In his latest post, Frank Zorrilla makes an astute observation that the four best-performing ETFs year-to-date were all down several years in a row heading into 2016.

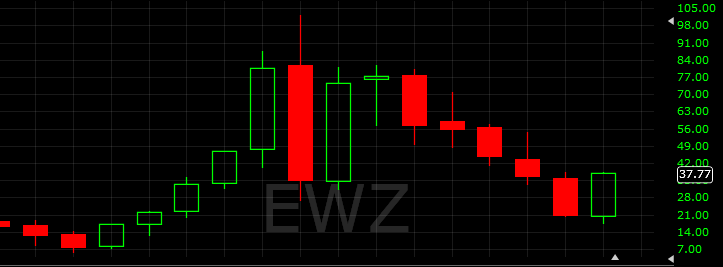

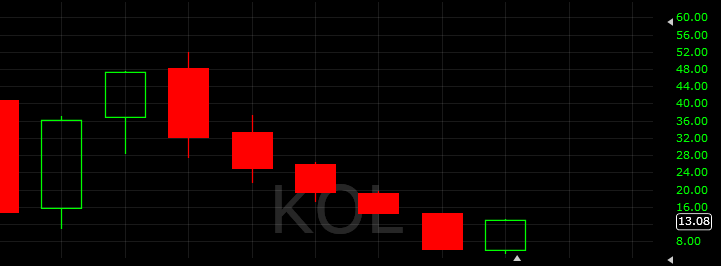

The best performing single ETF’S this year have been KOL (+108%), GDXJ (+107%), EWZ (+83%), and GDX (+72%).

Recent data by Dimson, Marsh, Staunton database, showed median country returns of 8.74% (all years) and 15.94% after three down years in a row, both suggest that you will double the median return of all years if you own a country ETF that is down three years in a row. It’s a very rare occasion that only happens 3% of the time.

If you take a closer look at this year’s top ETF gainers, you will notice that they were not down three years in a row. They were down 4 or 5 years in a row in the midst of a powerful bull market. Anyone who thought they were a great bargain in early 2014 or early 2015, bought too early and saw another 40% to 60% decline before there was finally a more sustainable relief rally. It doesn’t matter if you just manage your own money or other people’s money. You cannot lose 50% on a position in a bull market and remain in business.

The best performing industries in any given year are usually the ones that surprise the most. What are the type of industries no one expects to substantially outperform? The ones that were down a lot several years in a row and the ones that were up the most several years in a row. In the first case, no one really cares about those industries. They are not simply hated, they are ignored. In the second case, no one believes that their upside run can continue any longer.

There is not one sure recipe for finding the best performing industries every single year. Sometimes, they come from the bottom of the pit. Other times, they come from the top. We have to be flexible and willing to continually adjust to ever-changing market cycles.

Take a look at the long-term charts of the above-mentioned sectors. Each candle represents one year of price action.