Netflix recently hit new all-time highs and it ended up on the first page of many newspapers. 10,000 invested in Netflix’s IPO in 2002 is worth about $2.3 Million today. This amounts to about a 40% average annual appreciation.

As impressive as NFLX’s return is, it is not even the best-performing stock for the past fifteen years. Here are the top three. They are all consumer stocks – a Chinese video game maker, a U.S. energy drinks producer, and a U.S. video content creator and distributor.

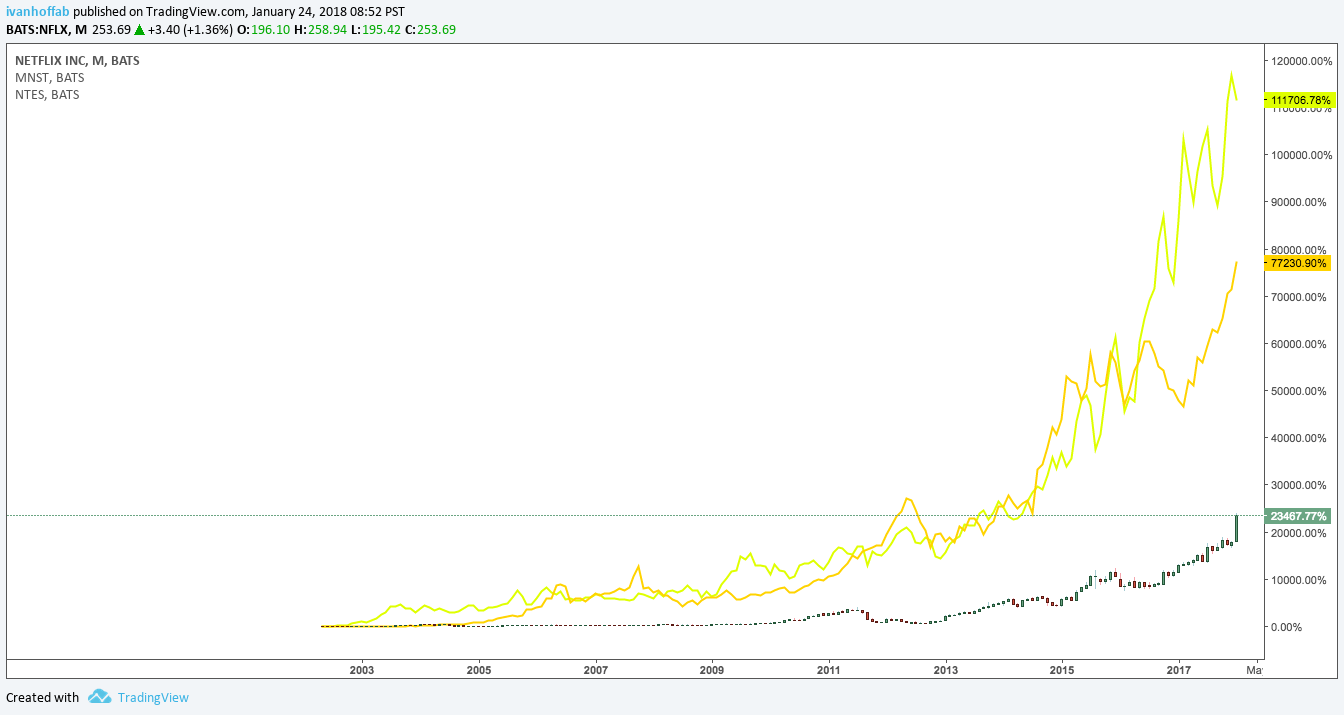

NTES +11,706%

MNST +77,230%

NFLX +23,467%

I know that I should be telling you who the next Netflix, Monster, and Netease are but even if I knew the future, the odds are that you would not be able to hold through all the pullbacks and volatility associated with huge long-term returns.

Just because NFLX has appreciated at 40% per year for 16 years, it doesn’t mean that it was up 40% every single year. Its price history has been a lot more volatile. It had one 50%, two 80% drawdowns in its history (one of them happened in just five months), and multiple 20% pullbacks.

NTES had three 50% drawdowns.

MNST had two 50% and one 80% drawdowns.

No human can stomach such drawdowns. No machine is programmed to do it either.

What is a lot more achievable from a psychological and emotional perspective, is finding stocks that have the potential to go up 50% or 100% in a year, ride them until their trends are over and then jump on the next ones, compounding your gains along the way.

Holding stocks that double in a year also comes at a price of significant drawdowns – not 50% or 80%, but 15% to 20% pullbacks are normal along the way. Such types of corrections are a lot easier to stomach. There are many more stocks that go up 100% in a year than there are stocks that go up 2000% in a decade.

We can go even one step further in our analysis and find out that there are many more stocks that go up 20% in a month than stocks that double in a year. And holding a stock for a 20% gain in a few weeks doesn’t really require to go through significant drawdowns. Small 10% to 20% short-term gains can compound quickly.

In other words, you can have your cake and eat it at the same time. You can achieve a significant return without having to go through significant drawdowns. As usual, there is no free lunch. As Henry David Thoreau said once “the price of everything is the amount of life (time) you exchange for it.”