The charts in this video are powered by MarketSmith

The new earnings season coupled with the coronavirus fearmongering is certainly contributing to a choppier tape. As a result, gold and U.S. Treasuries have been rallying. Both can be a good hedge. When the volatility genie escapes the bottle, it is hard to get him back in. A rise in volatility typically begets more volatility, at least in a short-term perspective.

Everyone is looking at the price action of the indexes for a clue if a correction is coming. The problem with this approach is that the indexes are lagging indicators.

The biotech ETF which was among the first ones to break out and lead this rally in October is now among the first ones to break below its 50-day moving average. 89-90 is a huge level for XBI and if it doesn’t hold, we might be in for a lot more volatility.

Of course, this might be just another sector rotation. On Friday, we saw enterprise software stocks showing clear relative strength. MDB, TWLO, EVBG, PLAN, and others were green in an ocean of red. It can be due to the strong earnings report from Atlassian (TEAM) or it can be because of a bigger industry-wide reason. We will know soon enough.

Try my new subscription service which includes a private Twitter feed with option and stock ideas, a weekly newsletter with concise market commentary and actionable swing and position trade ideas, the Momentum 50 list of market leaders and much more.

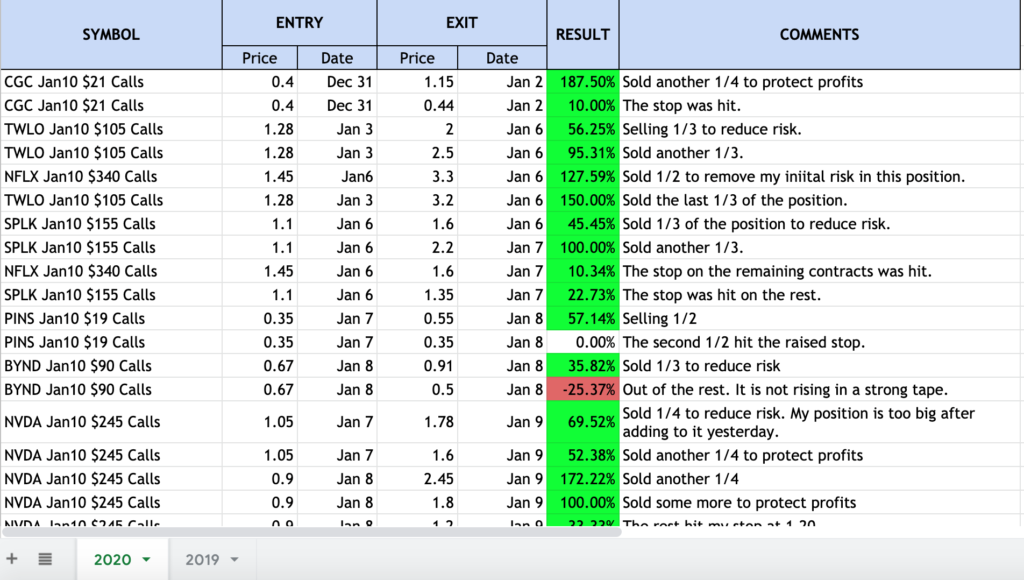

PERFORMANCE

Here’s a Google spreadsheet tracking all closed option and stock ideas shared on my private Twitter stream and weekly email for subscribers.