The charts in this video are powered by MarketSmith

There is so much liquidity in the system that everything is rising – U.S. stocks, emerging markets, junk bonds, Treasuries, gold, crude oil, crypto. Granted, there are still prominent negative momentum divergences but they can resolve through a sideways consolidation.

After rising anywhere between 300% and 2000% in the past three years, cloud stocks continue to make new highs and deliver solid earnings reports: SHOP, AYX, TEAM, etc. While cloud is still popular, there are other hot topics that are mesmerizing the momentum cloud – space (SPCE), online sports gambling (DEAC, IBKR, etc), AI and clean energy (TSLA).

Even Warren Buffett has become a momentum investor. His company just increased its stake in Restoration Hardware – a company that is selling $15k couches. Fun times. The good news is that premium are cheap, so buying some insurance while riding the uptrend might not be a bad idea. Just in case.

Try my new subscription service which includes a private Twitter feed with option and stock ideas, a weekly newsletter with concise market commentary and actionable swing and position trade ideas, the Momentum 50 list of market leaders and much more.

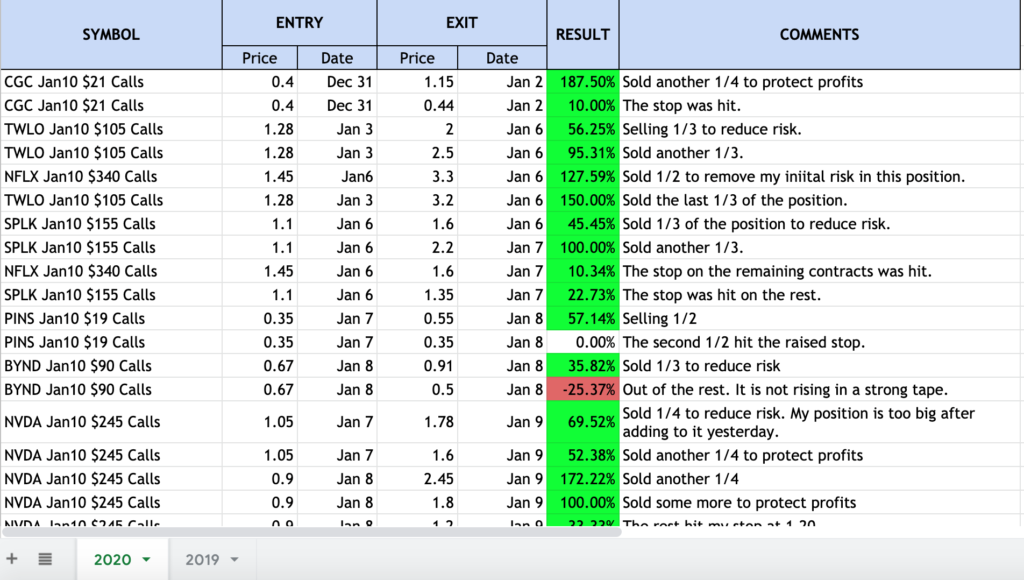

PERFORMANCE

Here’s a Google spreadsheet tracking all closed option and stock ideas shared on my private Twitter stream and weekly email for subscribers.