Money can be made in various time frames and I continue to experiment with time in search for the time frame that best suits my skills and life style. The equity selection approach is the same, but each time frame has its own risk management specifics. I start the day by scanning for unusual moves. By unusual I mean remarkable price and volume. Any stock that is up more than 10% on at least 300k volume, which represents 3 times its average daily volume, is worth my attention. There are too many stocks in the scan every morning, so to limit the list to 3-4 stocks that I will be watching during the day I look for the catalyst behind the move. Is it earnings’ related, industry related or is it a biotech company? The higher the volume and the longer the stock has been neglected, the better.

Here it is a look at two trades that I took today:

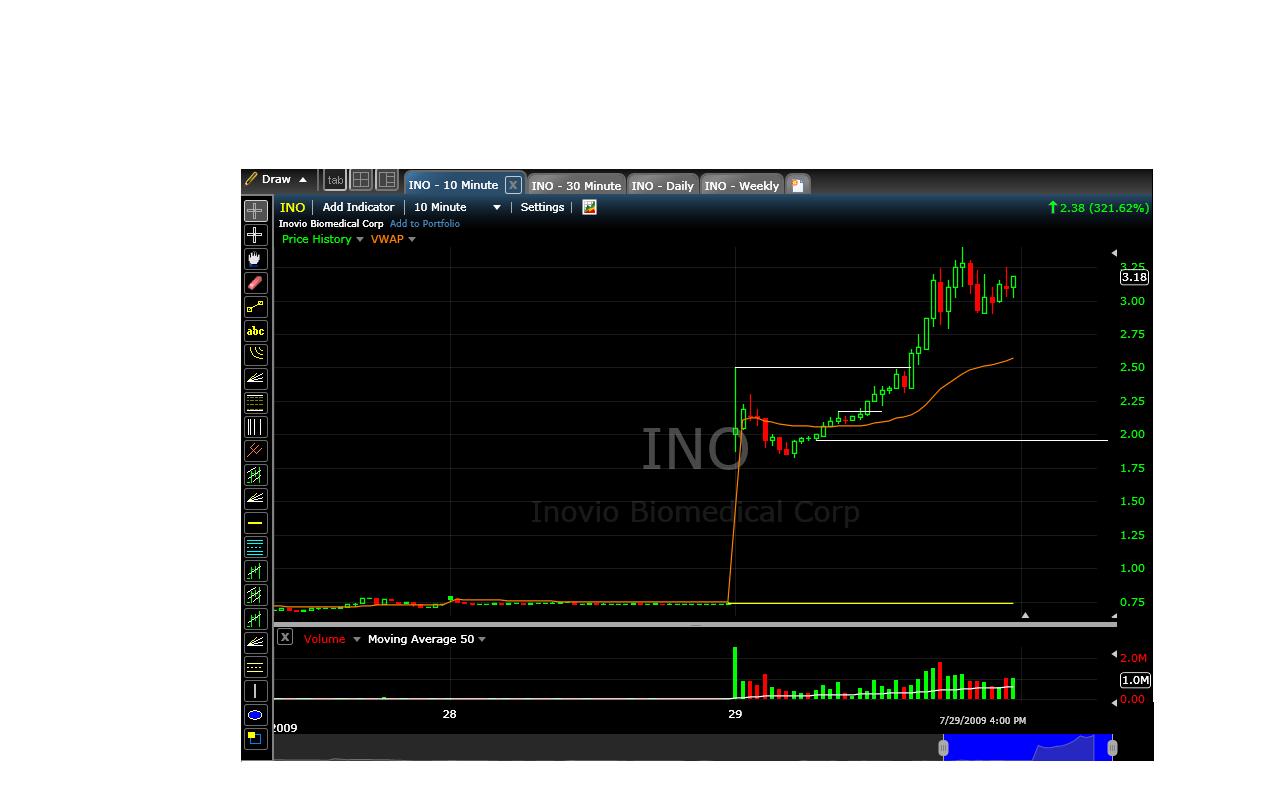

1) Running scans and watching the market during the fisrt 20-30 min

2) Waiting patiently for the stock to climb back above its daily VWAP. It did so at 11:40am on its 13th bar (10 min). I saw a tight consolidation (2.05-2.17) above the VWAP over the next 50 min.

3) The entry was on the 12:30 bar (18th) at 2.18 with a stop at 1.93

4) Total risk: $200; Risk per share: 0.25; Position’s size = 200 : 0.25 = 800 shares

5) Initial target was the high of the opening range or 2.50 ( I know, terrible risk/reward of 1:1. This is the main reason I am grading this trade with B- )

6) I could have sold 1/2 position at the initial target, but I didn’t. This is also a weakness I acknowledge. Once the initial target was passed, I used a 15 cents trailing stop. I was stoped at 3.07 for a gain of 0.89 per share.

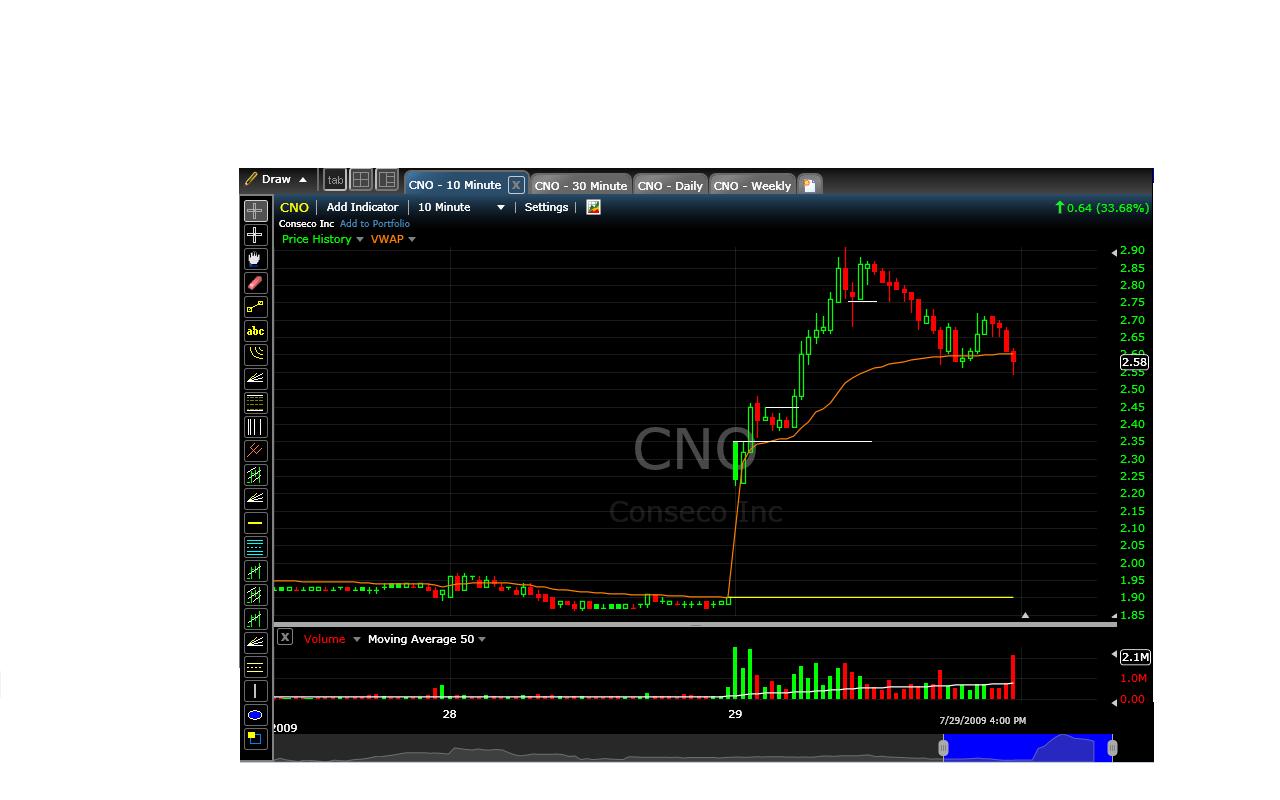

1) Nice bullish wedge consolidation above the daily VWAP during the 5th to 8 th bar.

1) Nice bullish wedge consolidation above the daily VWAP during the 5th to 8 th bar.

2) Enter on the 9th bar at 2.45 with a stop at 2.35 (2 cents below the daily VWAP and 3 cents below the consolidation area)

3) Total risk of $200; risk per share was 10 cents; Position size = 200 : 0.10 = 2000 shares.

4) I used a trailing stop and got stopped at 2.75 for a gain of 30 cents per share.

5) I grade this trade with A, since the entry was above the opening range; it was a break-out from a bullish pattern above the daily VWAP; the stop was relatively tight, which allowed bigger position’s size.

Sometimes day trades could be really profitable, but I still feel more comfortable playing in longer time frames, where the stops are wider and therefore the positions’ sizes are smaller.