All charts in this post are powered by MarketSmith

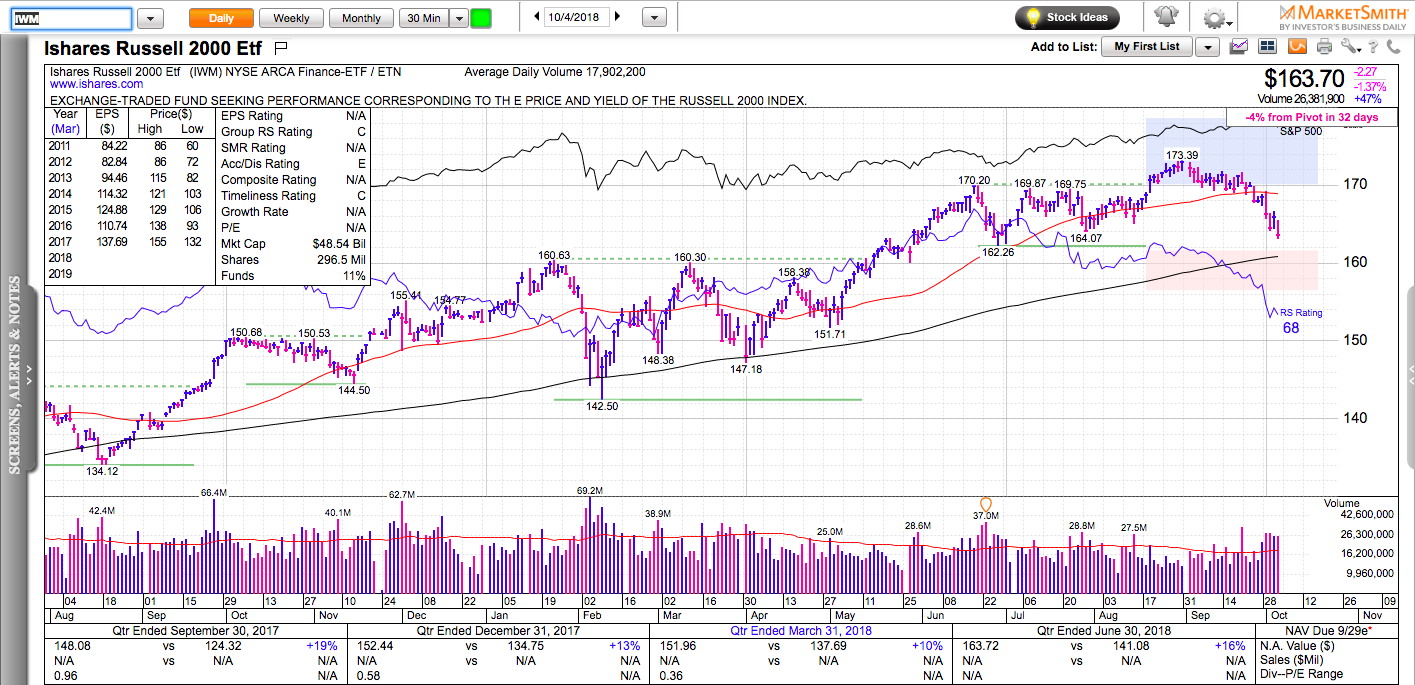

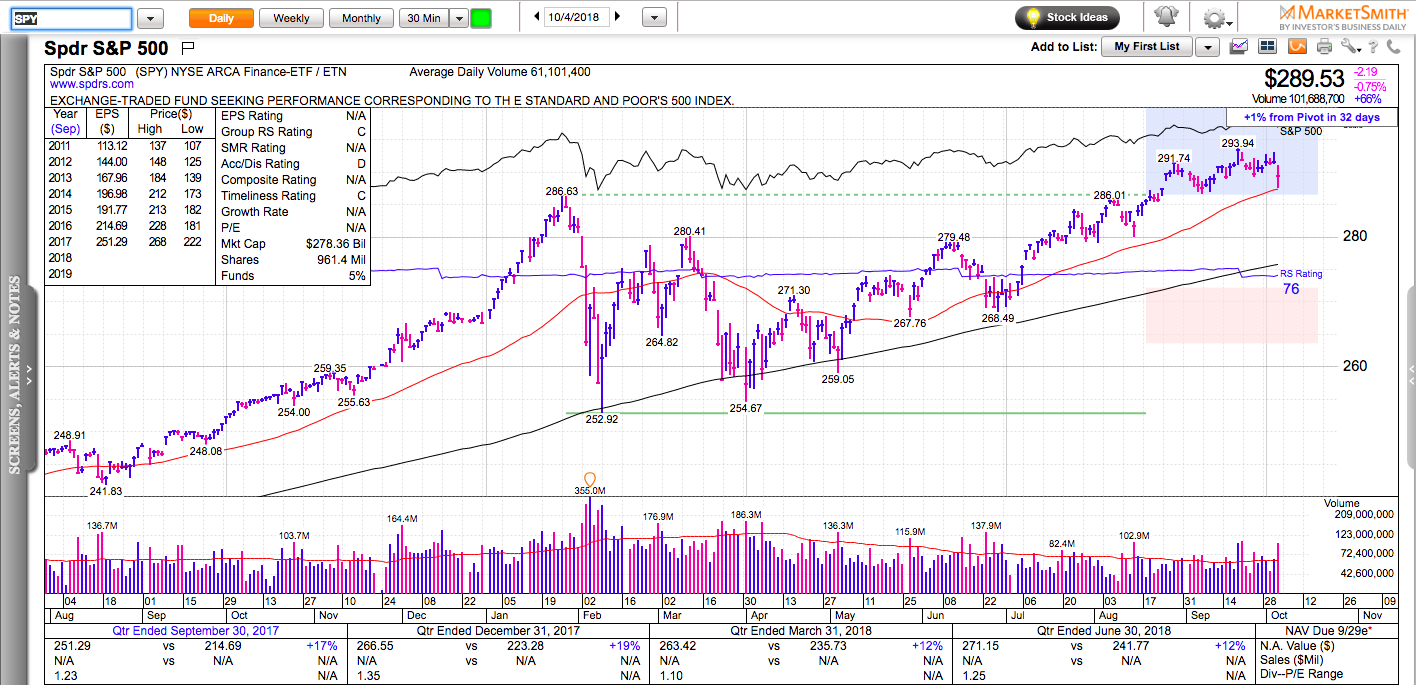

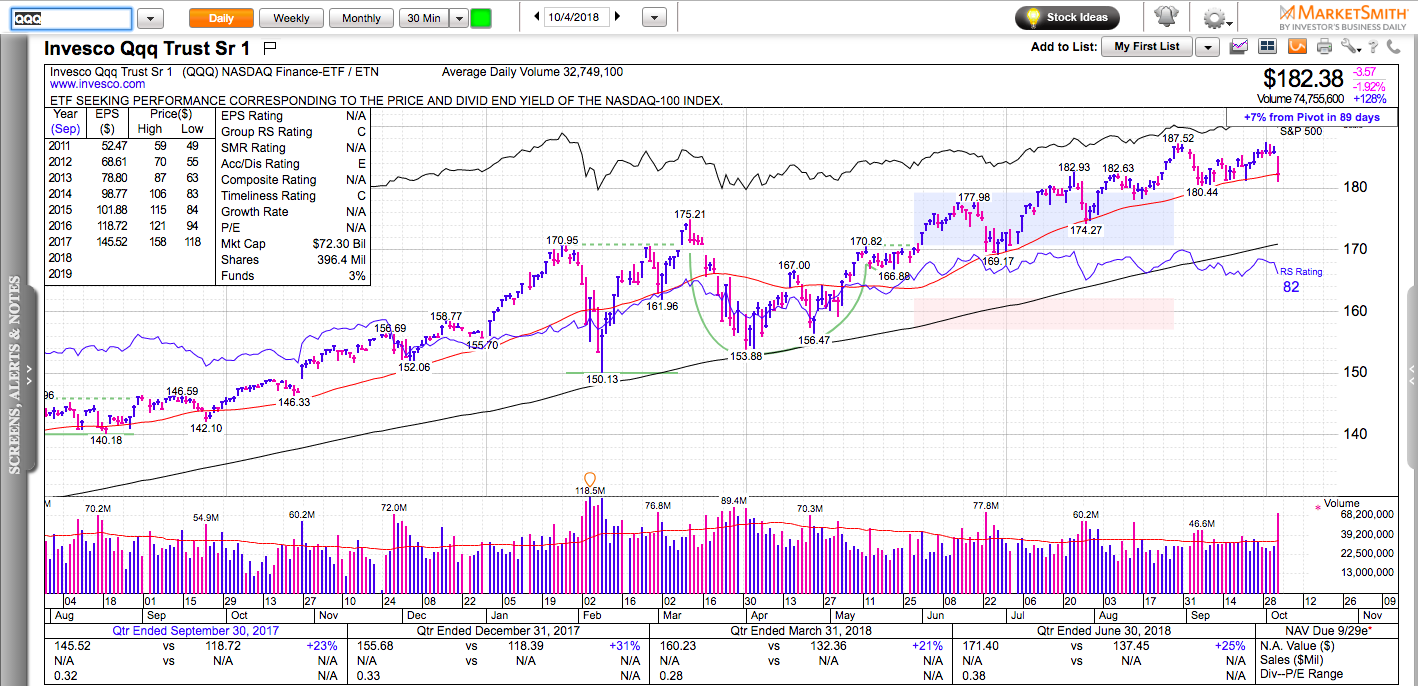

Today’s selloff has been foreshadowed for at least a couple weeks by the action in small caps, market breadth, and momentum stocks. The question is if this is the beginning of something more serious or the culmination of just another garden-variety pullback. No one really knows the answer. It’s important how SPY and QQQ act around their 50-day moving average. If they close decisively below it, we are likely to see a few more weeks of choppiness.

I notice that many people get frustrated every time the market sells off because many continue to trade the same setups that worked well in a strong market. Different markets require different approaches. It seems people forget that the same high-momentum stocks that outperform significantly when the market averages rally, can turn into excellent short setups during market corrections. Don’t be a one-trick pony. Have a plan for market corrections.

Pay attention to high-momentum stocks that fall 2-3% in a day and close below their 10-day EMAs. Such setups can provide a quick 2-3 day shorting opportunity in a weak market. The 50dma is a good place to cover.

Don’t forget to check out my latest book: Swing Trading with Options – How to trade big trends for big returns.