The charts on Momentum Monday are powered by MarketSmith

Three developments stood out last week:

1. The small-cap index, Russell 2000 had a big breakout. Small caps are trying to catch up with large caps, which many of which have been making new all-time highs every week in the past three months. For Russell 2000 to catch up with the S&P 500 and the Nasdaq 100, it will need some heavy lifting from energy and financial stocks which are still lagging for the most part.

2. The highest-shorted stocks outperformed again. So many stocks with high short interest continue to squeeze higher: CGC, TLRY, TSLA, LK, PETS, SHAK. Some potential candidates for the next week: DDOG, PTON, INMD, STNE.

3. The earnings season has just begun. So far, a few big banks and a few semiconductor companies reported. Starting next week, it gets a lot more interesting as companies like NFLX, SBUX, INTC, and TEAM.

We also talked about the impact of tariffs on semiconductors and why AMZN is lagging the other mega caps.

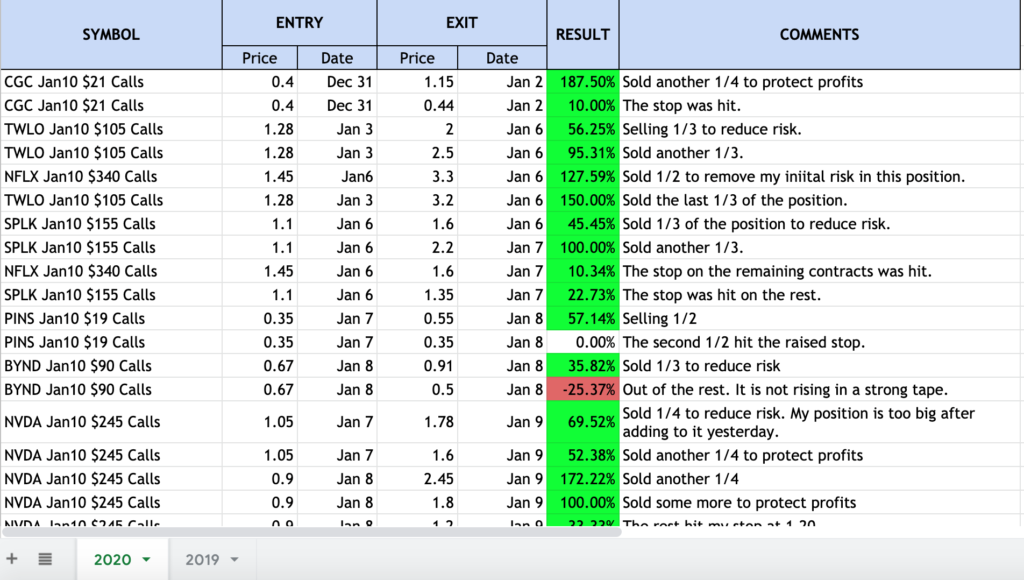

Try my new subscription service which includes a private Twitter feed with option and stock ideas, a weekly newsletter with concise market commentary and actionable swing and position trade ideas, the Momentum 50 list of market leaders and much more.

PERFORMANCE

Here’s a Google spreadsheet tracking all closed option and stock ideas shared on my private Twitter stream and weekly email for subscribers.