All stock charts in this post are powered by MarketSmith and I am an IBD Partner.

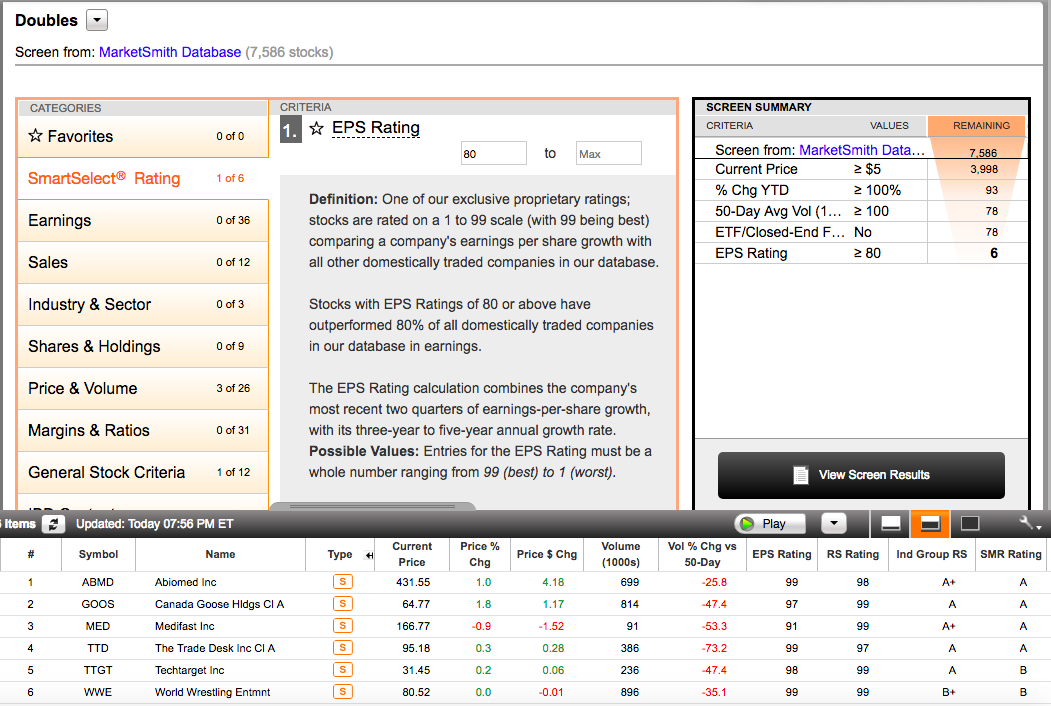

I ran a MarketSmith screen to see how many stocks priced above $5 and trading at least 100k shares a day, doubled year-to-date. The result: 78.

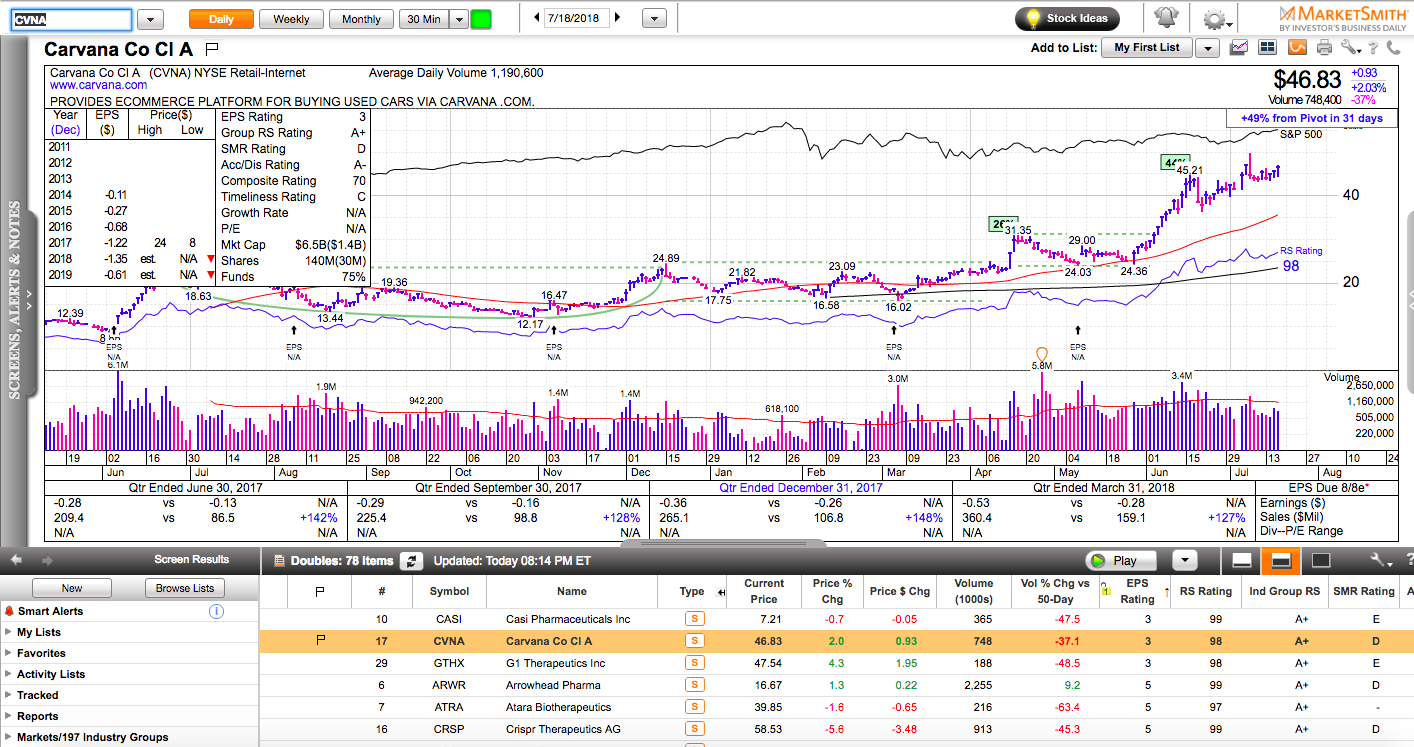

One can easily assume that most of those stocks probably belong to very profitable companies. I applied an earnings quality filter. It turns out that only 6 out of the 78 stocks are in the top 20% in earnings quality. This should challenge the common-held belief that earnings growth is the driving force behind strong price performance. The market is a lot more nuanced and complicated in a one to twelve months perspective. Expectations for future price gains drive demand and supply in the short-term and nothing impacts those expectations more than recent price action. Price momentum continues to be one of the least understood and most powerful characteristics behind many of the best-performing stocks every single year.