I am starting a new sequel of posts that will look at stocks that gained/lost more than 20% in a week. Was there something common among them, just before they started their move.

I am starting a new sequel of posts that will look at stocks that gained/lost more than 20% in a week. Was there something common among them, just before they started their move.

As of today’s close there are 61 stocks that gained more than 20% during the last 5 trading day. 37 of them were up more than 100% before they started their 20%+ move. It is true that we are experiencing an abnormal year, during which SPY is up 61% from its March’s lows, but the relative strength is a phenomenon that for the most part has always worked (stocks that outperformed during the last 6 months/1 year tend to outperform during the next 6 month/1year).

As of today’s close there are 3530 stocks that are priced above $1 and trade more than 100k share per day. 537 of them (or 15.2%) more than doubled during the last 6 months. As I mentioned already, out of the 61 stocks up 20%+ during the last week, 37 ( or 60.6%) have been already doubled before their last week’s move. One day is not statistically representative to declare that I have found a way to improve the odds of finding a fast moving stock. I have been following “the 20%+ in a week list” for a while and I can tell you that the stocks that had a 6 months gain of more than 100%+ before the fast move, were consistently north of 50% of the list.

In other posts I will point out other common characteristics among the fast movers.

Some trading ideas from my momentum screen for the next several days:

RVI NTWK JAZZ ROIAK GTN IGOI CBI AHCI PCX

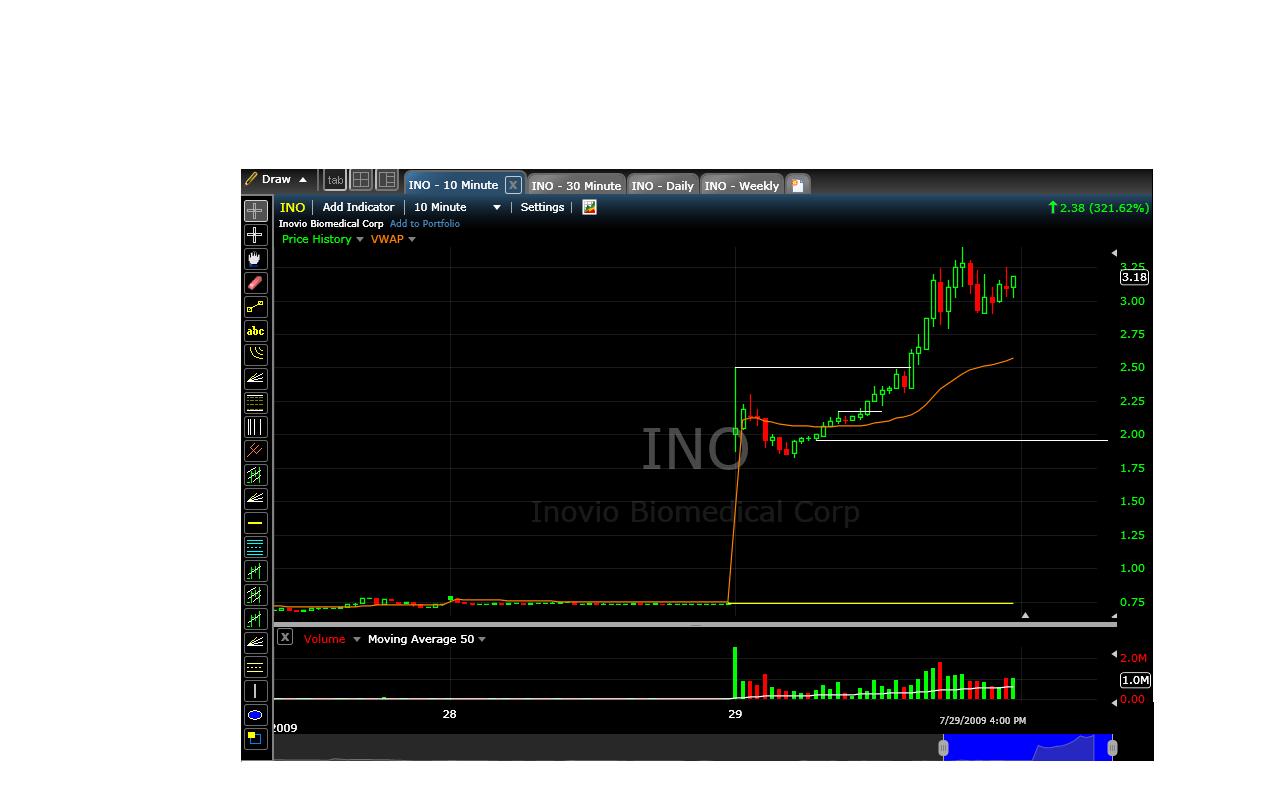

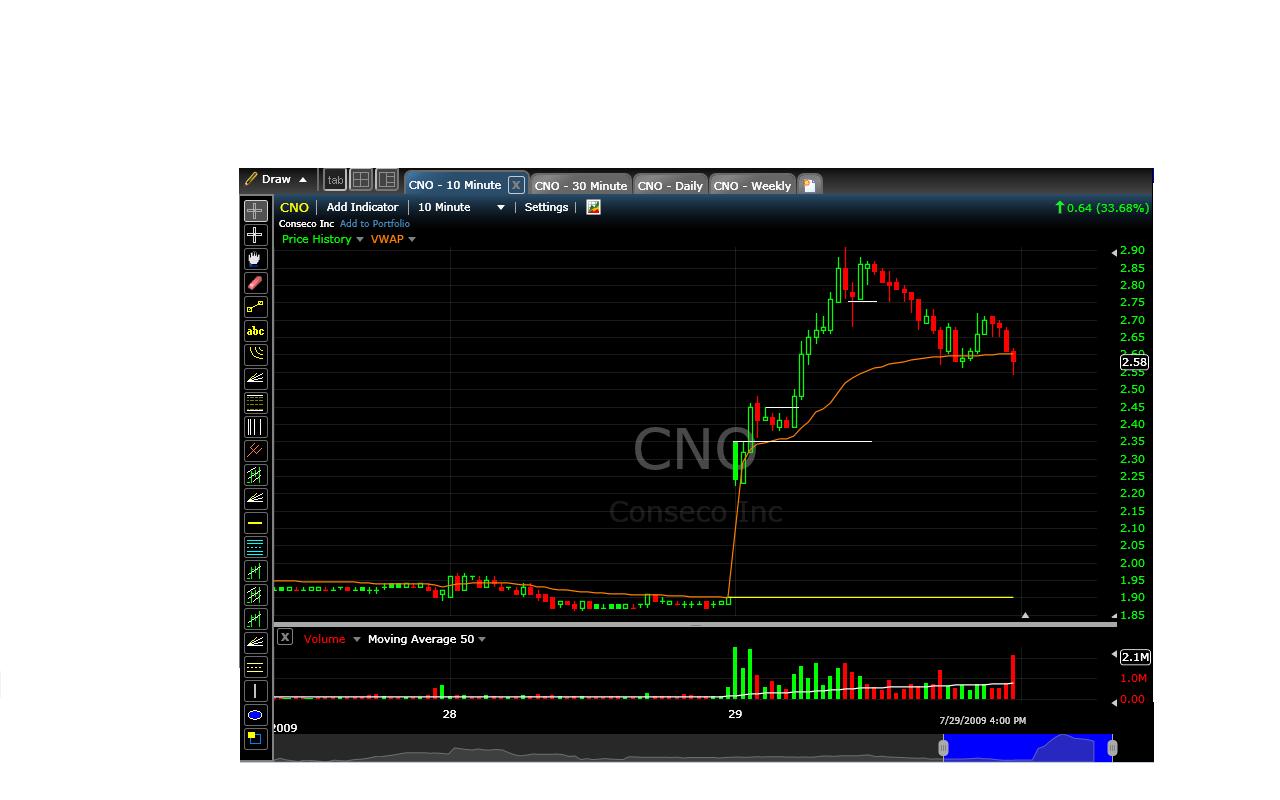

1) Nice bullish wedge consolidation above the daily VWAP during the 5th to 8 th bar.

1) Nice bullish wedge consolidation above the daily VWAP during the 5th to 8 th bar.