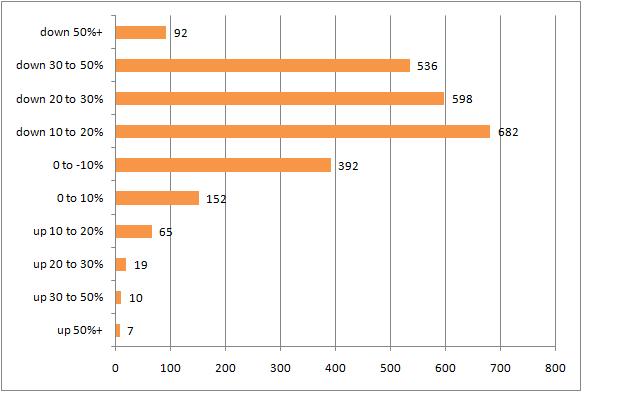

A snapshot of the monthly performance of stocks priced above $2 and with average traded daily volume of over 100k

We haven’t seen that much weakness in the market since Mid November last year. 1226 stocks were down more than 20% for the last month. This is an incredible destruction of shareholders’ wealth. So many different industries were affected, that it would be more beneficial to mention those that so far have managed the storm – Agriculture chemicals, Internet providers, Gold, Food processors, Semiconductors, Sporting goods, Wireless communications.

92 stocks have declined more than 50% during the last month vs only 7 up more than 50%. I follow this ratio closely as the market tends to turn when it reaches extremes. It has been there for the last couple of days, but this market doesn’t care about it and daily rewrites the history of all oversold indicators. Many expect (hope) for a bounce tomorrow.( Including me).

Other than 2 quick day trades in $UAUA( one short, one long), I sat on my hands all week. I have a bullish bias for tomorrow just because if you read the news you’d tell yourself that things couldn’t get any worse. They could and this is why I am still not willing to hold a position over night. I prefer to protect capital and live to trade another day.

In times like this, it is always useful to remember Paul Tudor Jones words about market extremes:

There is no training – classroom or otherwise – that will prepare for trading the last third of a move, whether it’s the end of a bull market or the end of a bear market. There’s typically no logic to it; irrationality reigns over supreme, and no class can teach what to do during that brief, volatile reign. The only way to learn how to trade during the last, exquisite third of a move is to do it, or, more precisely, live it.