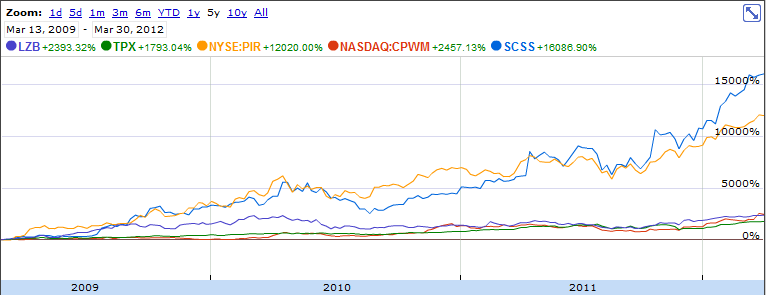

The S & P 500 has doubled for the past 3 years, but there are stocks that have done decisively better. Boring companies, selling mattreses, reclining chairs and sofas. I like to group them under the hood of “The World Looks for a Better Sleep” label.

In spirit of the immortal words of Gordon Gekko: Sleep is Good

The point is, ladies and gentleman, that sleep, for lack of a better word, is good. Sleep is right, sleep works. Sleep clarifies, cuts through, and captures the essence of the evolutionary spirit. Sleep, in all of its forms has marked the upward surge of mankind. And sleep, you mark my words, will not only save Teldar Paper, but that other malfunctioning corporation called the USA. Thank you very much.

The five stocks in the group: $SCSS, $TPX, $CPWM, $PIR, $LZB have returned on average 7000% for the past 3 years. $10,000 invested in an equal weighted Sleep Index in March 2009, would be worth $700,000 today.

Sleep sounds great as a concept, but it doesn’t represent the whole story behind the gigantic moves. Rising expectations for home improvement spending and housing recovery are also big catalysts behind the move. As long as expectations rise, prices rise.

Sometimes, the most boring stocks, no one is talking about become the best performers.

Keep in mind that those stocks are highly cyclical and every 6-7 years tend to go from a boom to bust mode.