I am currently reading ‘Moonwalking with Einstein – The Art and Science of Remembering Everything” by Joshua Foer and the book offers very good explanation of the importance of building procedural memory for pattern recognition. See some modified quotes from the book:

- The Zen-Nippon Chick Sexing School was based in Japan in the 1920s and offered a two-year program, which single goal was to teach how to recognize the female chicks from the cockerels. For the poultry farmers, male chickens are useless. They can’t lay eggs their meat is stingy. The sooner they can be disposed of – the better, but a costly problem has vexed egg farmers for millennia: It is virtually impossible to tell the difference between male and female chickens until they’re four to six weeks old. Until then they are indistinguishable and have to be housed and fed at considerable expense.

- In the 1920s, the Japanese figured out a way to distinguish between male and female chicks immediately after their birth, which helped to lower the price of eggs worldwide. The professional chicken sexer, equipped with a skill that took years to master, became one of the most valuable workers in agriculture.

- Chicken sexing is a delicate art, requiring Zen-like concentration and a brain surgeon’s dexterity. The gender of the young chick is recognized by the shape of their vent. By some estimates there are as many as a thousand vent configurations that a sexer has to learn to become competent. The job is made even more difficult by the fact that the sexer has to diagnose the bird with just a glance. There is no time for conscious reasoning.

- What makes chicken sexing such a captivating subject and the reason my own research into memory has brought me to this arcane skill – is that even the best professional sexers can’t describe how they determine gender in the toughest, most ambiguous cases. Their art is inexplicable. They say that within three seconds they just “know” whether the bird is a boy or a girl, but they can’t say how they know. What they have, they say is intution. In some fundamental sense, the expert chicken sexer perceives the world – at least the world of chickens – in a way that is completely different from you or me. When they look at a chick’s bottom, they see things that a normal person simply does not see.

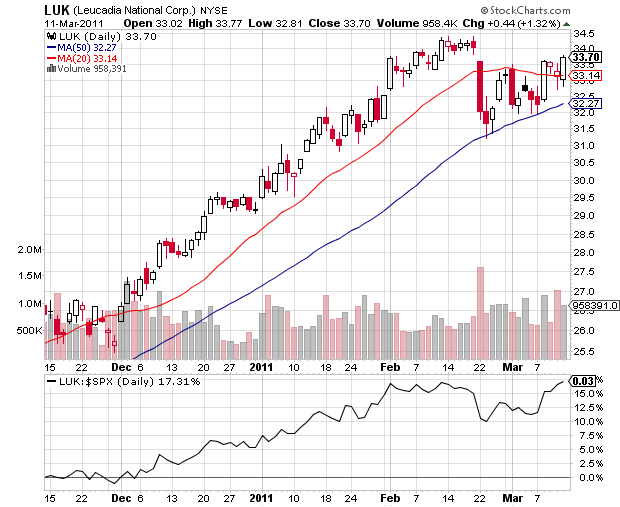

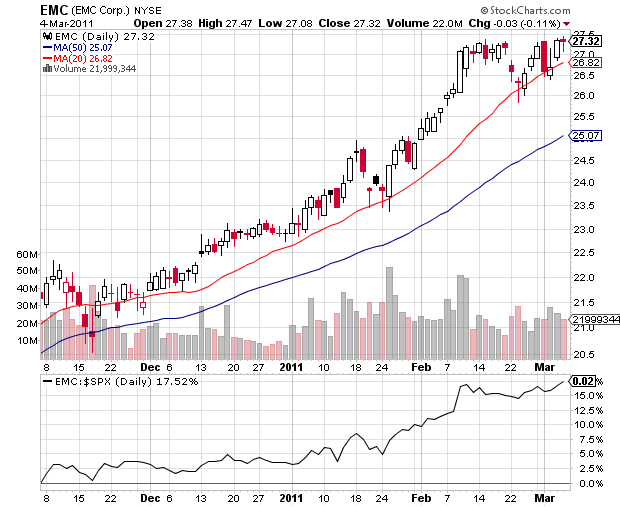

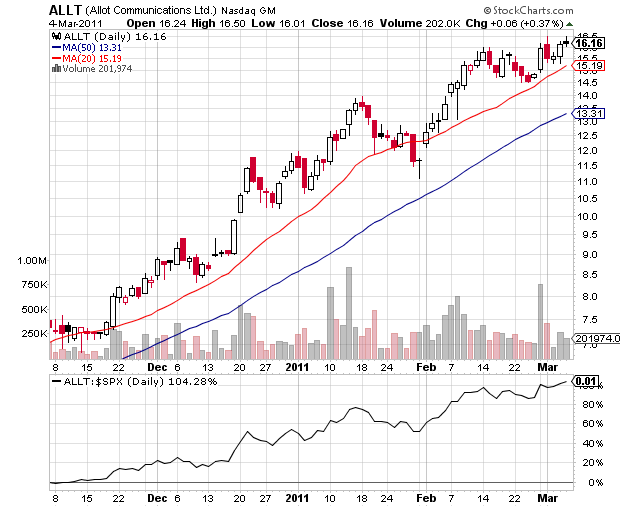

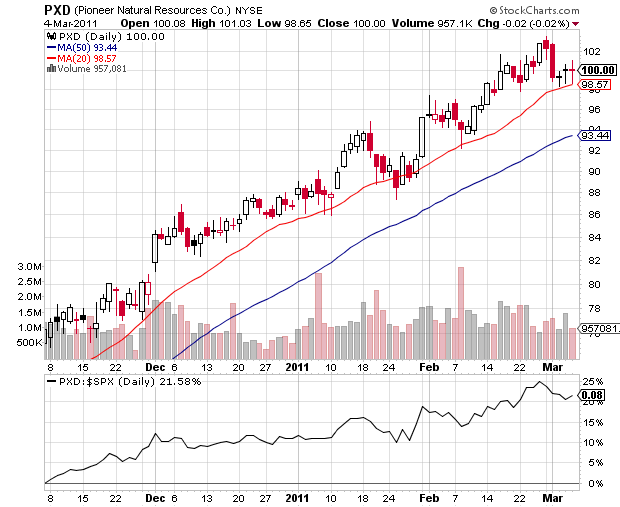

The best technical analysis experts are the modern chicks sexers. By looking at millions of charts at different time frames, they have attained the skill to recognize great technical setups from not so great ones. Their eyes see what most don’t and often they can’t even explain why they like certain chart. They just do, based on experience.