The stock market often discounts events that haven’t happened yet. As a result, it sometimes discounts events that will never happen. Other times, it will predict and influence the future with uncanny accuracy.

Prices change when expectations for future profits change. Expectations often change before fundamentals change.

Take NVDA, for example. It went from $20 to $170 in the past two years. The first two-thirds of its move was mostly based on P/E multiple expansion. The market was willing to pay more for the same amount of current earnings per share. As NVDA’s valuation increased, the percentage of its short float followed. Until earnings caught up.

Notice how its short interest fell off a cliff around the $100 level. This coincided with a drop in NVDA’s forward P/E ratio. This is a typical story that we see in so many other growth names. Once fundamentals confirmed market’s expectations, short-sellers retreated.

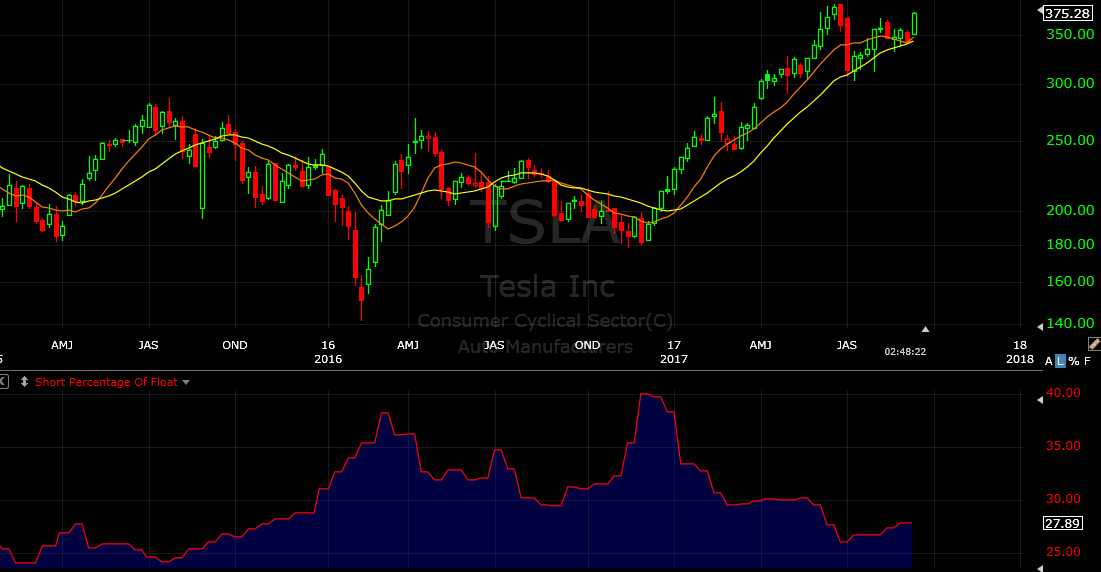

Short interest in momentum stocks doesn’t always rise with valuation. Tesla is a great example. Notice how the percentage of its short float spiked when it broke below its 20-week moving average in the second half of 2016. Short interest has been reduced significantly in 2017 as higher stock priced led to short covering and short covering led to higher stock prices.