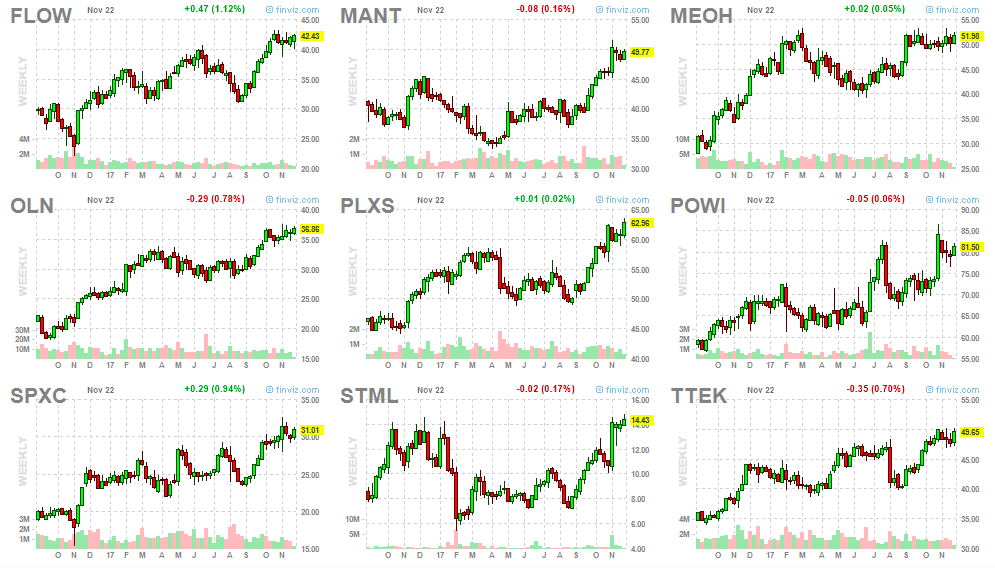

The stocks below have a very high short interest – over 20% of their float is short. They are close to their 52-week highs and have built a small base, which might turn into a launching pad for higher prices. Short sellers always sound smart, but they are often early and become victims to a short-squeeze – a process that rapidly rising prices that forces short-sellers to cover their bets, which adds more fuel to the upside momentum.