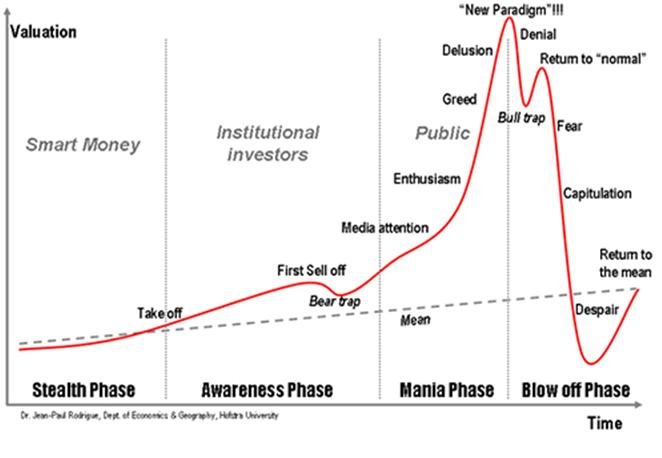

The word bubble is used to describe an excessive irrationality that leads to abnormal mis-prising of assets. Financial history reveals that bubbles are not specific to region, race or religion. Under the right circumstances, they can happen anywhere.

What are the ingredients of a typical bubble:

1) Low interest rate for a prolonged period of time (12-18 months). Easy access to cheap money eventually creates an excess money supply that leads to investment in projects with low and even negative return. Liquidity trumps fundamentals.

2) A new industry that most people don’t understand and therefore don’t know how to price. In late 1990’s investors were throwing money at every company with “.com” in its name disregarding the lack of revenues, profit and sound business model. Many realized that the companies they were buying would never make it to a green bottom line, but believed in the theory of a greater fool. As long as there was someone else to pay higher price, it was perceived as a “safe speculation”. In early 2000s, 3com sold 5% of its shares in Palm via IPO. The new issue took off so fast that its market capitalization became twice as much as that of 3com. But remember that 3com still owned 95% of Palm. It turned out that the value of 95% of Palm was worth $25 billion more than the entire market value of 3com, which essentially meant that market was pricing the value of all other 3com’s businesses and assets at negative $25 billion. Greed trumps fundamentals.

3) A large number of people suddenly start to feel rich. When they feel rich, they start to behave as such. The source of newly realized wealth could come from excessive savings or sudden increase in the value of equity (home or stocks). Suddenly people realize that they have access to a lot of money, which means that they can afford to spend more or/and they could work much less if they find a way to make their money work for them. The appetite for risk rises and the hunt for return starts. Money goes into the asset class that has performed best in the recent past. Price growth becomes exponential and it continues until Wall Street’s printing press manages to catch up with the demand for the desired securities. Warnings about massive mis-pricing are massively ignored. Confirmation bias is deeply wired in the human brain. We tend to search and find only information that proves and confirms our beliefs. Arrogance trumps fundamentals.

There were dozens of bubbles in our financial history and the frequency of their appearance has recently accelerated. It is safe to assume that as long as human beings take investment decisions, there will be other bubbles. They can’t be prevented, but their impact could be softened with a proper regulation.

To spot a bubble is easy, to profit from it is the hard part – because no one knows how big a bubble will become and how long it will continue. Many spotted the housing bubble in the USA in 2004-2005 and started shorting housing stocks. Needless to say, most took big losses as housing stocks quadrupled before they reversed course. Many speculators were right, but they were early and over-leveraged.

Nothing lasts forever. As Howard Lindzon would say “Find trends, ride them and get off.”