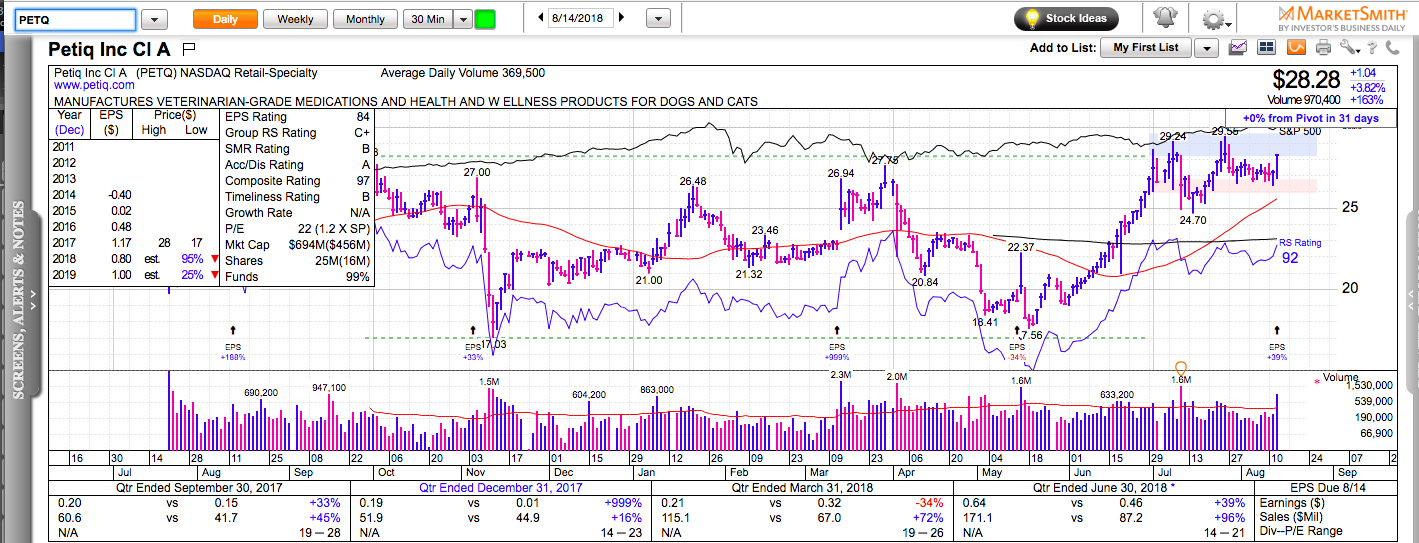

All charts on Momentum Monday are powered by MarketSmith

The bull market in the U.S. is alive and well with retailers and consumer stocks leading the way. Apple keeps rising despite its enormous size. Nike and Lululemon broke to new all-time highs. Weed stocks have been on fire ever since Constellation Brands bought 40% of Canopy Growth. Dip buyers are starting to get active in Netflix, Nvidia, and Chinese stocks. Highly-shorted stocks like MTCH, DDD, and PETQ are squeezing higher. Overall, there are a lot more reasons to be bullish than bearish.