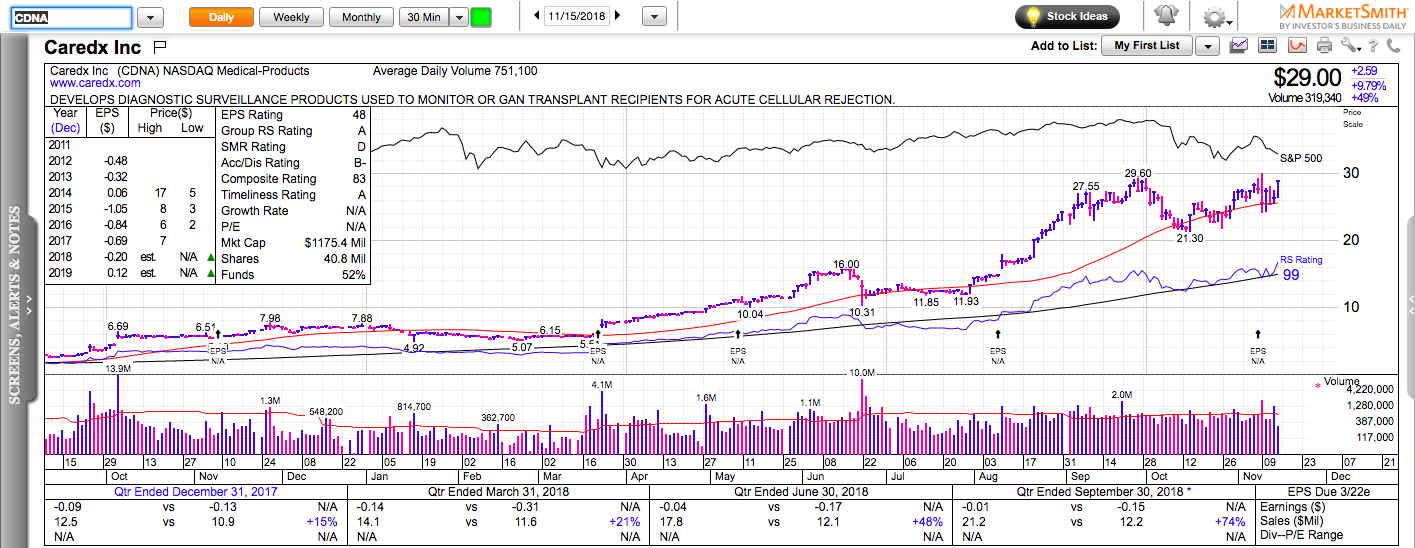

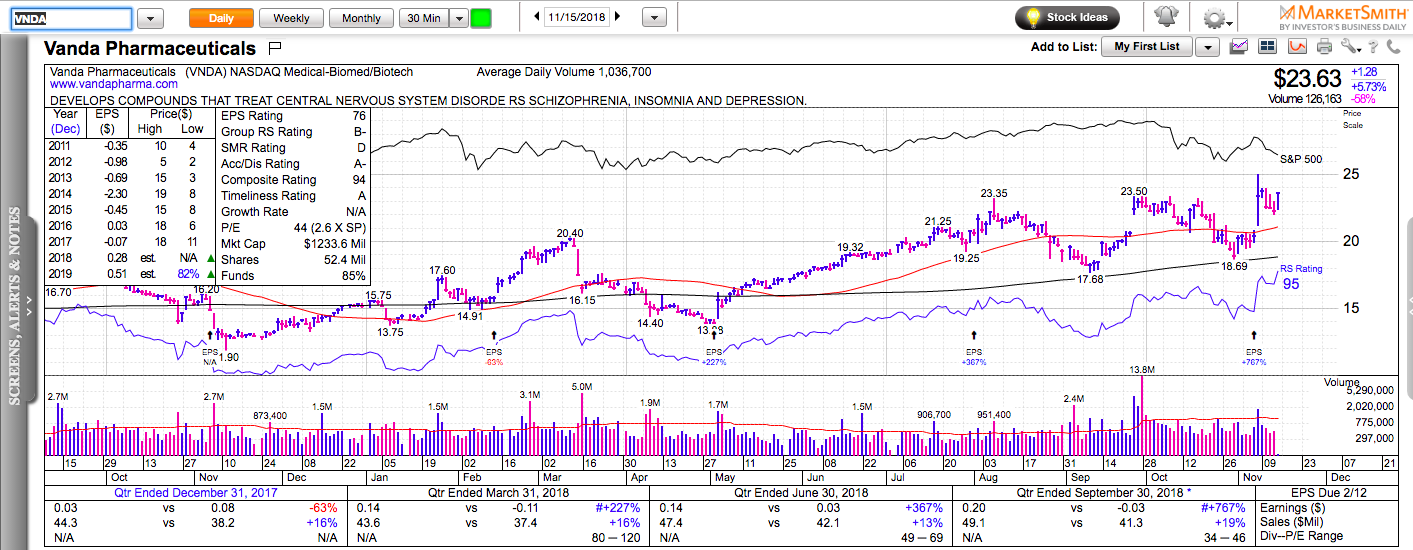

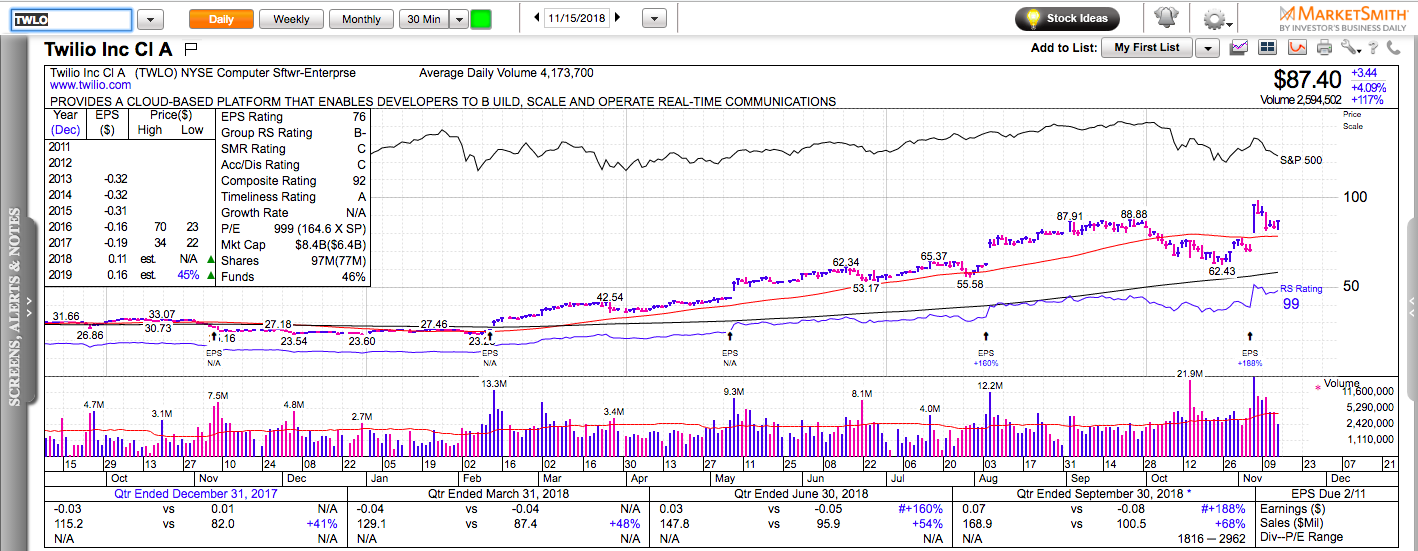

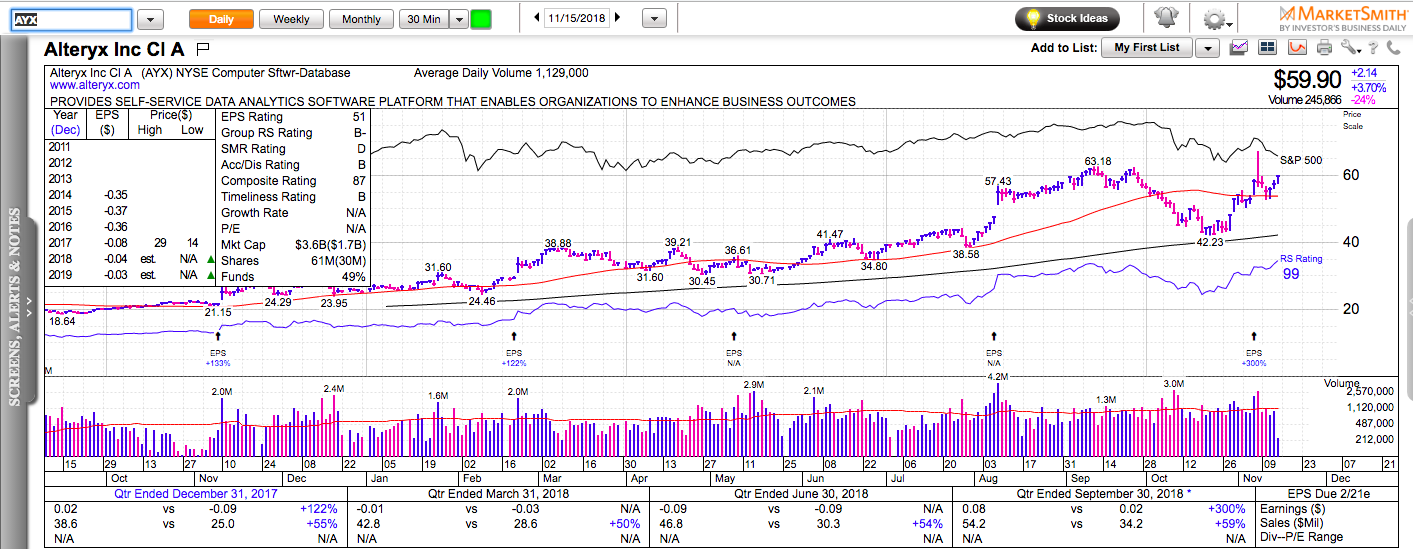

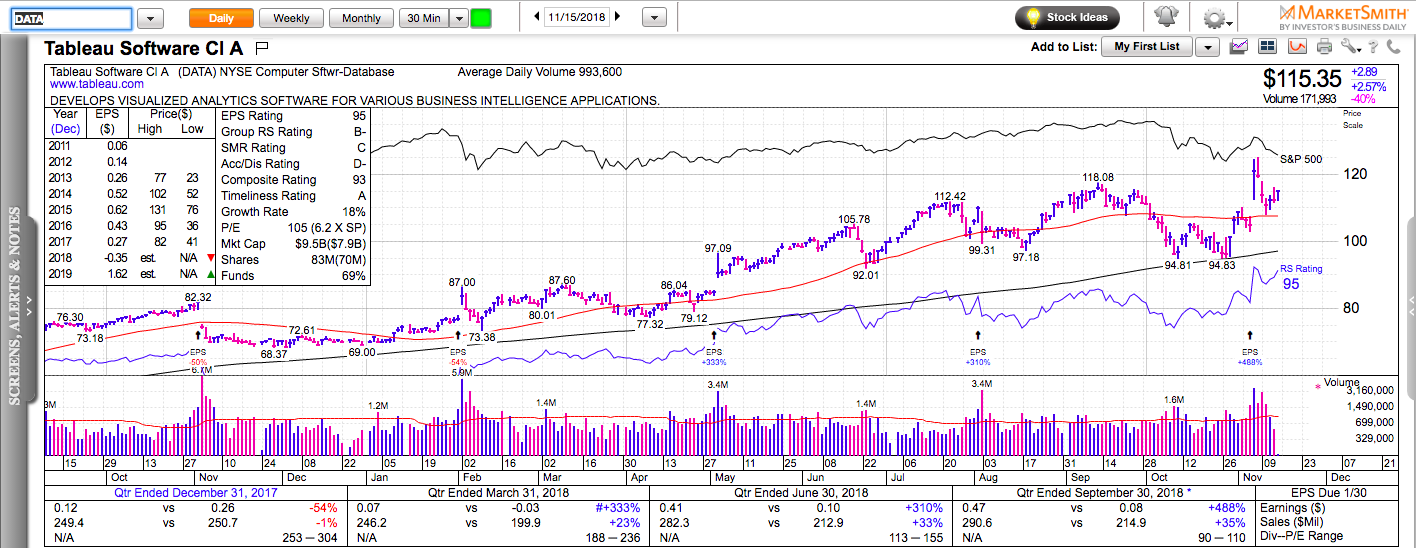

All charts on Momentum Monday are powered by MarketSmith

The major U.S. stock indexes are still in a downtrend. There’s no doubt about that. And yet, there are some signs of an impending short-term counter-trend rally. Market breadth is improving. More and more stocks are setting up near their 10-day exponential moving average.

We covered the catalysts and the technical setups in a few dozen stocks and ETFs TWLO, OKTA, LULU, SPY, QQQ, XBI, UBNT, EXAS, VCEL, AAPL, SMH, NVDA, XLNX, etc.

Check out my latest book: Swing Trading with Options – How to trade big trends for big profits.