The charts in this video are powered by MarketSmith

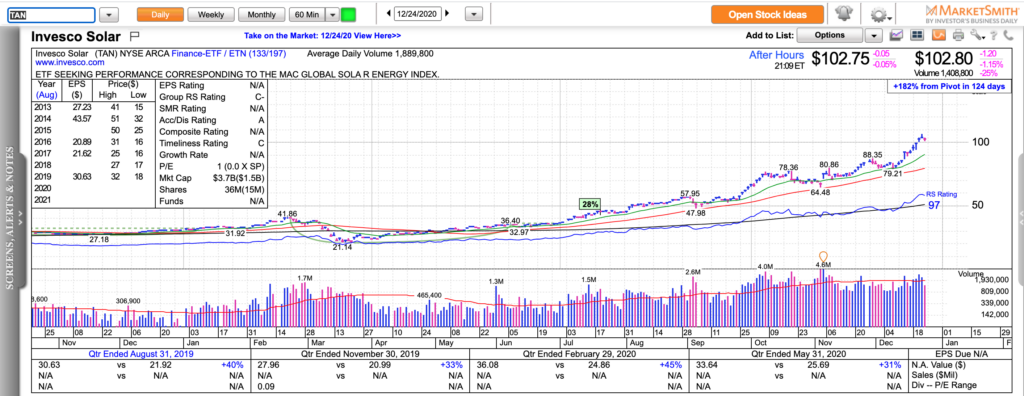

Don’t ignore industry relative strength. It is among if not the most powerful catalyst for short to medium-term moves in the stock market. Just take a look at the solar stocks in the past 4-5 months. So many of them tripled or even quintupled in the second half of 2020 and they continue to be hot and provide great swing trading opportunities on a monthly basis. It happened again in the past couple of weeks when many solar stocks bounced from their 20 or 50-day moving averages. Once an industry trend is established, it tends to persist for a long time. Look at other examples from this year – electric vehicles and parts, electric charging stations, fuel cells, lidar sensors for autonomous cars, online gambling and e-sports, gene editing, etc. It is not an accident that so many recent IPOs and SPACs have been in exactly those industries. When Wall Street smells a good story with unlimited demand, it makes sure to oversupply the market (feed the ducks). Eventually, it will matter and those trends will reverse but before that, some of those stocks can and have already gone up 5-10x. Our job as market participants is not to complain about the faults of the system but to find solutions – recognize trends and extract money from them.

Besides the hot action in clean energy and select biotechs, we are starting to see more signs of froth – SPACs sky-rocketing to absurd valuations without even knowing the company that they will merge with. Just 10-15 years ago, SPACs were looked down upon as a vehicle to bring public unremarkable private companies. Nowadays, they are the most popular way to get public. We are also seeing quite a few stocks that doubled in 4-6 weeks, double again after a brief consolidation (the so-called high-tight flags which are supposed to be a rare bull market formation are showing up all over the place and more importantly, they are mostly delivering). In the meantime, there has been an increase in reversals after technical breakouts. All of these are signs of a typical topping behavior but I would not short this market. It’s just too strong. The more likely scenario is that this hubris and FOMO (fear of missing out) will be resolved via another set of sector rotations. We just need to be paying attention where. Homebuilders and building material stocks are starting to set up again. Silver and gold miners are beginning to perk up. Financials are setting up for a potential breakout. There are enough places to rotate to if the hot action in cleantech and biotech subsides for a bit.

Try my new subscription service which includes a private Twitter feed with option and stock ideas, emails with concise market commentary and actionable swing, intraday, and position trade ideas, the Momentum 50 list of market leaders, and much more. See some of the recent testimonials.

PERFORMANCE

Here’s a Google spreadsheet tracking all closed option and stock ideas shared on my private Twitter stream and emails for subscribers.

Check out my free weekly email. to get an idea of the content I share with members.

Disclaimer: Everything I share is for educational and informational purposes only and it should not be considered financial advice.