Over the past month, it has become a tradition for the stock market to rally at the beginning of the week and give back the gains at the end. Elevated volatility and 1% opening gaps have become a common occurance. This type of market environment has conditioned most of us to take profits quickly and limit overnight exposure to a minimum. This is natural. No one wants to wake up leveraged to a 3% gap in the opposing than the desired direction and the current headlines driven market is absolutely capable of everything.

Macro-wise, nothing has changed. Greece is still bankrupt, just like it was last year at the same time. The difference is that now capital markets care. Why now? Maybe it has something to do with a cyclical global slowdown in the face of overleveraged governments in the Western hemisphere and an increasing inflation in the emerging market world. No one knows for sure.

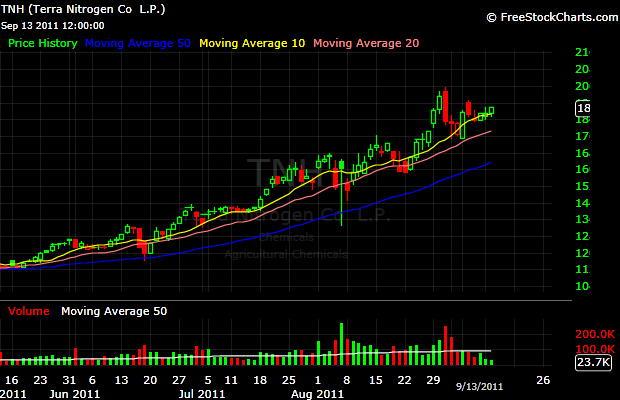

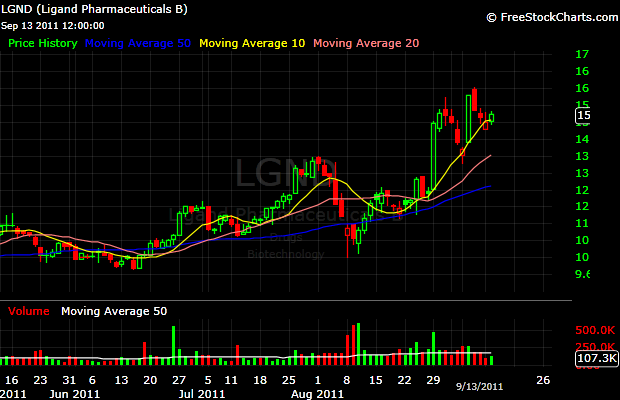

Let leave the macro analysis to the economists, and take a look at the price action. Two weeks ago, I mentioned that September won’t be like Correlation 1.0 August. It would be a market of stocks and so far I’ve been proven right. If your watchlist consisted of stocks like $ATHN $MAKO $STAA $VRUS $ULTA $PANL $WPRT $QSII… you wouldn’t even know that the market averages are in trouble. Focus on what you can control – the stock you trade, your entries, your exits and your position sizing.

Now is certainly not the time to be aggressive and to chase, but if you are looking to initiate some new long positions, the following suggestions could be a good starting point: