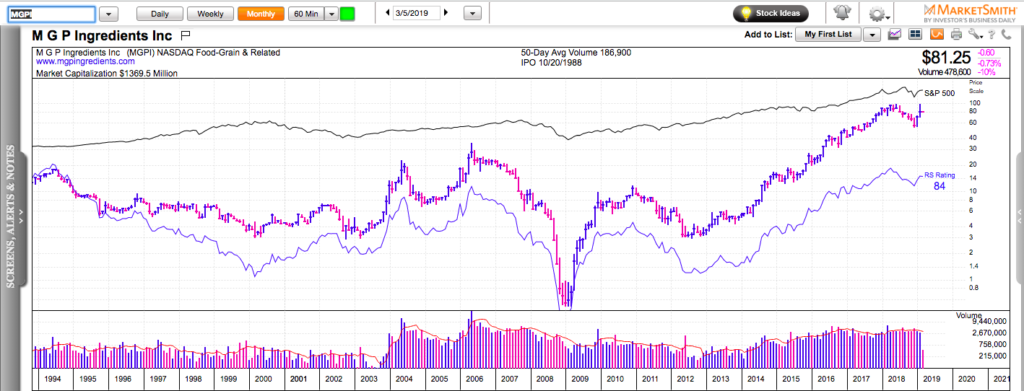

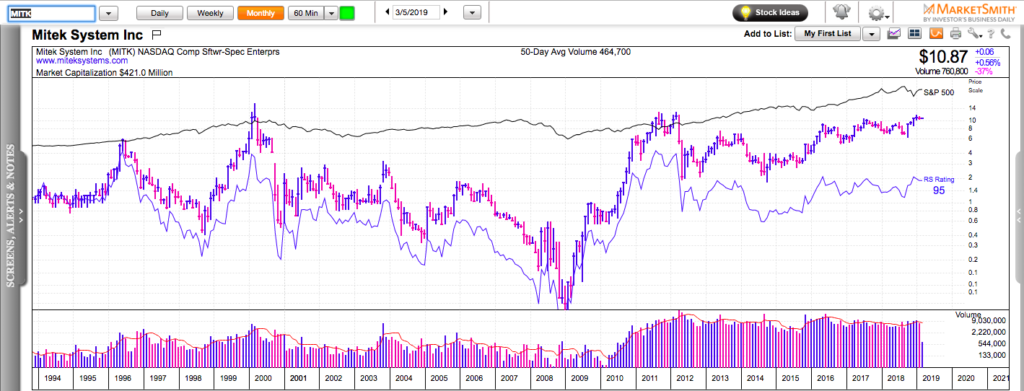

All charts on Momentum Monday are powered by MarketSmith

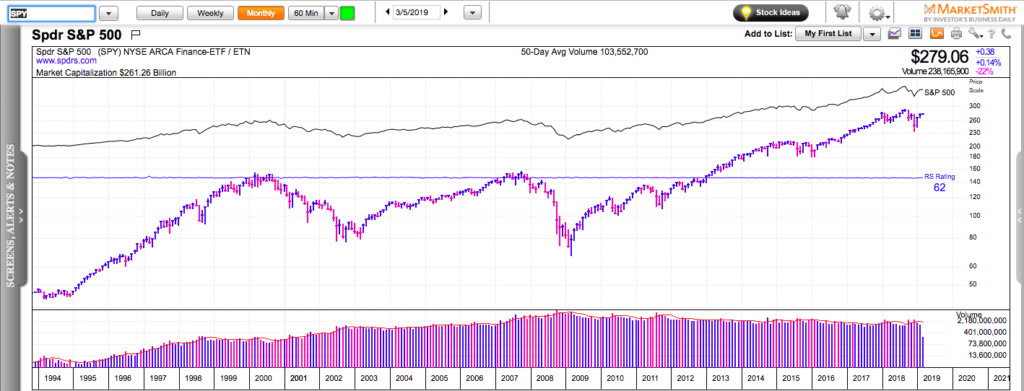

The major U.S. stock indexes pulled back from areas of major resistance. $280 for SPY, 175 for QQQ, and 160 for IWM (Russell 2000). Is this the beginning of a significant leg lower or just another garden-variety shallow correction. Judging by the price action in many momentum stocks, it looks more like the latter.

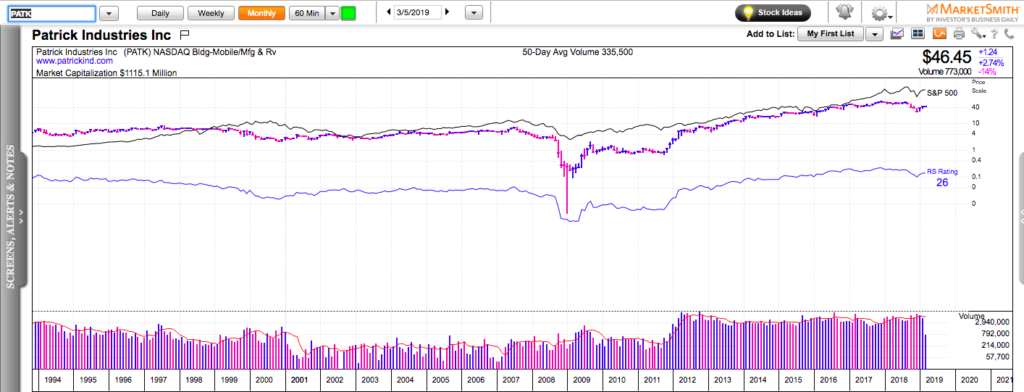

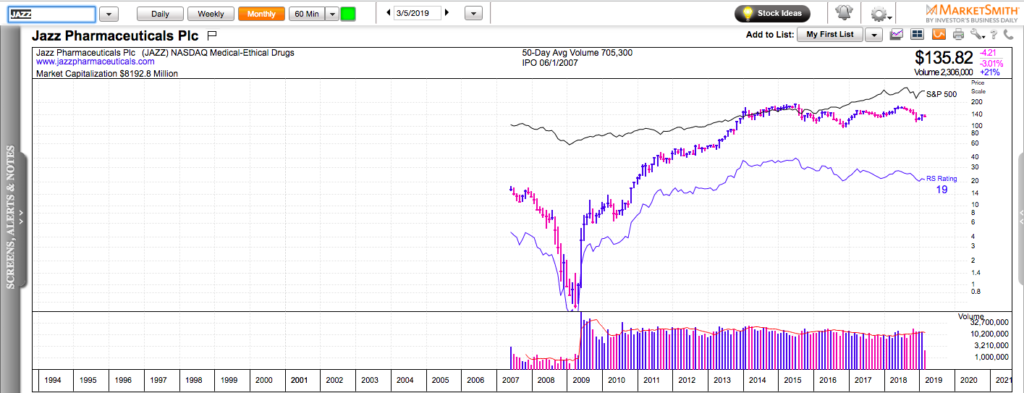

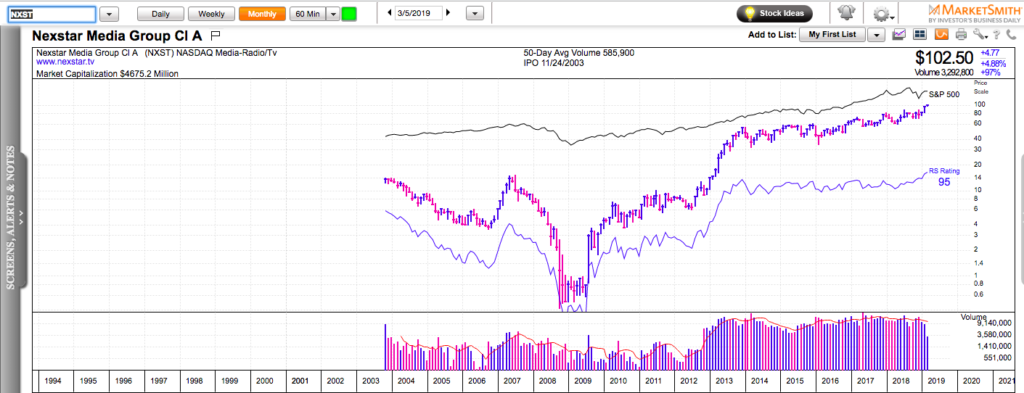

Momentum stocks are often leading the market, higher and lower. If the market declines and most momentum names go sideways or even try to break out, the correction is most likely a buying opportunity. This is exactly what are seeing in the current market.

Keep in mind that no indicator has a 100% success rate. If some unexpected news comes out of nowhere and surprises the market, those same momentum stocks will get hit hard and will fall with the rest of the market. This is why I am using the expression “most likely” – it’s a probability, not a certainty.

Check out my latest book: Swing Trading with Options – How to trade big trends for big returns.