Capital constantly moves from one sector to another, from one asset class to another. While your major attention should be focused on price action of the assets you own or trade, the ratios below help to look below the obvious surface and gauge the underlying market themes. You can tell a lot about capital markets’ confidence and direction of money flow.

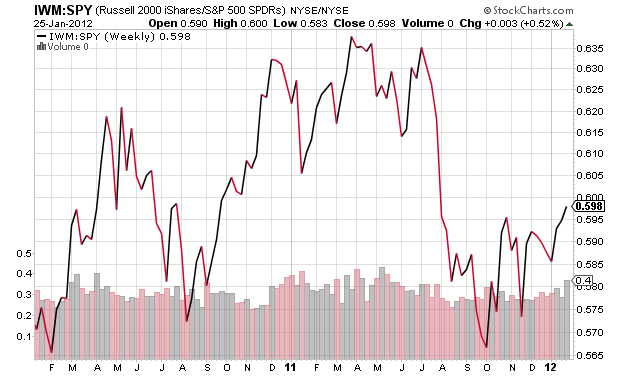

1) Small cap ($IWM) vs Large Cap($SPY)

Small caps are more volatile as they are easier to move. They tend to outperform in periods of rising confidence and drastically underperform during corrections, when the bids for them simply disappear.

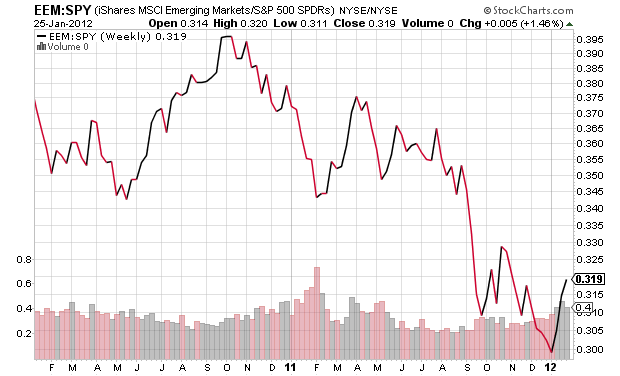

2) Emerging Markets ($EEM) vs $SPY

Emerging markets are synonymous to higher growth and higher yield. When the the fear of missing out is bigger than the fear of losing, emerging markets tend to outperform.

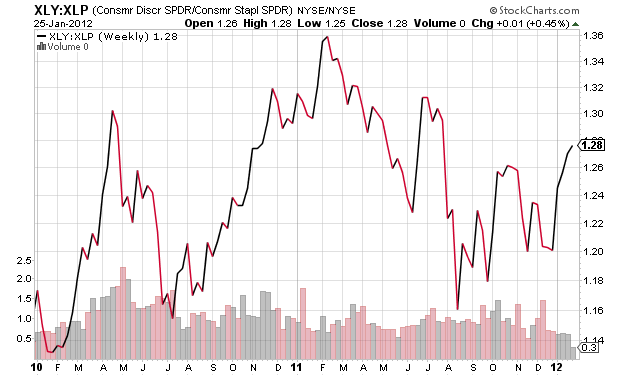

3) Consumer Discretionary ($XLY) vs Staples($XLP)

When the stock market is in a process of discounting potential economic slowdown, staples tend to outperform as money chases recession-proof, dividend paying companies like tobacco and healthcare, for example. Consumer discretionary stocks are cyclical plays and tend to outperform during periods of increased optimism.

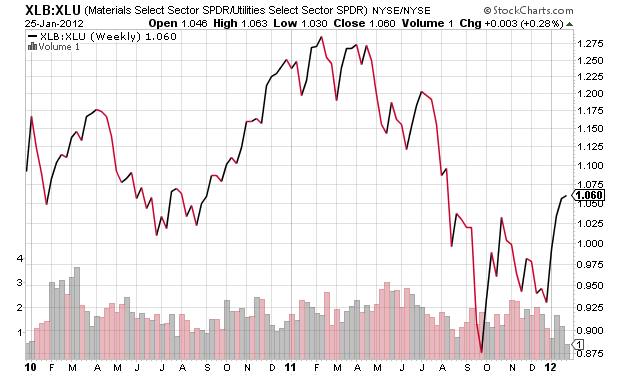

4) Basic Materials ($XLB) vs Utilites ($XLU)

The ultimate leading indicator of rising inflation is price action in commodities. Highly leveraged, high dividend paying utilites tend to outperform in period of pessimism and deflationary expectations, and severely underperform during “risk-on” market periods.

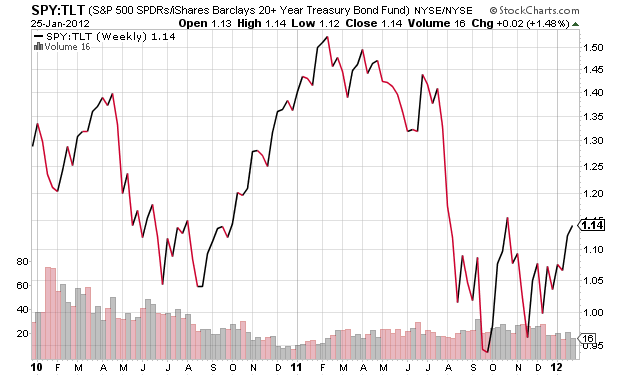

5) $SPY vs Long-term Treasuries ($TLT)

When the return of principle is more important that the return on investment, U.S. Treasuries are considered the ultimate safe haven and capital flows to perceived security. When money is chasing return and market mood is improving, capital tends to favor equities.

For example, curently the 5-year U.S. Treasury note yields less than 1%, the 30-year treasuries yield 3.15%. No hedge fund could justify its fees or pension fund reach its annual target by investing in these vehicles. Once the fear of losing principle subsides and inflation expectations kick in, equities tend to outperform.

15 thoughts on “Five Indicators to Gauge Risk Appetite”

Comments are closed.