MarketSmith powers the charts in this video

I published a new trading book recently. Check it out on Amazon.

The bulls won the first quarter of the year and it wasn’t even close; especially when it comes to tech stocks. The Nasdaq 100 (QQQ) gained 21%, the semiconductor ETF, SMH was up 31%. The best performers year-to-date are three of the worst performers from last year: NVDA (+90%), META (+76%), and TSLA (+68%). All of this happened in the midst of mostly weak earnings that came well below estimates, the Fed raising the benchmark interest rate to 5% and talking about a potential recession later in the year, several big banks going bankrupt, and commercial real estate stocks enduring a massive correction. This is one resilient market that swept away all bad news and decided to focus on what could go right.

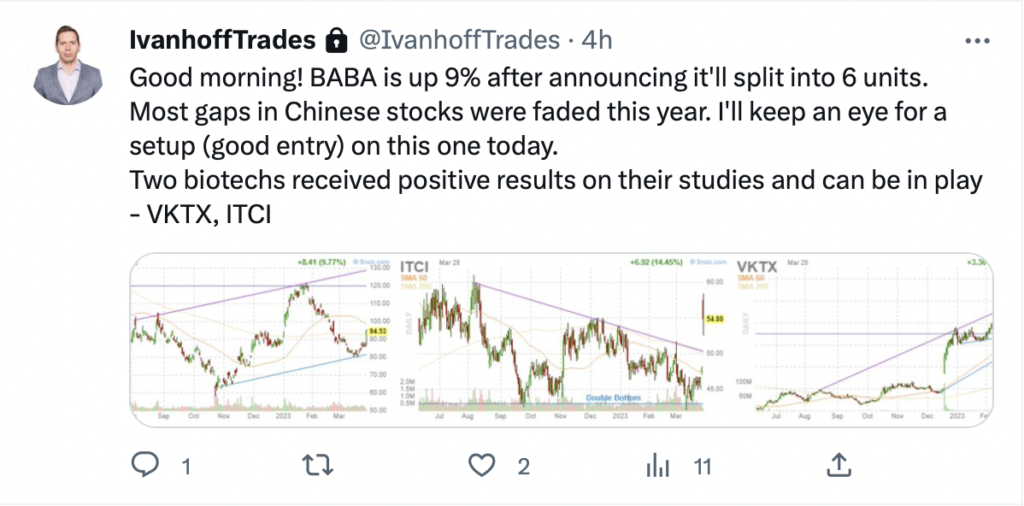

They say don’t fight the Fed but one should also don’t fight the market either. Rising prices lead to FOMO and FOMO leads to short-squeezes. Anything with high-short interest was on absolute fire last week: AI, UPST, MSTR, DOCN, MBLY, WWE, etc. and this process might be just beginning.

Obviously, not everything is perfect. Small caps, IWM is still below its 200-day moving average. Financial and commercial real estate stocks are still looking vulnerable. And yet, there’s plenty to be optimistic about – at least when it comes to the price action in tech stocks. The big question is if everyone is turning bullish and starting to chase breakouts just before the proverbial rug is pulled again. No one really knows. If you see a good long setup, take it with half size. If you see 3 out of 5 working as anticipated, the odds are this trading environment is favorable for long swings.

We will have to see some selling first before we consider turning bearish. All the negative macro talk has turned many people too bearish while the price action has been predominantly bullish, especially in tech. Maybe, the bears end up being right at some point this year, but we will receive plenty of evidence before that happens. A correction doesn’t happen overnight. They take time to develop and provide many clues along the way. There’s no reason to guess when and to stay scared out of the market when price action doesn’t suggest so.

Try my subscription service which includes a private Twitter feed with option and stock ideas, emails with concise market commentary and actionable swing, intraday, and position trade ideas, the Momentum 40 list of market leaders, and much more. See some of the recent testimonials.

PERFORMANCE

Here’s a Google spreadsheet tracking all closed options and stock ideas shared on my private Twitter stream and emails for subscribers.

Check out my free weekly email to get an idea of the content I share with members.

Disclaimer: Everything I share is for educational and informational purposes only and it should not be considered financial advice.