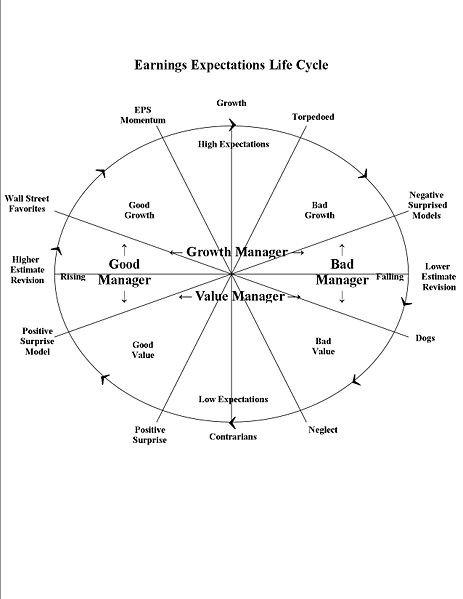

The Earnings Expectations Life Cycle is a theory developed by Richard Bernstein. It describes the dynamic process with which market participants view stocks. Despite what we might think about a favorite stock, the expectations for all stocks follow this cycle, although those for individual stocks may not pass through every point on the cycle and expectations may go around the cycle at different speeds. In addition, stocks may go through minicycles in which they repeat portions of the larger cycle before passing to the next stage.

The Earnings expectations cycle consists of the following stages:

- Contrarians: Market participants who invest in stocks with low earnings expectations. Most investors find these stocks unattractive or overly risky.

- Positive Earnings Surprises: Eventually a low expectation company begins to disseminate more optimistic information. The stock regains investors’ attention. Research of such stocks may begin to increase.

- Positive Earnings Surprise Models: Stock picking models that search for significant variations between analysts’ earnings expectations and actual reported earnings highlight stocks that enjoy positive earnings surprises. Traditional earnings surprise models wait for actual earnings to be reported, hence the model reside in Stage 3, while the event itself may be in Stage 2.

- Estimate Revisions: Analysts begin to raise earnings estimates in response to rising earnings expectations following the earnings surprise. Some analysts’ estimate revisions may lag the initial surprise significantly because these analysts may be reluctant to believe that the surprise is a sign that the company’s fundamental statistics are improving.

- Earnings Momentum: Investors who follow earnings momentum themes begin to buy the stock as estimates and reported earnings continue to rise and as year-over-year comparisons begin to improve.

- Growth: When strong earnings momentum continues for a long enough period, a stock is termed as a growth stock. These stocks are neither newly identified growth stocks (which are probably uncovered by superior growth-stock investors during stages 4 and 5), nor are they true growth companies that completely alter the business environment. Rather, most investors now agree that these stocks are indisputably superior. When everyone thinks that a stock is superior, it is time to be sold.

- Torpedoed: An earnings disappointment occurs. The stock is torpedoed. Its earnings expectations and price sink.

- Negative Earnings Surprise Models: The same models from stage 3, begin to highlight stocks with lower than expected earnings as potential sell candidates.

- Estimate revisions: Analysts begin to lower earnings estimates in response to the earnings disappointment. Again some analysts tend to lag because they do not believe that earnings shortfall is a sign of fundamental problem with the company.

- Dogs: After disappointing for a long enough period, these stocks are shunned by investors. Rumors regarding takeover, restructuring, or bankruptcy may affect the stock price temporarily, but investors generally avoid these stocks.

- Neglect: Investors have become so disinterested in the stocks or group that brokerage firms begin to believe that research coverage of the group may not be profitable, hence coverage begins to dissipate. The lack of available research information may set the stage for a renewed cycle.