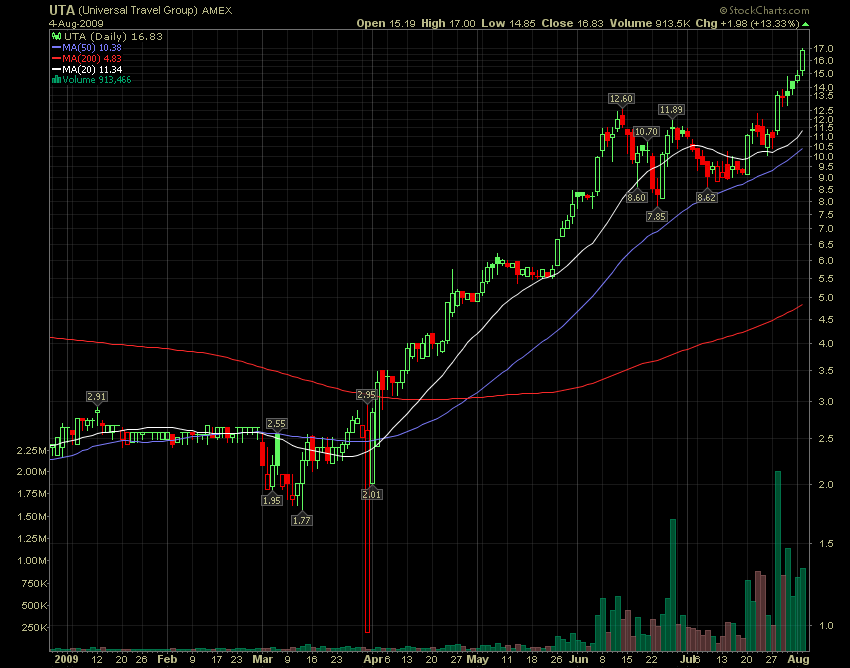

The odds are that the future best performing stocks will be neglected for a long time before they start really moving. Neglected price-wise and volume-wise. Then they’ll experience a sudden price and volume expansion, fueled by a catalyst or many of them, one after another. Prices are moved by catalysts as they provide a reason for funds to accumulate certain stocks. Why do I care how funds’ managers think and act? Well, they control 80% of the market’s volume and have the ability to create trends. A remarkable liquidity expansion is a sign of institutional interest. Everyone knows the saying that it takes a crowd to attract bigger crowd. In the investing/trading world, it takes liquidity expansion to attract even more players, who will boost price and volume even further.

The essence of catalysts has always been about expectations for higher earnings in the future. Those expectations could be based on various reasons:

– better than expected EPS and sales’ growth;

– lifting guidance for next quarter (year);

– new contract or sequence of new contracts, which proceeds represent significant part of the company’s sales; (take a look at OSK, CRAY, STEC)

– legal changes that alter the business environment for the whole industry; (solar subsidies);

– FDA’s approval for certain drug or small bio-tech company enters into a multimillion agreement with a pharmaceutical giant.

– great earnings’ report by a member of the same industry group. It often leads to the so called “sympathy play”, where all members of that group are getting a lift. The reason behind it is very simple. Due to their size, funds need weeks and sometimes months to accumulate the desired number of shares of one company. Since they rarely could achieve that, they look at peer members of the same group. This is why we say that stocks tend to move in groups. Look at what happen in the Auto&Truck parts industry this year. 1/3 of its members more than doubled in value since January 09. Successful funds’ managers think in terms of major investing themes. They base their decision on the prospects for a whole industry group.

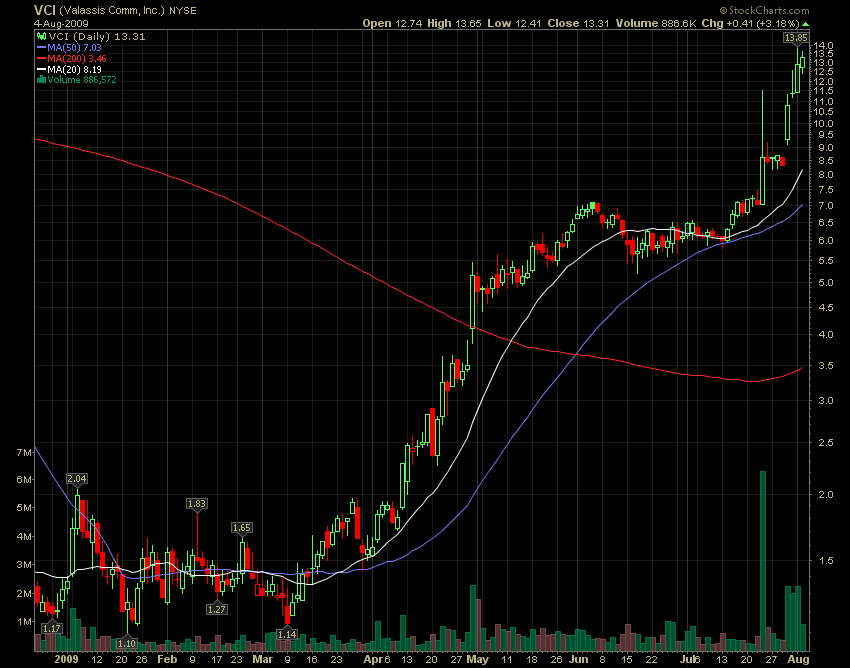

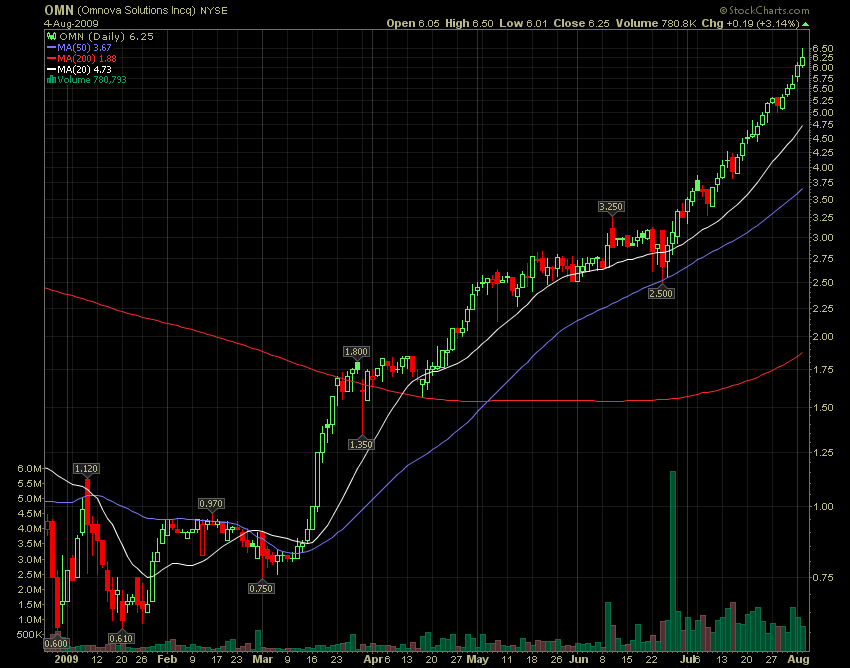

If you study the best performers YTD, you will notice that prices move in thrusts. A stock that goes up 100% in a quarter is not going to rise steadily 1-2% every day. It will experience powerful move in congested period of time. The bulk of the move will take place in one to four weeks, followed by a period of sideways consolidation in a tight range. When a new catalyst appear, there is a break out from that range and the process repeat itself until doesn’t. Entering after a break out of such consolidation areas is the smart way to trade as you will participate in the beginning stage of new momentum leg and you have a clear spot where to locate your stop (real break outs don’t go back to the old range).

A few more words about momentum. Developing traders often look at stocks that are up 30% in a day or up a lot, several days in a row and blindly short, assuming that the stock is up too much too fast and it needs to correct. They are making a fatal mistake. The fact that the stock is too overextended to be bought doesn’t mean that it has to be shorted. Market has always been irrational and what is high usually goes higher. What looks like a straight up action on the daily time frame, is often a healthy uptrend with clear periods of consolidation in the 30 min and 10 min time frames.