Dr. Brett Steenbarger

Category: Uncategorized

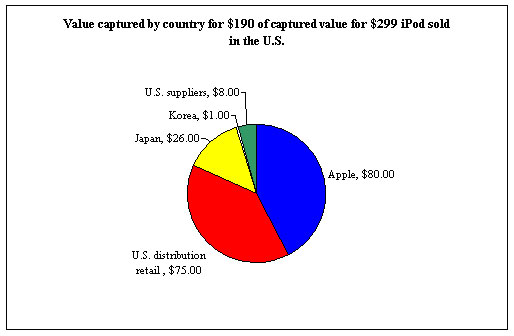

Misconception about Manufacturing

“Just because something is “made in China” or somewhere else in the emerging world doesn’t necessarily mean that the money from its construction goes to that place alone.”

Edmund Conway

Achieving greatness

“How can people experience themselves greatly if there’s no single thing during the day that they undertake in an exemplary way? Good enough *is* good enough, but it’s not good enough for greatness. In life as in bodybuilding, if you don’t go beyond yourself and set the bar just beyond your comfort level, you never grow and develop. You never become more than who you are.”

Dr. Brett Steenbarger