At the beginning of the year I posted the 10 best performing stocks for 2008. The list included the following stocks:

At the beginning of the year I posted the 10 best performing stocks for 2008. The list included the following stocks:

Best performing stocks in 2008

EBS +413% / Biotechnology

STSI +345%/ Cigarettes

CRD – B +258% / Business services

GAI +245% / Appliances

AIPC +224% / Processed and Packaged goods

MXC +210% / Independent Oil and Gas

DARA +194$ / Biotechnology

KIRK +173% / Home Furnishing Store

FINL +151% / Apparel Stores

GBR +147% / Oil & Gas exploration

Let see what happened 6 and half months later:

EBS = -50%

STSI =-73%

CRD-B =-69%

GAI = -17%

AIPC = +30%

MXC = -17%

DARA = -22%

KIRK = +308%

FINL = +32%

GBR = +40%

An equal weighted percentage portfolio of all the 10 members and without using any stops would deliver 16.2% YTD. Another example of the real investing world, which confirms that 10% of our trades usually account for 80-90% of all the profits.

Huge moves, but no real edge in either direction. You might try to create a portfolio with the top 10 best performing stocks of the last year and put a stop just below the last higher low on the weekly chart. Such an approach will guarantee you that you will ride the move as long as it continues and you will jump when there is a clear sign that the major trend is in trouble.

Biotech stocks proved again that they are rarely suitable for an investment. They are trades. Many double, tripple and quadruple and then go back to where they started. Using stop losses with them doesn’t really work, since in the majority of the cases they just gap down. One way to hedge your biotech bets is to costantly protect them by 90-day OTM puts. This will protect you from disasters on the downside and give you plenty of room to ride the upside. Another possibility is to sell every month OTM calls, that are about 15-20% away from the current price. Such an approach will allow you to gradually decrease your cost basis. It will limit your upside potential and it won’t provide too big of a cushion on the downside, but it is still better than not having an exit plan. If you get exercised, your profit will be more than 20% for the month. If trend is still looking healthy, you can always jump right back in. Keep in mind that many of those stocks don’t climb gradually. The bulk of their move is often congested within a week or a month.

Catching a trend and riding it is what all investors should aim at. The ones that make money consistently know that no trend last forever and they always have an exit plan.

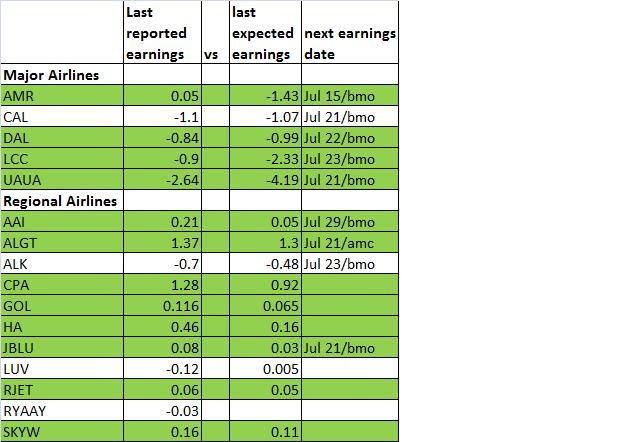

There are not many industries, which stocks experience as much turbulence as the airlines. Airlines stocks are highly cyclical and their price moves are highly dependend on the price of oil. The past year was a roller coaster for many members of the Major & Regional Airlines groups. Many experineced moves from -80% to +300%, several times.

There are not many industries, which stocks experience as much turbulence as the airlines. Airlines stocks are highly cyclical and their price moves are highly dependend on the price of oil. The past year was a roller coaster for many members of the Major & Regional Airlines groups. Many experineced moves from -80% to +300%, several times.