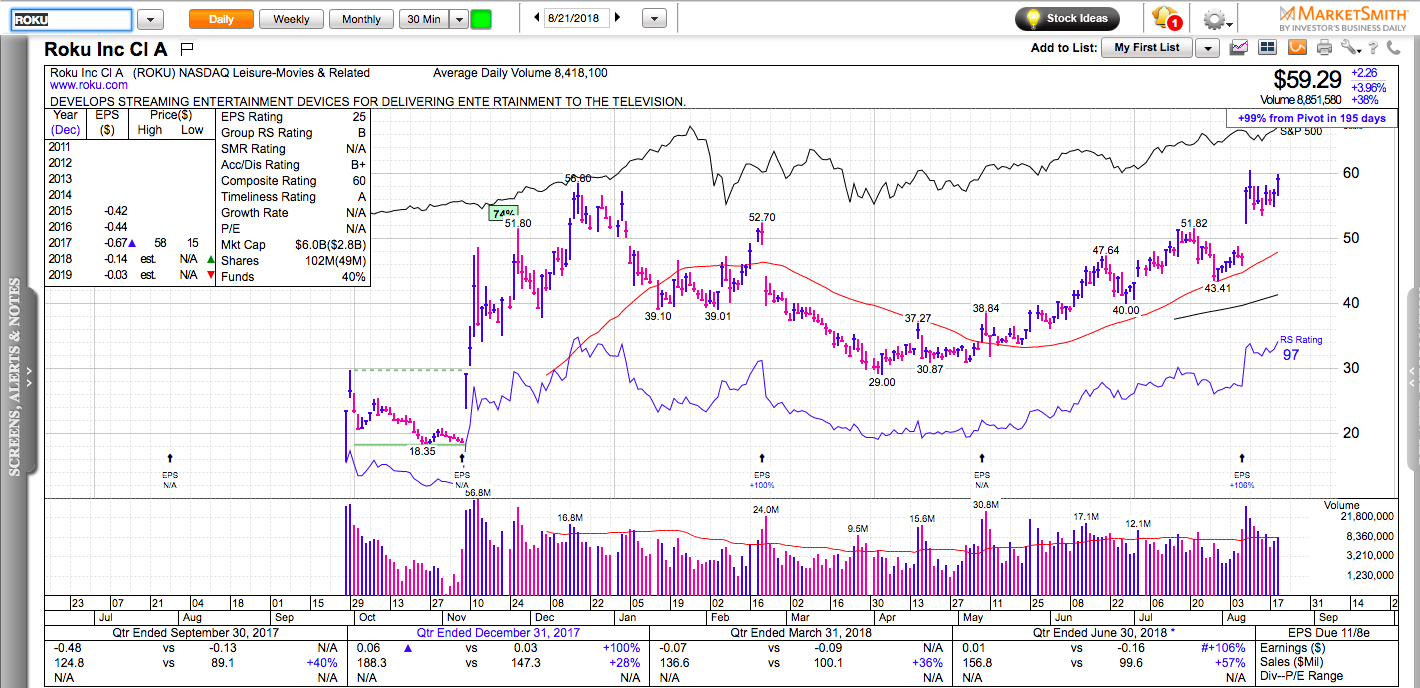

All charts in this post are powered by MarketSmith

There are currently many eyes on ROKU. Some say that too much attention is never good for a stock and it often leads to failed breakouts. I say, sometimes great setups look like great setups and there is no reason to overthink and overcomplicate things. I am long ROKU for the following reasons:

1) It crushed earnings estimates two weeks ago: analysts expected a significant loss, ROKU reported a small profit. Big earnings surprises typically lead to big moves.

2) The market reacted positively to ROKU’s earnings report: it gapped up and it closed near the highs of its earnings day’s price range. The stock has consolidated in a tight range near its all-time highs ever since.

3) There are plenty of disbelievers in the stock and the company’s product. As a result, 13% of its float is short. Short interest is often a source of future demand, especially when short sellers are forced out of their positions when a stock keeps climbing higher.

4) We are in a bull market, which means that most stocks setting up for a breakout are likely to break out and many breakouts are likely to follow through.

A break over $60 might lead to a quick move to $65-70. A close below ROKU’s 10-day EMA (currently near 55) would invalidate my thesis.