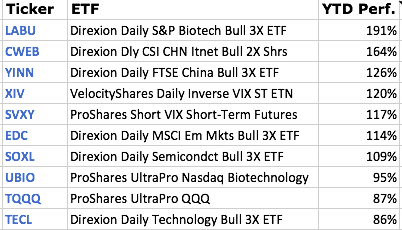

Contrary to the popular opinion, the best performing ETF year-to-date is not the inverse short-term VIX ETN, XIV. A brief glance at the best performing ETFs so far this year doesn’t only tell you what has been working – in this case, biotech, China, emerging markets, and semiconductors. It also gives you a hint of what could be hot if there’s any performance chasing in the fourth quarter.

Taking setups in a currently hot industry is the single best tool for good risk management because it minimizes the number of failed trades and substantially increases the chances of catching a big short-term move. There are two main ways to gauge industry relative strength:

- Top-down – by looking at the performance of all industry ETFs on various time frames.

- Bottom-up – by looking at all individual stock setups. The industries with the most constructive setups are the ones currently in play.

I apply both approaches.