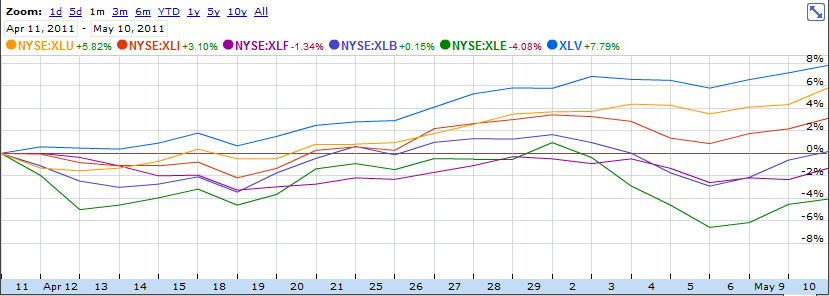

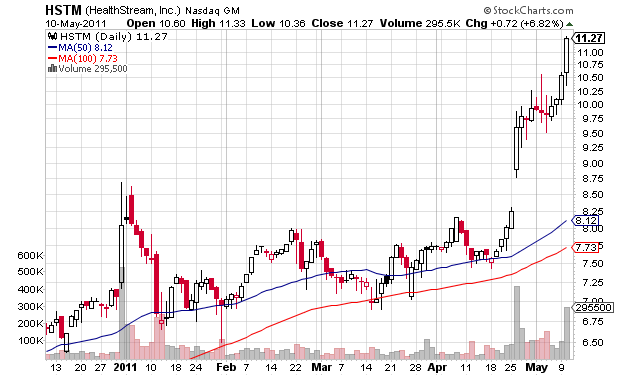

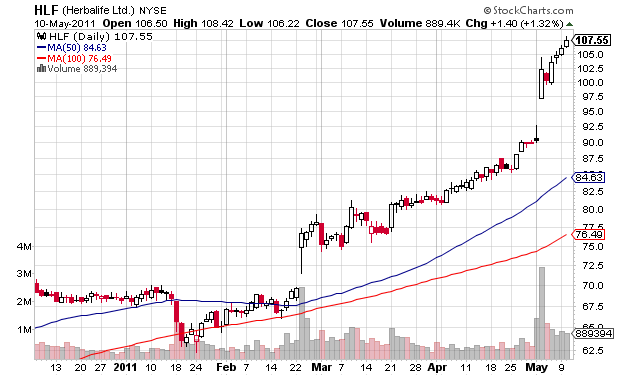

More than 150 stocks reached an all-time high price level at some point today. Some of the highest volume moves came from the Healthcare sector. It is not a secret to anyone that follows the stock market that this is the sector that has been substantially outperforming over the past month (up 7.8% vs $SPY up 2.2%).

Let’s take a look at some of the big recent gainers in the sector.

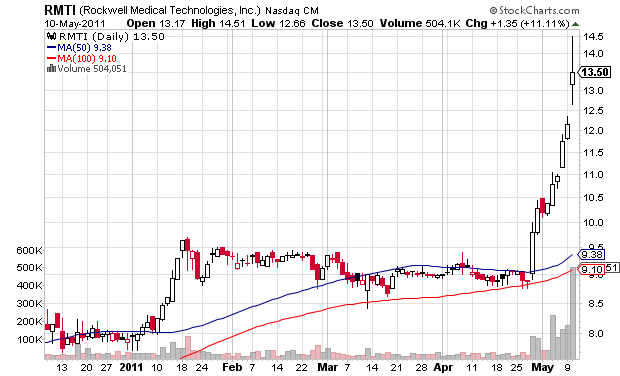

$RMTI broke out to a new all-time high on April 28. The volume on that day – 5 times the 50-day average. The stock never looked back. It looked extended all the way up. Despite the humongous volume today, the stock closed far from the upper side of its daily range. It looks vulnerable to a pullback here.

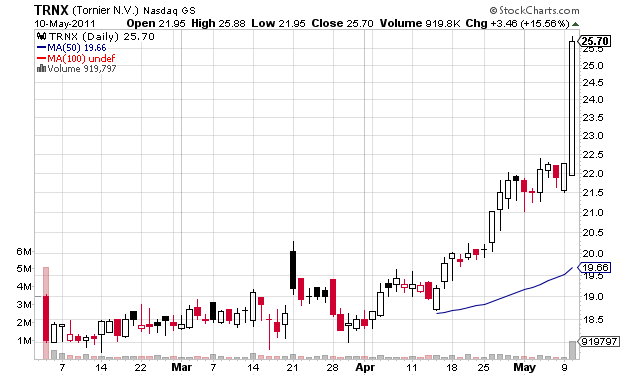

$TRNX had an unsuccessful breakout attempt on March 21. It gapped up and gave back everything during the day, finishing at the bottom of its range. The second attempt for a breakout was way more successful. April 26. The stock was already in an established uptrend (10day MA above the 20 above the 50dma).

Not every breakout to new all-time high is a reliable signal. There are three additional factors that will improve the odds of success:

1) volume: the higher the better; it is an indication of institutional involvement.

2) catalyst (directly related to an earnings announcement or a sector move)

3) base: breakouts from long sideways ranges indicate a major development that has changed the supply/demand dynamics.

In hindsight everything seems so easy and clear, but when it has to be applied in reality, it is much more difficult. The equity selection criteria is often based on a study of the past winners. What traits did they have in common before they started their move? The truth is that many other stocks that share the same traits as the winning stocks will fail. It is really hard to differentiate them at the beginning stages of a new trend. Not every high-volume breakout to new all-time high from a good base will turn into a major winner. No one knew that when $OPEN gapped to $30 in February of 2010, it will go to 120 in the following year. No one knew that when $NFLX gapped up to $60 in January 2010, it will go to 250 within 12 months. The more one stock appreciates, the more it is studied and the nature of its move analyzed. As the price rises, the number of myths and explanations of the catalysts behind the move multiplies. Some of them are right, some of them are wrong. In the grand scheme of things, they are all irrelevant.

The real secret sauce is called risk management. Proper equity selection will help you to find the big winners, the stocks with the most potential for price appreciation. Risk management will help you to ride your winners long enough to make a difference in your returns and to cut your losses quickly, so you stay and thrive in the game.