The charts in this video are powered by MarketSmith

One of the major characteristics of bear markets is very high correlations between stocks regardless of their current or expected fundamentals. We saw that last week when in the first half most stocks sold off together and in the second half they rallied – again together.

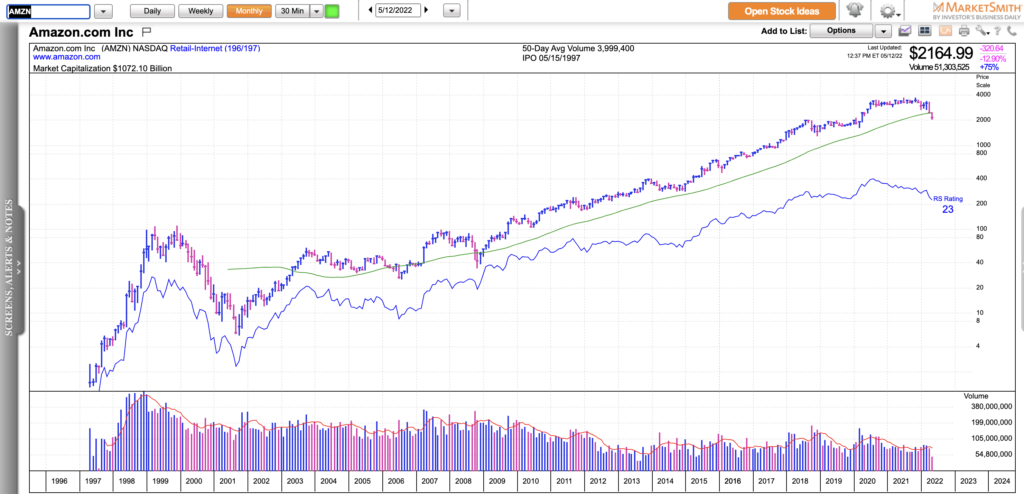

During market corrections, some religiously look for stocks that show relative strength. The premise is simple – if a stock tries to break out to a new 52-week high while the general market is selling off, it is likely to be a future momentum leader. We have seen this time and time again. One of the most recent examples is Cloudflare (NET). Between February 20 and March 5th, 2020, NET rallied to new all-time highs. At the same time, SPY dropped 15%. At the time, I wrote that NET is likely to be a future leader. Guess what happened in the next few weeks. The market accelerated lower bringing down everything with it. In a few short weeks, NET went from a new all-time high to new all-time lows. When the market calmed down and started to climb, NET quickly made new all-time highs and it went up 10x from there.

Keep a watch list of growth stocks that hold well and even try to make new highs when the market is in a correction but keep in mind that those growth stocks are not very likely to make big sustained moves until the market starts to climb.

We are in the midst of a bear market bounce. It could last only a few days or a few weeks. Any such climb would be a climb of a wall of worry. After a few months of selling, most market participants are not thinking about buying dips blindly and are not trusting the rallies. It will take a long time for this sentiment to change which means that excessive volatility and frequent reversals are still here to stay for the time being.

Try my subscription service which includes a private Twitter feed with option and stock ideas, emails with concise market commentary and actionable swing, intraday, and position trade ideas, the Momentum 40 list of market leaders, and much more. See some of the recent testimonials.

PERFORMANCE

Here’s a Google spreadsheet tracking all closed options and stock ideas shared on my private Twitter stream and emails for subscribers.

Check out my free weekly email to get an idea of the content I share with members.

Disclaimer: Everything I share is for educational and informational purposes only and it should not be considered financial advice.