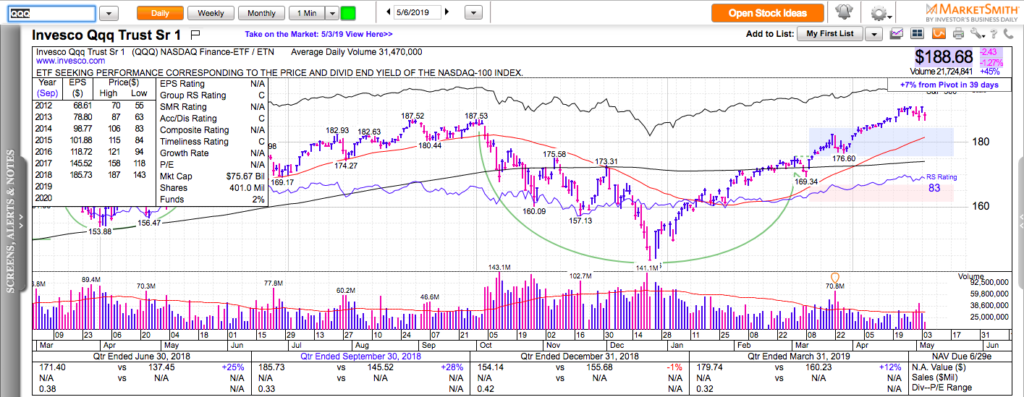

All charts in this post are powered by MarketSmith

Buying dips in a bull market is a high reward – low-risk setup. The challenge is that it is not as easy as it seems when you look at past charts.

Here are the four typical stages of a bull market pullback (shakeout):

Stage 1: The indexes close at new all-time highs after a few up days in a row. Everyone is buying breakouts and chasing stocks. Making money seems easy. The fear of missing out defines people’s decision making.

Stage 2: Quick and unexpected pullback. Those who bought at the highs are now underwater. We are starting to see an increasing number of failed breakouts. The sentiment is sobering up but it is still mostly bullish. There are three distinct groups of active market participants here – Group A – those who are quickly taking loses; Group B – they are buying the slight dip; and Group C – those who wait for a more significant pullback to enter.

Stage 3: The dip gets deeper. The sentiment is starting to turn bearish. There is no trace of the fear of missing out. Volatility is rising. Headlines are predominantly negative.

Group A (those who quickly cut losses in Stage 2) are starting to think about shorting stocks.

Group B (those who bought the slight dip in Stage 2) are cutting losses, complaining about how choppy the market is and are going to a mostly cash position.

Group C (those who were waiting for a bigger pullback) are now scared and don’t want to buy the dip anymore.

Stage 4: Many stocks are down to levels of potential support or are starting to recover after false breakdowns.

Group A (those who started to short in stage 3) are now underwater and starting to cut losses. Overwhelmed by the recent choppiness in their account, they have lost confidence and are not thinking about buying stocks yet despite seeing some positive developments in price action.

Group B (those who went mostly in cash in stage 3) – the majority of them still don’t trust the market but some are dipping toes in the water with small positions and seeing positive results.

Group C (those who initially waiting for a bigger pullback but got scared when it came) are still suspicious of the market activity. Most don’t do anything. Some open small starter positions.

Stage 4 is typically the environment which offers the best trading opportunities from a risk-to-reward perspective. After stage 4, there’s Stage 1 again, where everyone feels that it is safe to go back in the market and making money is easy.

This four-stage cycle repeats multiple times in a general market uptrend and it is the reason why many active traders struggle in a bull market.

Check out my two best trading books:

Swing Trading with options – How to Trade Big Trends for Big Profits

Top 10 Trading Setups – How to find them, hot to trade them, hot to make money with them.