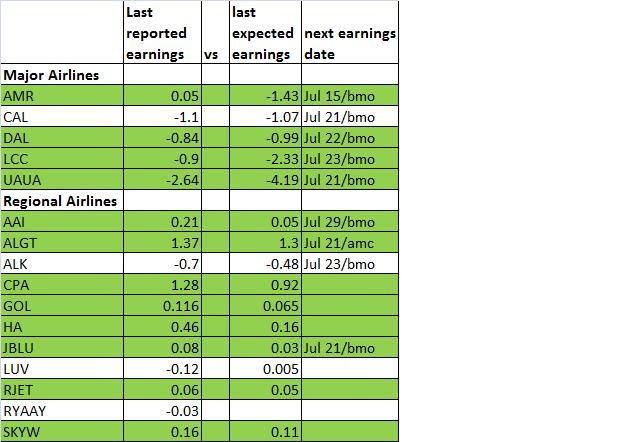

On July 15th TRGT gained 137% as 7.5 mill shares changed hands, representing 45 times the average traded volume during the previous 100 days. The stock broke out at new 6 month high from a long and relatively tight range. A new trend was born. Another biotech that doubled in 60 seconds. The news:

Targacept’s treatment for major depressive disorder was shown effective and safe in mid-stage clinical trials, paving the way for late-stage trials and discussions with the Food & Drug Administration approval. The company is also in discussions with a number of pharmaceutical companies to find a strategic partner for the development and commercialization of TC-5214, designed as a supplemental treatment in combination with other medications.

For trading purposes the nature of the news is not that important. The market reaction is. And it was a powerful reaction characterized by vast liquidity expansion (dollar volume expansion = price*volume). Since that day the stock never looked back and almost doubled after the initial explosive move.

I know it is too easy to point out recent big winners, but past is the only source to learn from it. I noticed that stock the very day it broke out, put it in my watch list, but didn’t take any action. It was just one of multiple opportunities that the market offered. I expected it to give back a little of its gain or at least to consolidate sideways, before it continued higher. I waited for a proper base of support to form and to enter the break-out from that base. It never happened. The stock just continued climb slowly every day, disregarding of the general market’s health.

What were the possible entry points after that:

1) the break-out above the high of the gap day or above $8.00. You enter early, but the potential support is too far away, therefore the size of your position should be very small (6.75 was one alternative ).

2) The break-out from the bullish flag in the $8.30-9.00 area with a stop at 8.00.

3) The bounce at 10.90 from the 10 DMA, which was also a break-out from bullish wedge. Stop at $10.00.

4) A potential break-out above flag at 13.40 with a stop at 12.40. The stock looks extended, but it looked the same way about 100% ago.

Nevertheless stops are there for a reason. Use them.

Watch for sudden, big liquidity expansions. Keep an eye on stocks that are up more than 50% in a month.

At the beginning of the year I posted the 10 best performing stocks for 2008. The list included the following stocks:

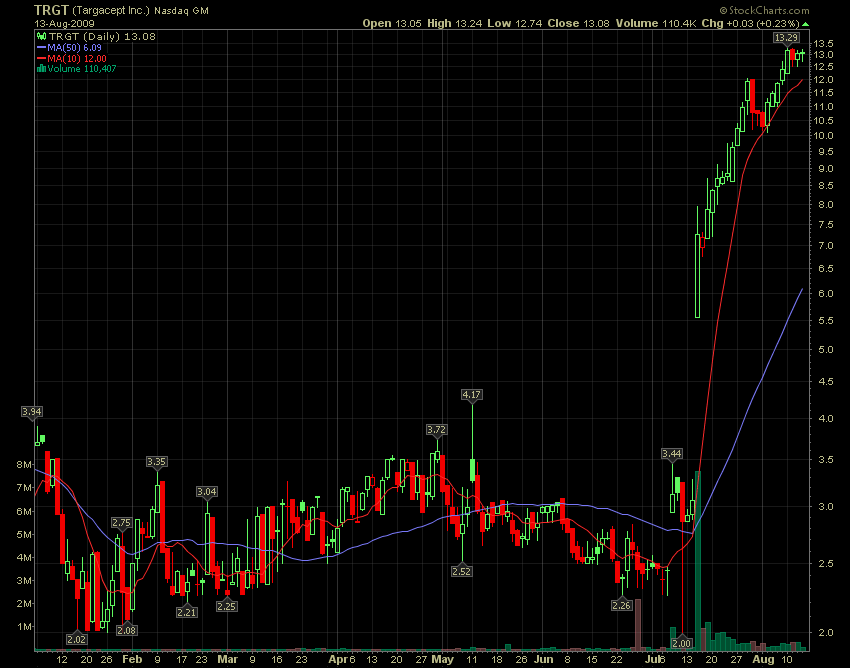

At the beginning of the year I posted the 10 best performing stocks for 2008. The list included the following stocks: There are not many industries, which stocks experience as much turbulence as the airlines. Airlines stocks are highly cyclical and their price moves are highly dependend on the price of oil. The past year was a roller coaster for many members of the Major & Regional Airlines groups. Many experineced moves from -80% to +300%, several times.

There are not many industries, which stocks experience as much turbulence as the airlines. Airlines stocks are highly cyclical and their price moves are highly dependend on the price of oil. The past year was a roller coaster for many members of the Major & Regional Airlines groups. Many experineced moves from -80% to +300%, several times.