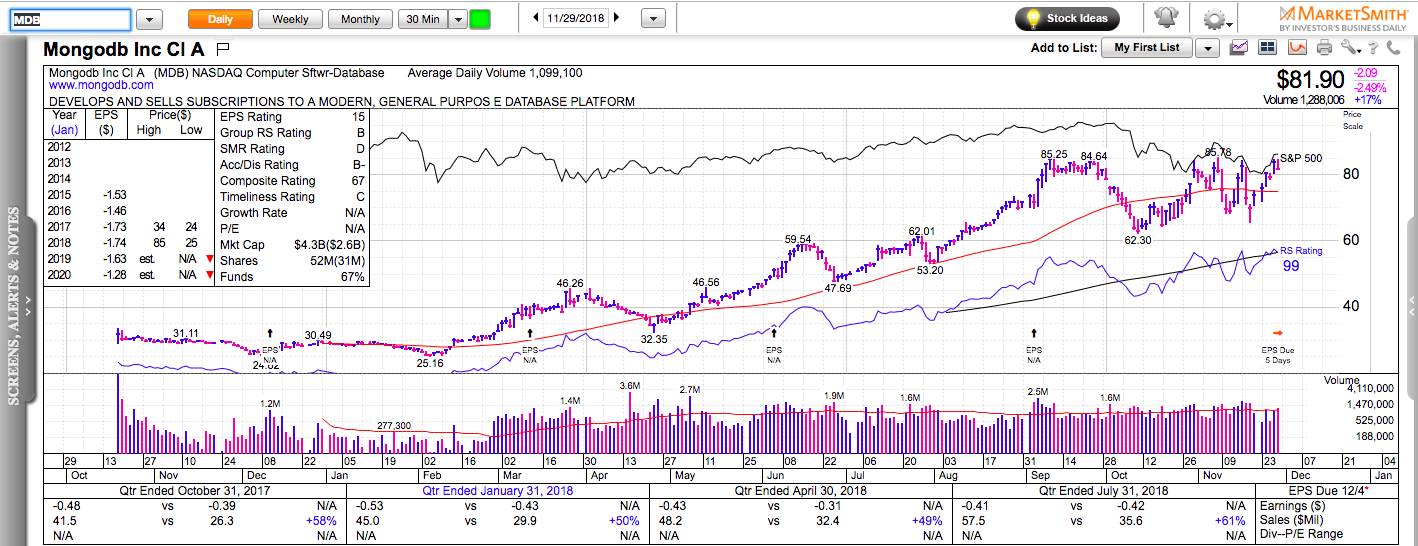

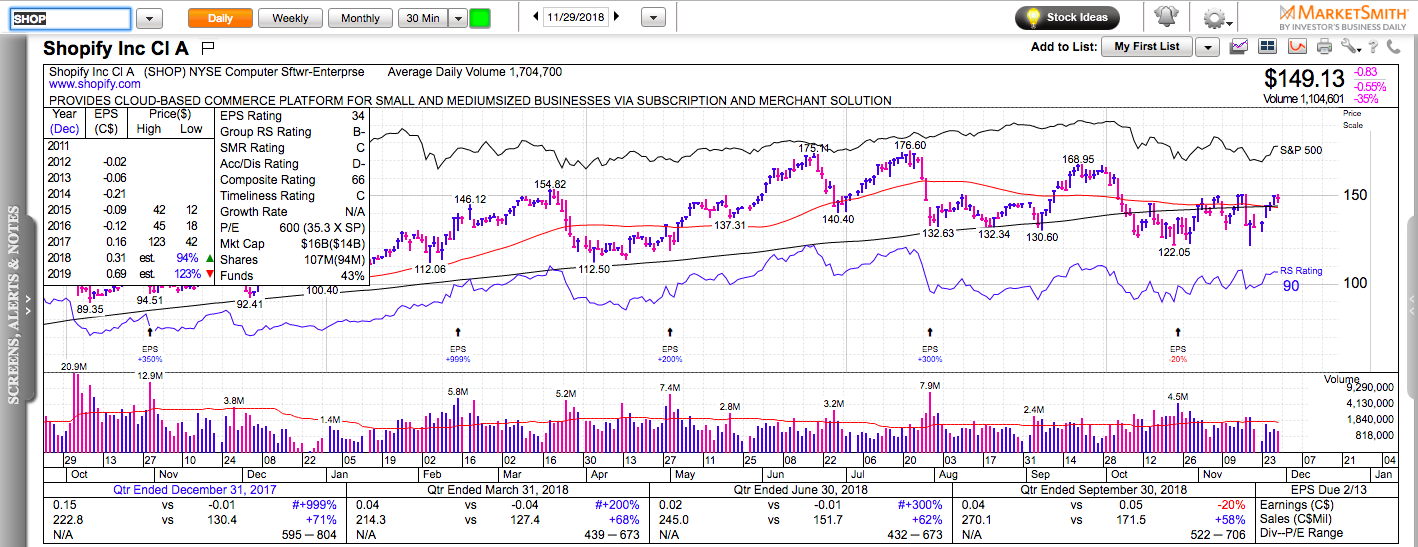

All charts in this post are powered by MarketSmith

MDB is consolidating near all-time highs. A break above 85 might trigger a bigger upside move. 80 is a decent stop level for a short-term trade. Keep in mind that most breakouts have failed in the past couple of months, so you should not overstay your welcome. Be nimble and take partial profits quickly. I’d sell half at 90 which represents 1x risk, a quarter at 95 which would be a return of 2x risk and let the rest ride until it closes below its 10-day EMA.

It’s always good to have several scenarios for a stock, especially in this market environment where the wind changes on a daily basis. If MDB clears 85 but it fails quickly and closes below 85, it can probably be shorted for a move to 75 (especially if the major stock indexes are breaking down as well).

The problem with MDB is that they report earnings on December 4th, so none of the above mentioned scenarios will have enough time to play out.

SHOP has been a wild horse in the past couple of months. Trending stocks tend to acknowledge their 50 or 10-day moving averages (stay above them while in an uptrend and below them while in a downtrend). This hasn’t been the case with SHOP, which has been languishing between 120 and 150 for quick some time.

A break of 151.60 can potentially push SHOP to 165 in a short-term perspective. If that breakout fails and SHOP goes below 143, it can be shorted until 125.

Check out my latest book: Swing Trading with Options – How to trade big trends for big returns.