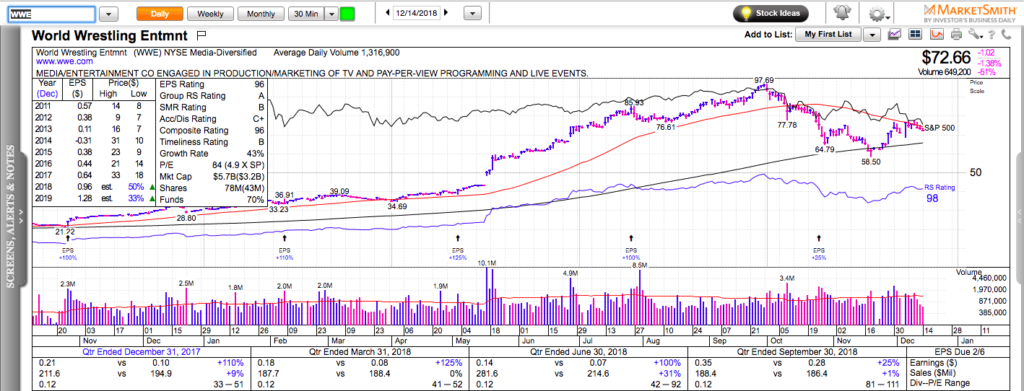

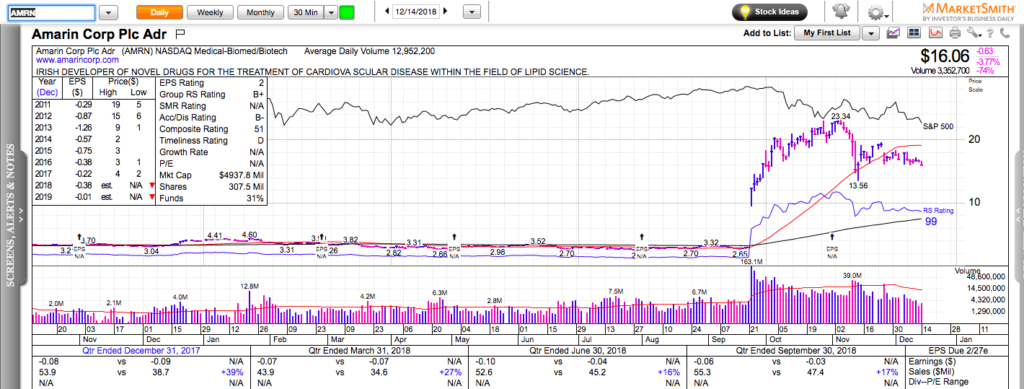

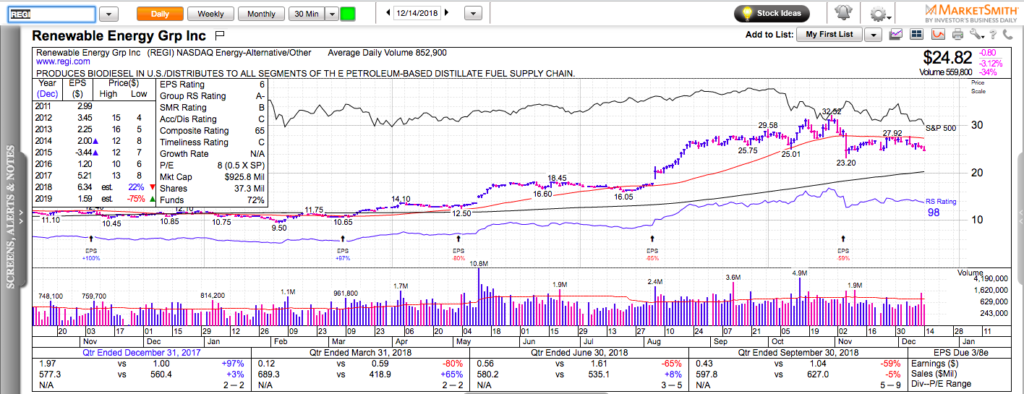

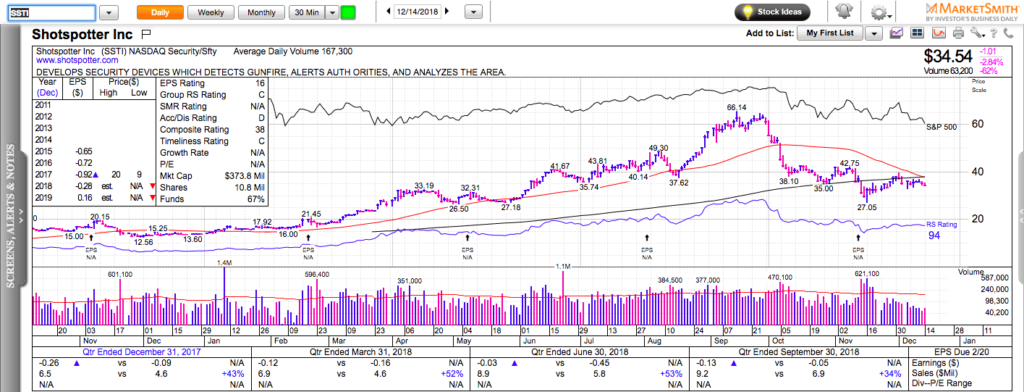

All charts in this post are powered by MarketSmith

The market is still in a correction mode but plenty of stocks have had a good year. As of December 15, there are 62 that have more than doubled. If you study their charts, you will notice how the majority of them started their move with a huge-volume breakout to new 50-day highs.

We see quite a few enterprise software names on the list, which only comes to remind us to always pay attention to industry relative strength. It is a lot more sustainable catalyst than just company’s earnings: TWLO, TTD, OKTA, MDB, AYX, COUP. Most of these names continue to be among the strongest stocks currently in the market and are likely to outperform if the general market bounces.

There are also a few cannabis related stocks, which was one of the hottest industries in 2018: TLRY, NBEV.

As usual, the list is dominated by biotech, healthcare and medical research names which account for almost half of the big 2018 winners.

There are a couple turnaround stories in the retail space – CROX and FOSL. There were a lot cannabis-related earlier in the year, but the correction in the last two months has caused a lot of damage to the sector.

While the S&P 500 is down 11.2% from its 52-week highs, the 2018 Doubles are down on average 24.3% from their 52-week highs. Most of them offer multiple great long trading opportunities during their ascent. Now, quite a few of them are setting up on the short side. Some examples to consider: WWE, REGI, SSTI, AMRN,

Check out my latest book: Swing Trading with Options – How to trade big trends for big returns.