The month of January traditionally tends to give way to some unlikely winners: small caps, low priced and/or striking underperformers from the past 12 months. These types of stocks were sold in the later part of the year for either tax loss or reputational purposes. No fund manager wants to report to his/her clients that they own the year’s most striking losers or small caps with questionable business practices. As a result there is some forced selling in the 4th quarter and buying back in the first weeks of the new year.

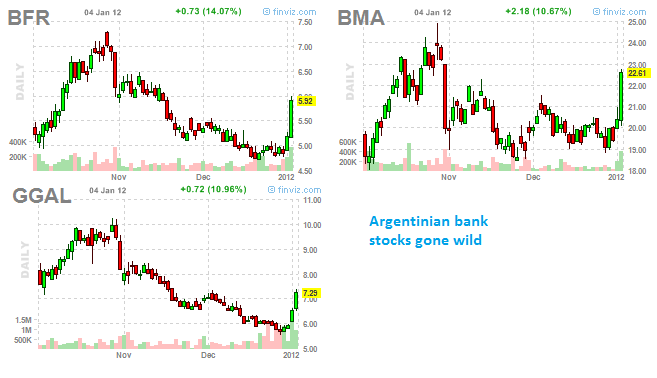

For example, the first two trading days of 2012 were especially beneficial for some Argentinian bank stocks that were beaten down in 2011:

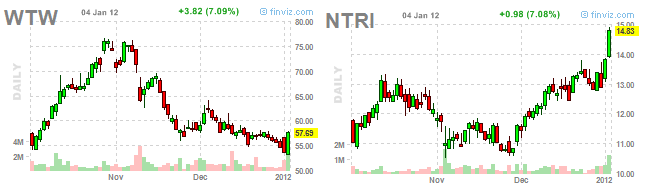

Weight loss stocks are also having a comeback. Not surprisingly, after taking into account many people’s New Year’s resolution to get in shape and the fact that $MCD went up 30% in 2011. A lot of calories have to be burned 🙂

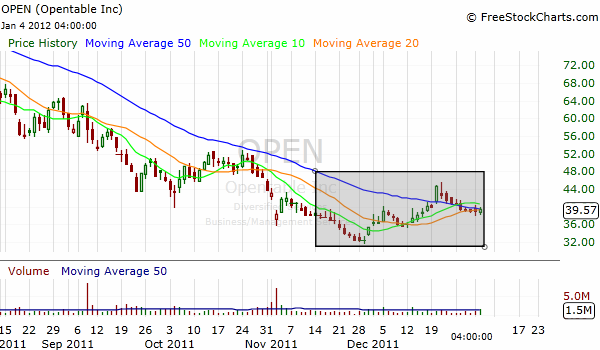

Some of the declining stocks reverse course near the end of the year as the selling for income tax purposes subsides. Typical recent example is $OPEN.

This is something that happens consistently every year. A good setup to keep in mind.

2 thoughts on “The Real January Effect”

Comments are closed.