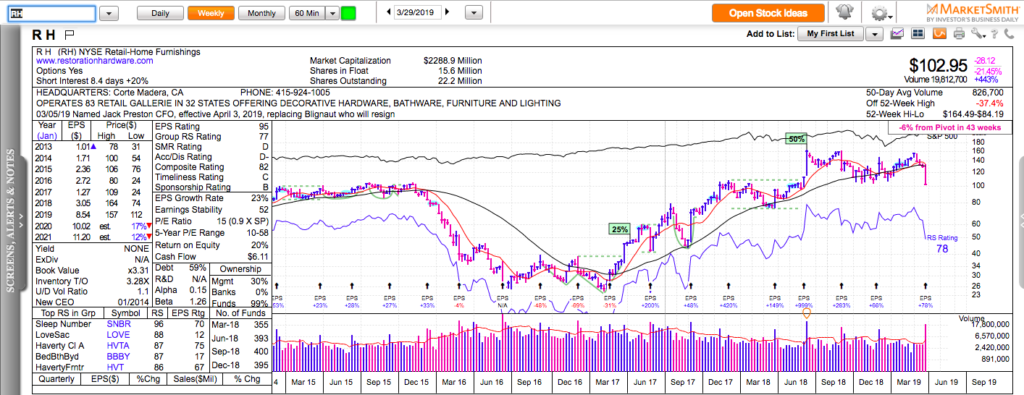

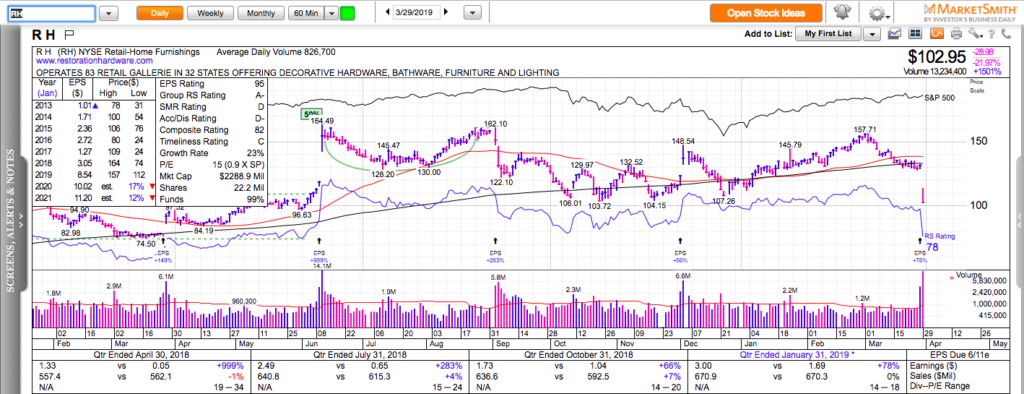

All charts in this post are powered by MarketSmith

RH had a tough day on Friday. The market didn’t like the lack of sales growth and sent their shares 20% lower near the $100 mark. Since $100-105 has acted as resistance before, many assume that it can act as a support today.

RH is a highly shorted stock with a tiny 18-million shares float. 35% of its float is short. If enough short sellers decide to

From a longer-term perspective, things are not that rosy for RH. The CEO of the company borrowed heavily in the past few years in order to buy back RH shares. As a result, RH became highly leveraged with a debt/equity ratio of 37 and its outstanding shares have declined substantially: from 40 million to 27 million shares. The drop in outstanding shares is the main reason why RH can report a 75% earnings growth along with 0% sales growth.

To sum things up: RH is leveraged to the hills, it is in the highly cyclical overpriced furniture business and its sales are not growing. The company borrowed a lot of money to buy back its own stock at a very high price. When the next recession comes, I won’t be surprised to see RH trading under $10 per share. People should treat it as a short-term trading vehicle and not as a long-term investment.

I have no position in RH.

Check out my last two trading books:

Swing Trading with options – How to Trade Big Trends for Big Profits

Top 10 Trading Setups – How to find them, hot to trade them, hot to make money with them.