Disclaimer: This is feedback for my educational subscription service. I haven’t asked or compensated anyone in any form for it. Past ideas’ performance doesn’t guarantee future ideas’ performance. Your experience with the service might not match the experience shared below.

–

“Thank you for a great day today! AMD and SE options paid for a lifetime subscription. Really appreciate all you do!” – Josh, May 8th, 2023

–

–

–

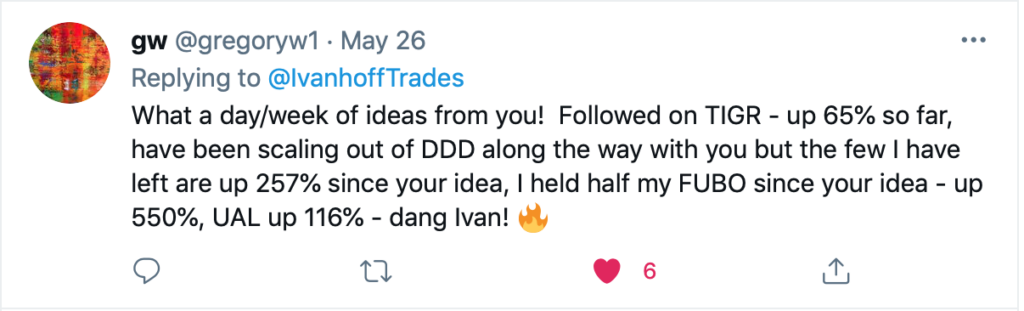

“Hi Ivan – just wanted to thank you again for your ideas. This week I had my first 7-bagger on PLUG. I only had 20 contracts but was a good week! Thanks for all you do for us. Have a great weekend.” – Gregory. W., Oct 9, 2020

–

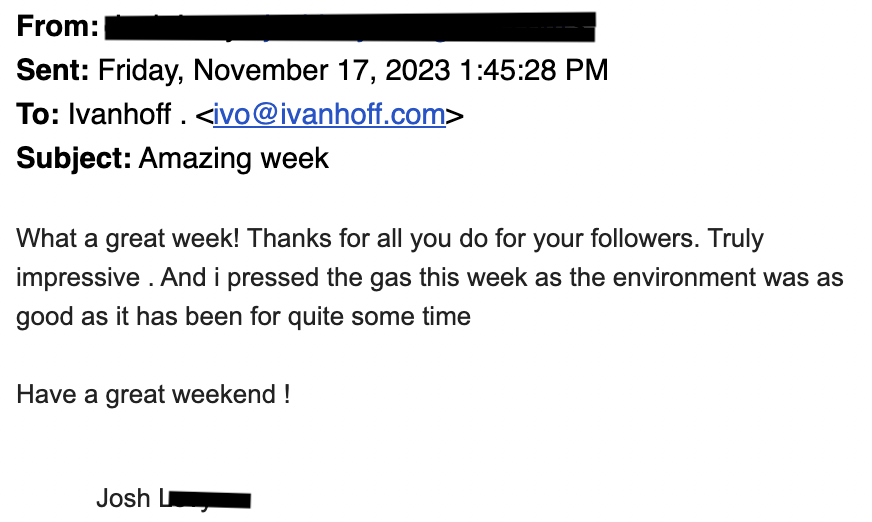

“Hi Ivan,

I want you to know how much I am enjoying being a member of your service. I am very appreciative that you share your trade set-ups and alerts. I have previously tried several different services before finding yours, and I lost a lot of money with all of those other services. Your service really stands out above the rest! I consider your service to be more conservative, meaning quality over quantity. In my experience, the majority of services out there over-trade because that is what new traders want (that is my guess). With your service, I can get a good understanding of the overall market through your commentary and whether trades are being alerted or not. I most definitely appreciate your professionalism and humbleness. Like a breath of fresh air! Everything combined makes your service a trustworthy service. No other service I have had experience with provides the same.” – K.M., Sep 29, 2020

–

“Ivan,

I have been subscribing since February, and have done very well. Up $50K.

However, if I had followed each trade with a $1,000 investment in each transaction, I would be up $200K.

Since most trades are 3 days or less, once would only need $25K to produce these results.

Thanks” – R. C., Sept 19, 2020

–

“Hi Ivan,

I really want to thank you for all your guidance and your hard work. Getting your subscription has been a life changer decision to my account so far. For the first time in a long time, I am able to see some green on my account. I have a small account and was bleeding every day before I took your service and you been a godsend blessing for me.

I am one happy customer so far and wanted to extend my gratitude to you.

Thank You very very much again.” – T.L., Aug 20, 2020

–

“Hi – I just had to thank you for this week. I know you sent an idea to close MCD. But I was away from my computer. I had bought $5k of options. By the time I saw your note I was down by $2k so I didn’t exit hoping it would bounce back. I held throughout the week selling along the way as the price rose up. And by expiration at the close today I was up by $16k (on top of my $5k investment). I’m sure my numbers are tiny compared to what you regularly trade, but for me it’s so amazing to have made $16k on those options – what a happy feeling. Just wanted to thank you — I wouldn’t have bought those without your help and ideas. As they say at McDonalds “I’m lovin it” – G.W., Aug 7, 2020

–

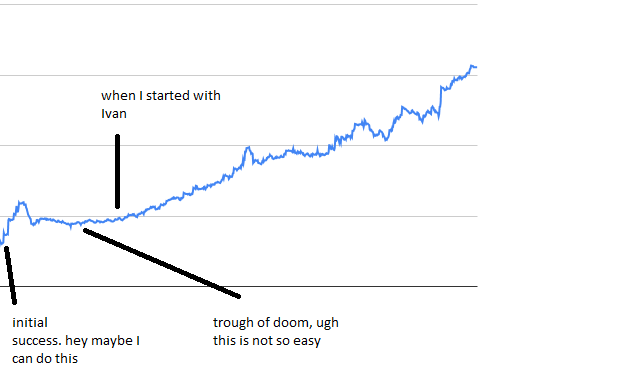

“I could not have done it without your guidance 🙂 Here is the annotated chart of my equity curve, ha!” – S.R., Aug 7, 2020

–

“Hi Ivaylo – hope all is well with you. Just wanted to say a few things. First, I am so glad to be a part of your group. Your email ideas and the eduction sections you write have made a big difference in how I have been trading.

Second, one of the good trades I made was on your $JMIA call a few weeks back (made 100% on those). But after the original expiration I rolled that over to Nov 21 $10 JMIA calls at $1.70. They are trading at $7.44 today – so up about 330%, or a gain of $5,600 on my $1,700 rolled-over investment. So a huge thanks for that original idea.” – G.W., July 31 2020

–

“Ivan,

First off, I want to thank you for the premium service you provide. I know enough that there is a lot of money to be made right now with options, but, I also know if I tried to do it alone I’d likely get blown apart. Your service has been extremely successful and educational. Thank you for that. In less than 7 trading days I’ve made significant money and I have been more so practicing position sizing, starting very small as I get a feel for the service.

Quick story – one of my first decent size trades following you was the TWTR calls last week. Shortly after entering the trade, news hit the markets the Moderna vaccine wasn’t effective and markets just tanked into close. The whole time I am a little nervous and expecting you to tweet how you’ve reduced risk, cut losses, etc…Nope. You’re stone cold into close, barely phased, you briefly commented on the Moderna news after market, and BOOM, shortly after market opens the next morning those TWTR calls were double the entry value….It might be the amateur in me, but I was impressed.

Anyhow, thanks again. Really appreciate what you’re doing. Please let me know if there is anyway I can assist. – Mac D., May 26, 2020

–

“I paid u $99/month to basically try out your service. After 2.5 weeks, I made $4,500 taking small positions. I am thankful for the simplicity of your service.

Do u have an annual or lifetime discount on your service as I am now convinced of the efficacy of your service and if there is a longer-term subscription model to your service, I would like to take advantage of that.” – A. G., May 21, 2020

–

“Ivan – just want to tell you how awesome the new service is. I’ve been with you a long time, and i just love it. Educational and the best part is you don’t give you too many selections/ ideas. The hardest part of other services i have used is that they give out so many ideas/ trades that an average person can’t really take all of them and of course it seems like you miss all the good ones and take all the crap.” – Josh L. , April 29, 2020

–

“Just did a monthly review. My net swing trading cash position is up $13.4K for April. Excellent return on your premium service. Thanks for the hard work and excellent investing insights. Excited for 2020 trading! ” – R. C., April 20, 2020

–

“That $NUGT paid your cost for 3 years! Thank you!” – Jon W., April 14, 2020

–

“Thank you for another profitable week! Thanks for letting me be a part. You are helping me change my financial future!!! “- J.C., April 2020.

–

“I have been following you (and Howard) on the Momentum Monday for a while now and lately have been part of your Ivanhoff Capital group. My first month has almost come to its end and I’m very satisfied with the result. I was wondering if I could change my subscription for a yearly subscription instead of my test subscription of 1 month. It has been interesting and rewarding to follow your instructions.

Attached in this mail my portfolio of the past month, just to show you your good work. (even though I’m sure you already know it) You almost got me out of my negative trend due to this latest “crash”. I’m sure next month I will be on the positive side, if I keep following your advice.” – M. H., April 2020

–

Disclaimer: Past performance is not a guarantee of future results. Everything I share is for informational and educational purposes and it should not be considered official financial advice.