It turns out that most hedge funds have severely underperformed the S& P 500 year-to-date, in a bull market. Sometimes being too smart is a hurdle in the market. You overthink, you overtrade and at the end of the day, you are just running to stand still.

Markets could be as complicated as you want them to be. There are some ways to make sense out of the insanity:

1) Bull markets are markets of stocks. Most stocks will appreciate in a bull market, but some will go up much more than the average. Stock-picking skills matter a lot under such circumstances.

2) Bear markets are stock markets. Correlation is very high and most stocks move together up and down, disregarding of fundamentals. Stock picking is irrelevant here.

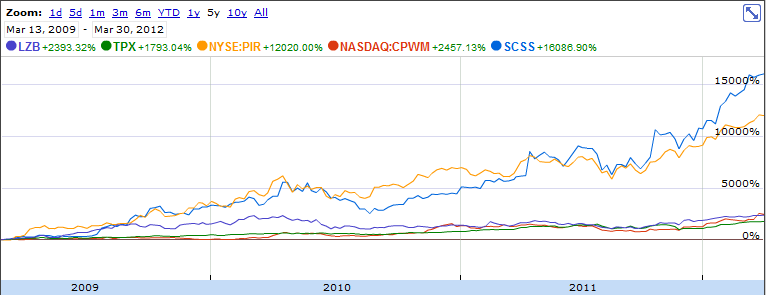

3) Bear markets make long-term investors a lot of money. Forced liquidation brings down prices to drastically low levels, to a point that some reasonably sound businesses are priced for default. Those are the type of stocks that become the best performers once the market turns north. Look at the Sleep Index, which is up 7000% for the past 3 years.

4) Mean-reversion works, but what is your time-frame of operation. We all suffer from recency bias. This is why when an asset goes from $100 to 70$ in a month, it suddenly seems “cheap”. When an asset goes from $20 to $30 in a month, it suddenly seems too expensive. Our brains are wired to think in terms of mean-reversion, but the trouble is that we also expect instant gratification for our actions and mean-reversion works best in long-term time frames. What seems too “cheap” could easily become “cheaper”. What seems expensive could easily become “more expensive”. Irrationality often trumps patience and solvency.

5) Only price pays. No matter how smart you are, how sophisticated your market approach is and how great your investment thesis is, unless the rest of the market agrees with you, you won’t make a cent.

6) Trading is like dating. You should only keep the stocks that make you happy.

7) Never Say Never. Being wrong is not a choice, staying wrong is.

8) You are your own biggest enemy. Intelligence helps to realize what needs to be done to be successful in the market, but it doesn’t guarantee that you will be able to apply that knowledge in practice.

9) The press will never run out of negative headlines. Fear sells best. There is always something to worry about, but you should never worry about something that doesn’t depend on you.

10) Sometimes, short-term price moves are just nonsensical noise, designed to make you second-guess yourself and shake you out of well-thought out, reasonable positions. Stick to your plan.