First, I would like to make a quick distinction between position setups and swing setups. The purpose of the Stocktwits 50 is to find stocks that are likely to trend up for an extended period of time. From my perspective, the idea behind the typical swing setup is to catch a 2-10 day move within an existing trend.

When looking for swing setups, the two most important factors to consider are:

– recent price volume dynamics: most swing setups consist of an uptrend move, followed by consolidation in the upper range of that move. Traders have come up with different names for them: flags, wedges, triangles..; Keep in mind that finding the so called flags and wedges is never a guarantee of success. It is not that easy. There is one more factor that needs to be taken into account: the industry group;

– which industry group is currently hot; Stocks tend to move in groups and being in the right technical setup in the right group could mean the difference between a 5% and 20% move; the difference between a failed breakout and a breakout with continuation. For example, last week I specifically underlined the energy and precious metal stocks on my Stocktwits steam. The best performing stocks for the week came from those groups.

Let’s take a quick look at the forthcoming week and what we can expect.

Oil futures are up after the situation in North Africa and the Middle East has worsened over the weekend. As zerohedge mentioned on the stream: “Don’t worry. Ben Bernanke will print more oil.” We are likely to see some silly moves in oil names, which will be a continuation of last week. On the first glance, the energy stocks look a bit extended, but that does not matter in short term perspective. It matters only in terms of risk management. When you enter extended stocks to monetize on a sector move, it is a good idea to decease the size of your positions.

Gold and silver futures are up too. In the past, geopolitical crises were positive for the dollar. These days, they are positive for gold and silver as they are considered the new safety currencies.

Will the rest of the sectors continue to rise or the market will take into account that rising oil might spark another global recession? The market reaction will tell. In general with zero interest rates and rising inflation, US stocks are still in the sweet spot as an asset class. Of course, don’t forget that even in the best years for the market, there has always been a period of 3-12 week correction. When is it going to happen is anyone’s guess. There are two types of forecasts – lucky and wrong. I rather watch price.

Last weekend I underlined 12 specific names from the Stocktwits 50 list that I liked for swing trades and 10 of them were actually the St50 best performing stocks of the week. I will keep that tradition.

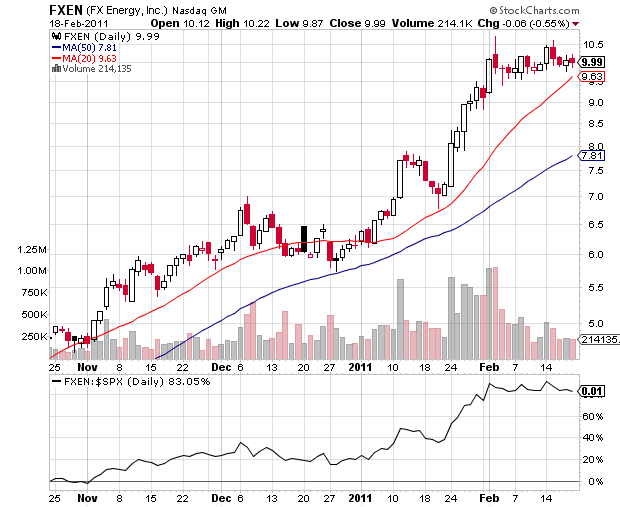

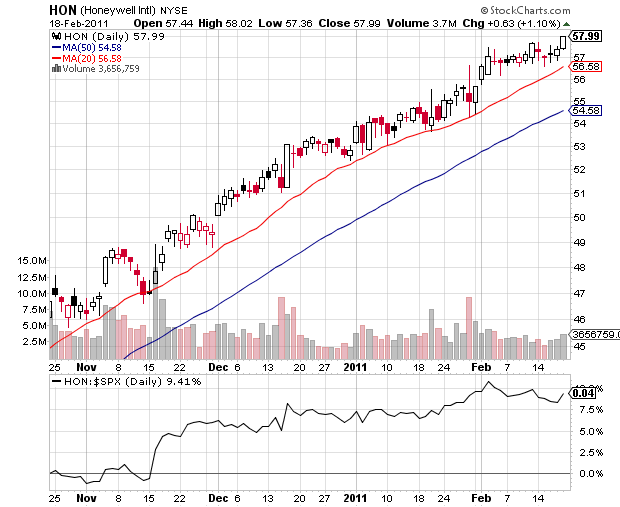

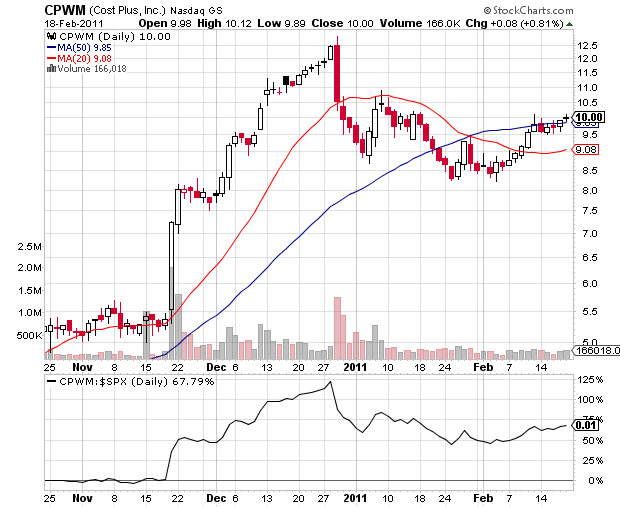

Without further ado, the 10 st50 swing setups that caught my eye this weekend:$BHI $FNSR $AMAT $FXEN $CTSH $EMC $BRKS $CPWM $HON $LULU