The market seems tired as it approaches it declining 50dma. The small caps ($IWM) led to the downside today, indicating that no one wants to risk too much in front of big economic announcements. The latest Unemployment report is expected tomorrow. I don’t think it will have any significance whatsoever. The market has already accepted and probably discounted that unemployment is likely to stay elevated for an extended period of time just like the 0% interest rate and that the economic growth is likely to slow down accros the world. Bad economic news is not really news for Wall Street anymore. It is expected. European banks remain the potential turning points that could impact sentiment.

I have a feeling that both bulls and bears will be disappointed in the next few months and we won’t see neither retesting of the August lows, neither repetition of last September rally.

The recent market turmoil has conditioned many traders to quickly take profits, pull back to safety when the slightest risk is perceived and reduce overall exposure as much as possible. This is what volatile markets do to your mind. They make you much more conservative and urge you to question every trading or investment thesis you have. It is a condition that is curable, but only by the market and through time.

The good news is that the correlation 1.0 period is behind our back and individual stock catalysts matter again. We are in a stock pickers market.

Three big moves deserve to be highlighted today:

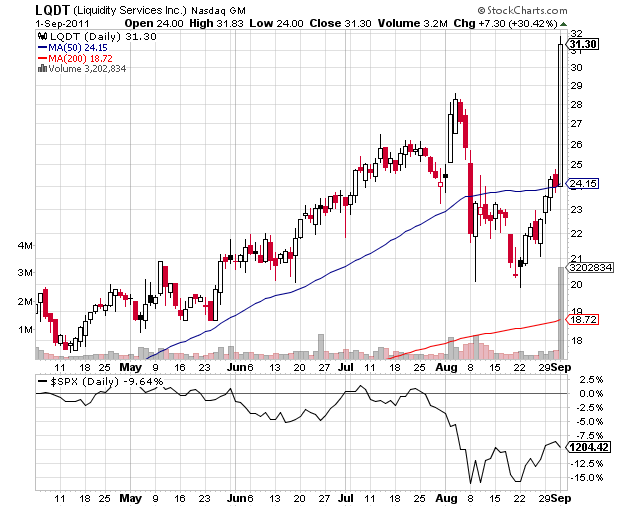

$LQDT rocketed 30% to all-time high, trading more than 12 times its average volume. These are the signs of elephants dancing, of institutions buying. The auction website for surplus and salvage assets announced that it has agreed to acquire the consumer goods remarketing business of Jacobs Trading Company for $140 million.

$SPRD, which is Chinese semi-conductor company, advanced 8% to a new 50-day high. Capital has been coming back lately to some of the more established Chinese ADRs.

$DTLK gained 9%, bouncing from its rising 50dma. They had a tremendous earnings report that lifted the stock to new 5-year high back in July. Then, the selloff in August took it down.