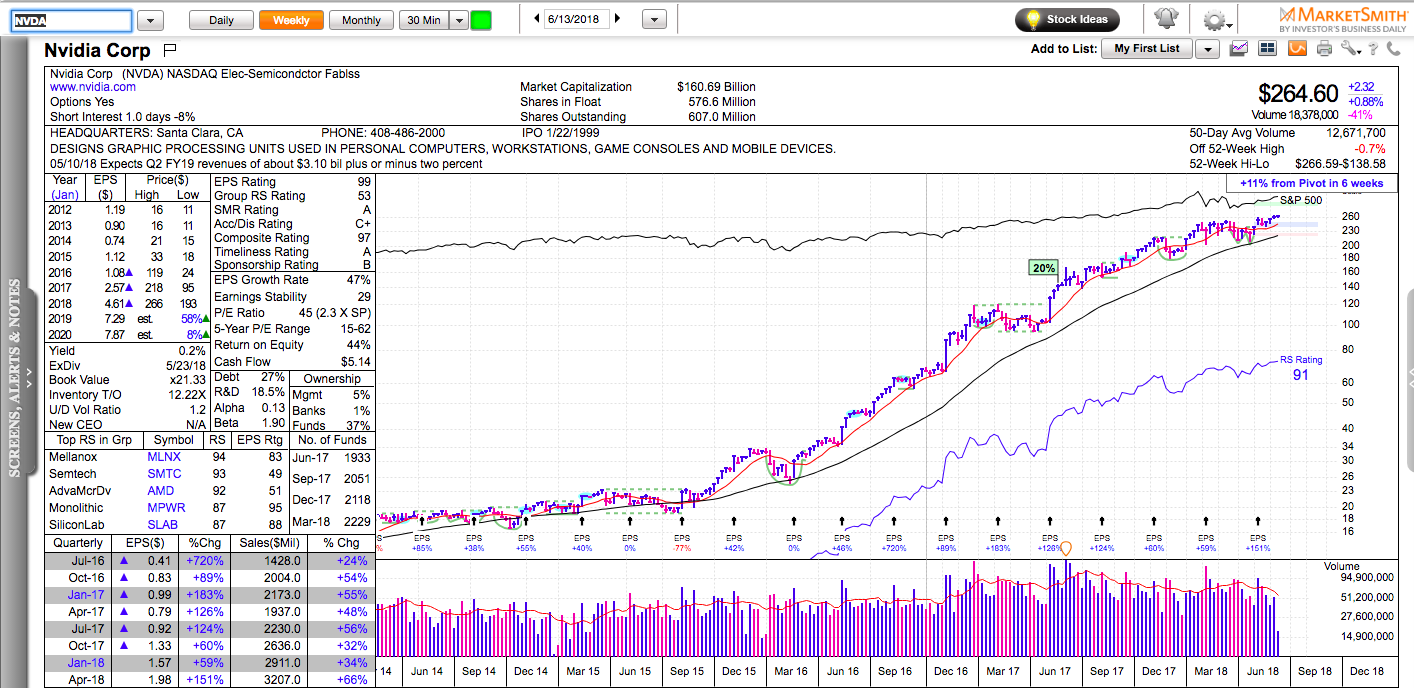

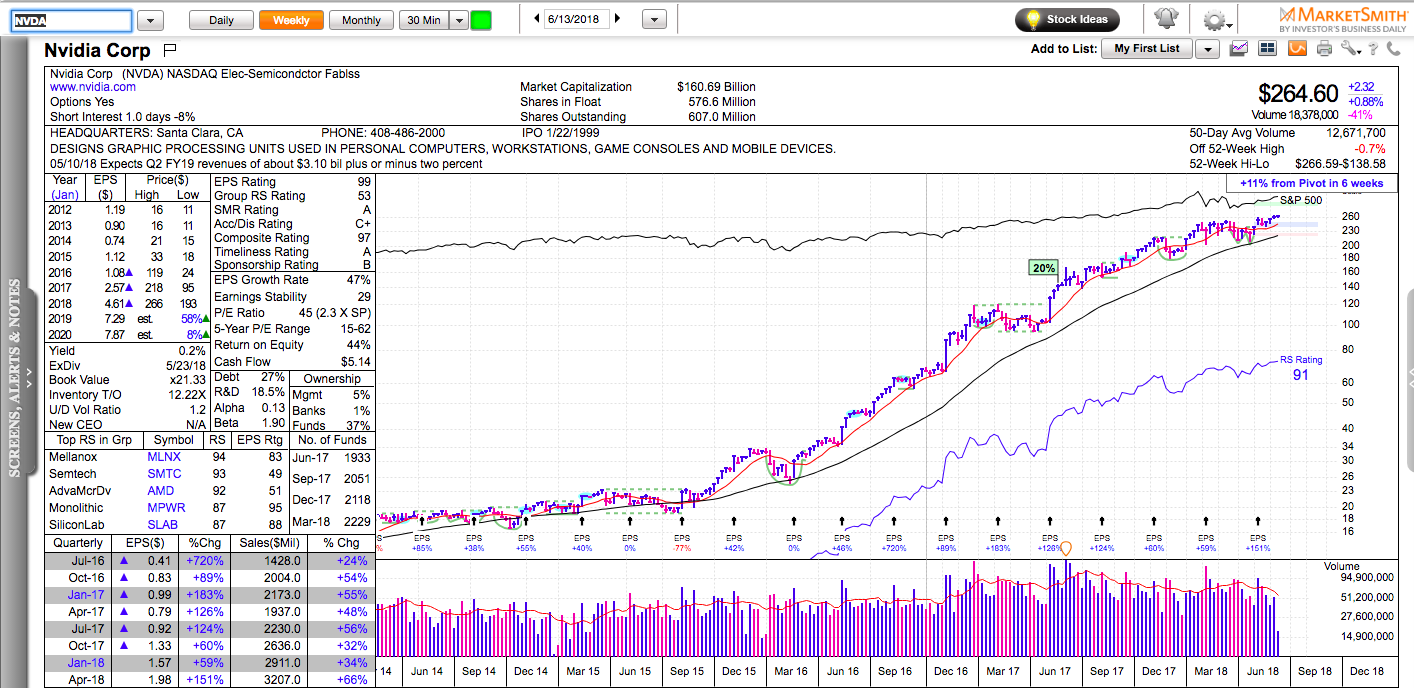

Charts in this post are powered by MarketSmith.

The two biggest errors in bull markets are usually errors of omission. Not buying a stock because it is up too much too fast or not buying a stock because you sold it at a lower price recently.

If you bought something at 10 and sold it at 14, the odds are that you are not going to buy it back at 20. Even if the new setup looks incredible, it will be like chasing to most. This is why momentum investing is a contrarian approach and it continues to work. It seems easy only in hindsight, but it is never so when you have to apply it in real time.

People need time to adjust to new prices. When a stock goes from 40 to 160, it seems extremely expensive to everyone. It takes spending a considerable amount of time in that new price range, for people’s mental model to change. This is why many momentum stocks build new bases after a considerable recent run.

The typical momentum stock goes through 3 distinct stages:

1. Price leads – expectations for a brighter future attract buyers and a company price appreciates very quickly mainly because of a P/E expansion. The market is willing to pay a higher price for the expected earnings. FOMO (fear of missing out), short squeezes, and the overall market sentiment also have a big impact. An optimistic market might be willing to pay several times higher price than a pessimistic market for the same earnings growth.

2. Price spends some time in a range while earnings growth catches up with the market expectations. The market made a bet for a brighter future in stage one and now the company needs to prove the market right by delivering strong earnings growth. If a company fails to meet the market’s high expectations, its stock might quickly decline 50% or more.

3. Price growth and earnings growth go hand in hand.

NVDA might be a typical example. It had a huge run in 2016-2017. It seemed expensive all the way from 40 to 200. Then, it spent 6 months in a range and now it is setting up again near its all-time highs. $300 is very possible scenario by the end of 2018.

Disclaimer: everything on this website is for informational and educational purposes only. The ideas presented are not recommendations to buy or sell stocks. The material presented here might not take into account your specific investment objectives. I may or I may not own some of the securities mentioned. Consult your investment advisor before acting on any of the information provided here.