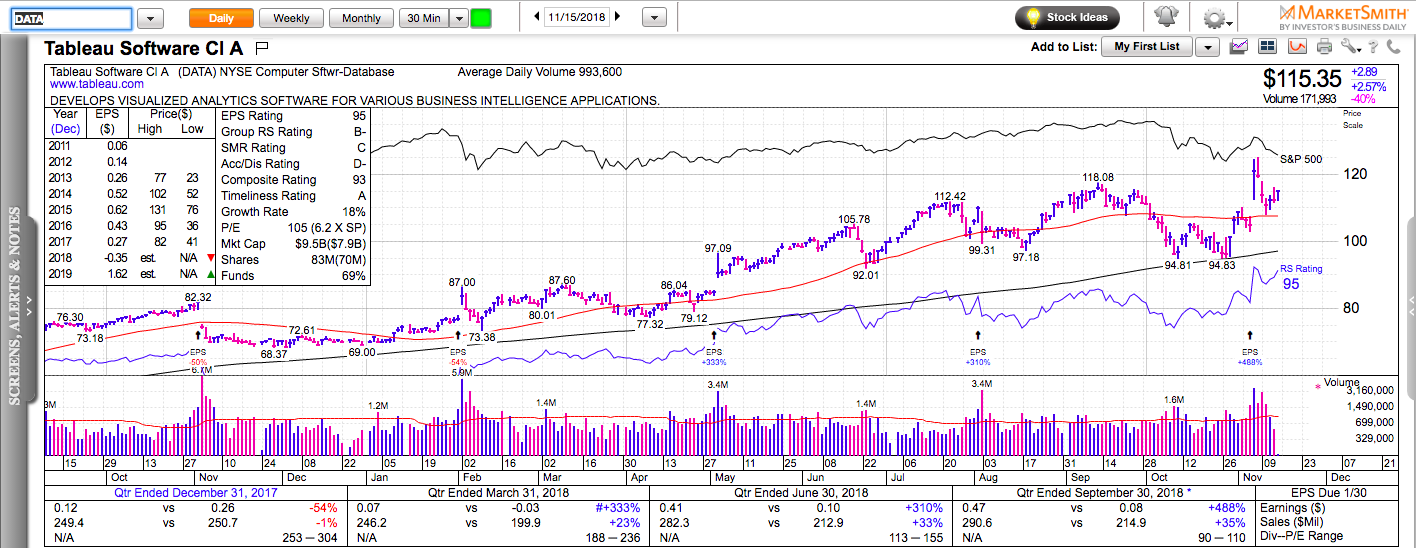

All charts in this post are powered by MarketSmith

SPY and QQQ have recently pierced below 270 and 165 – levels that were considered important to hold. In addition, one of the best-holding sectors (the last bastion of hope) – retail, has been crushed in the past couple of days. The market mood is grim. The price range in the major U.S. stock indexes has contracted today. Market breadth is starting to improve. These are the exact conditions that might lead to a short-term bounce.

There are two types of stocks that tend to outperform everything else during market bounces:

1) The ones that got hit the worst (biotech).

2) The ones that held the best.

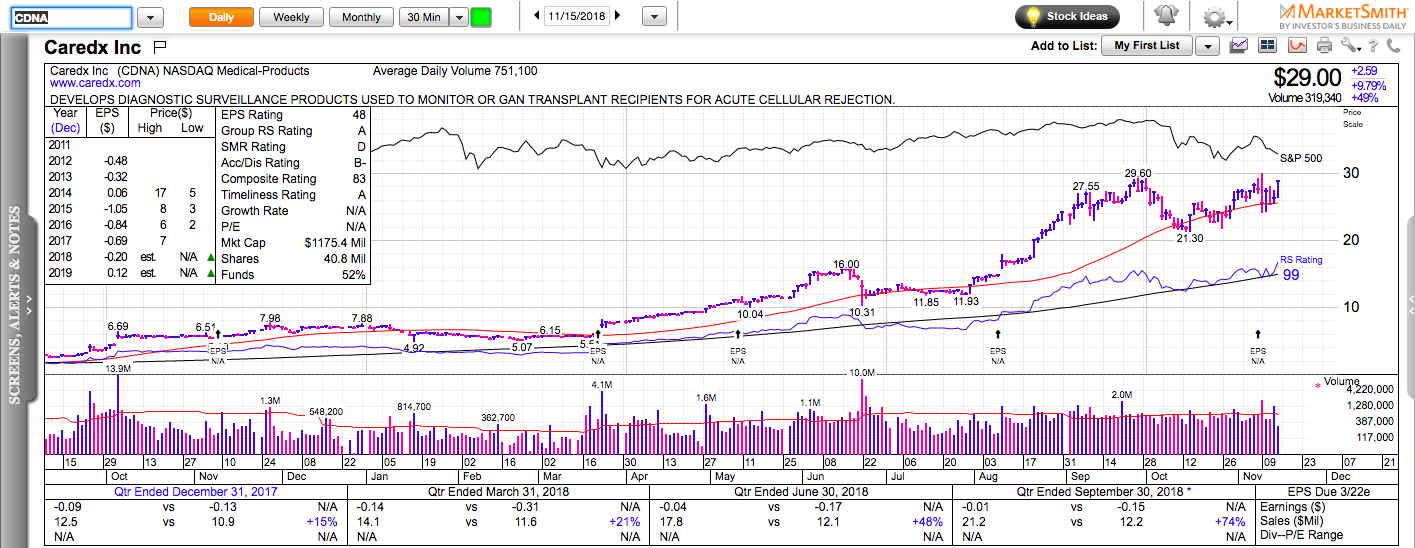

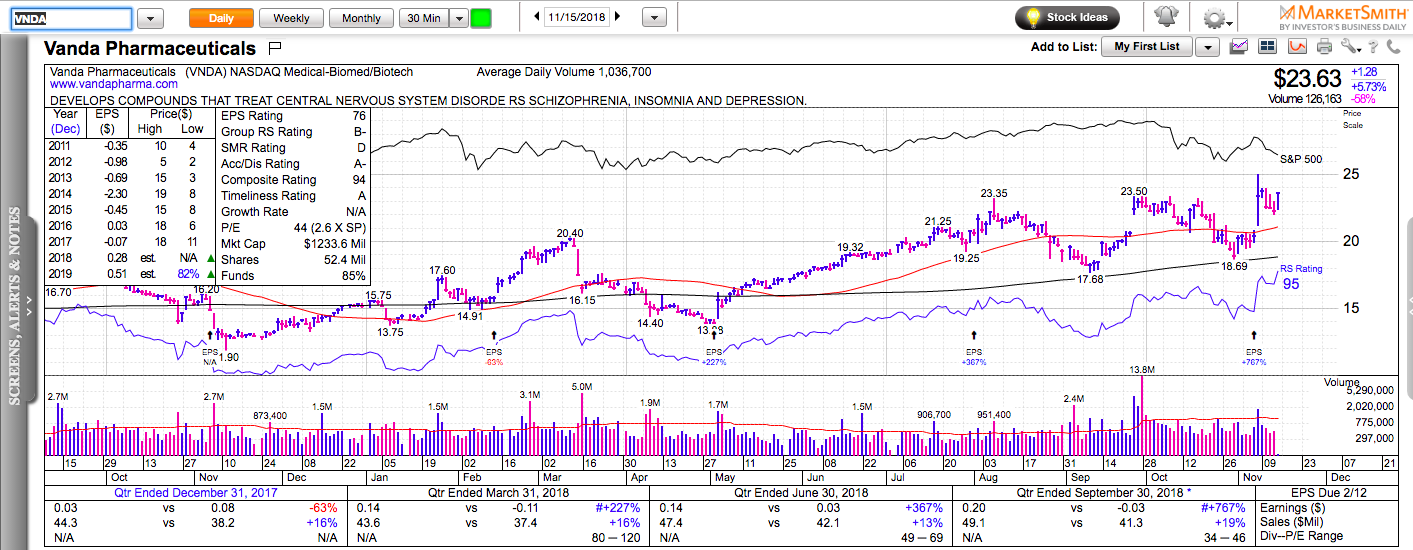

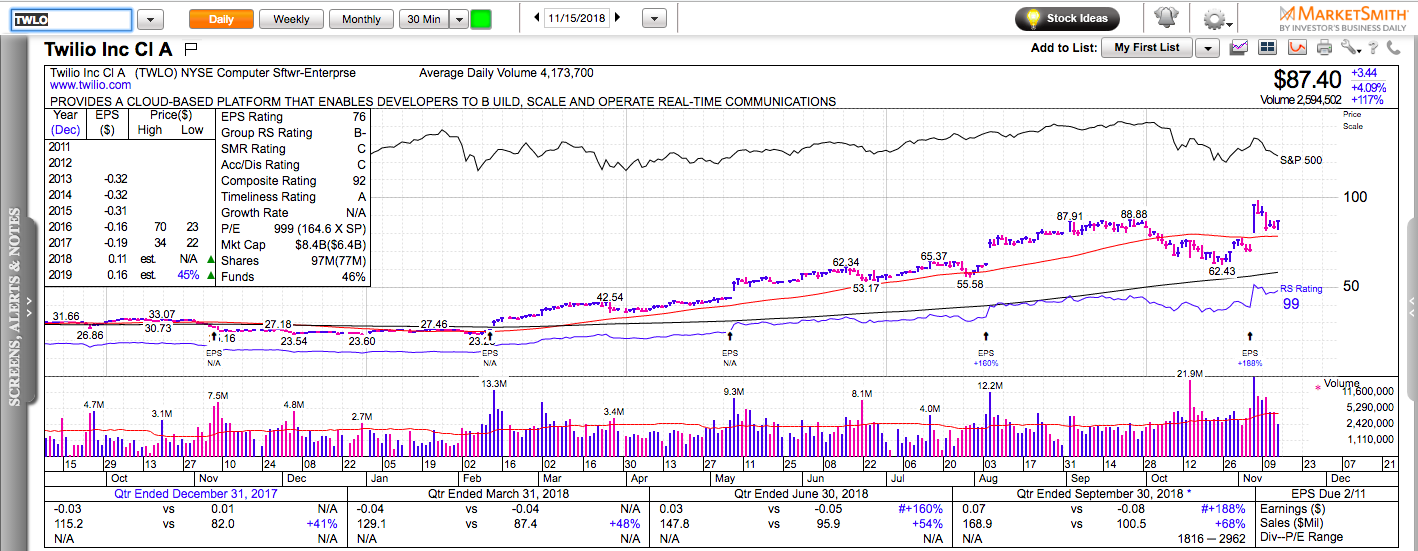

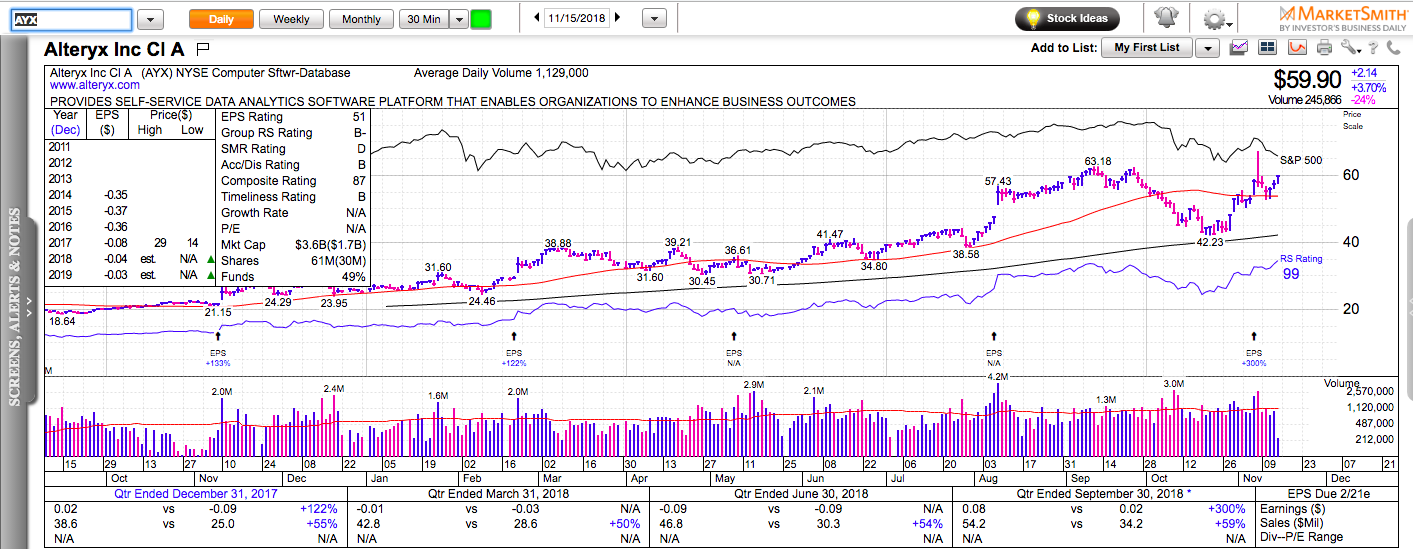

Here are five stocks that have recently beat earnings estimates and are showing notable relative strength (they went sideways or up while the market was declining): CDNA, VNDA, TWLO, AYX, DATA.

Check out my latest book: Swing Trading with Options – How to trade big trends for big returns.