Various market breadth readings have been overbought for a week already. In most situations, it means that a short-term pullback is likely. There is one exception. When stocks recover from a deep correction, it is normal for market breadth to quickly reach overbought levels and stay there for quite some time while sector rotations take care of the extremes.

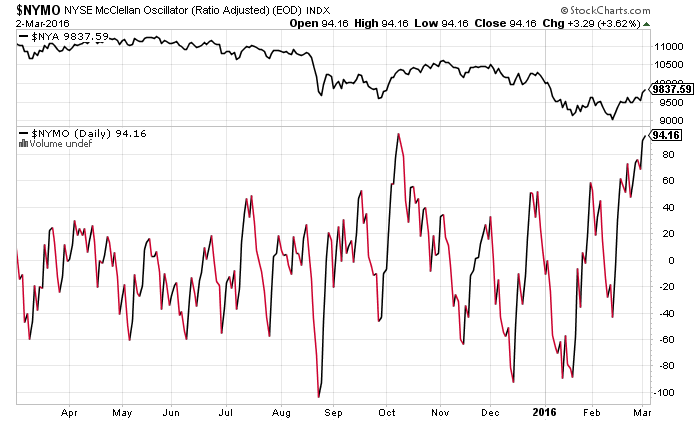

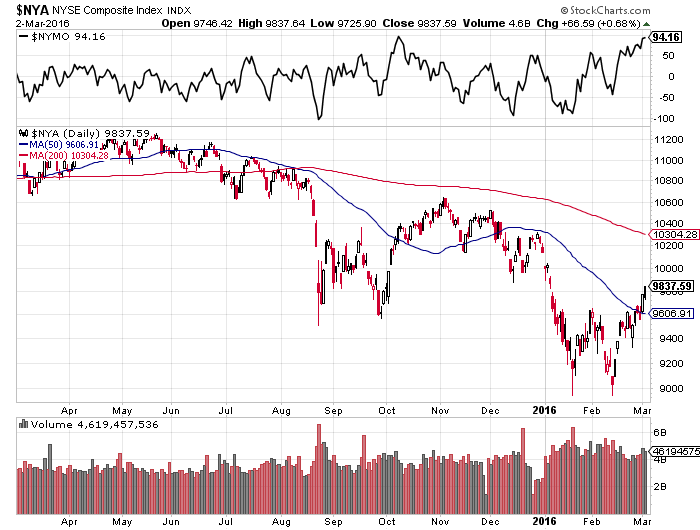

Look at the chart below featuring the New York Stock Exchange Composite (NYA) and the NYSE McClellan Oscillator ($NYMO).

There are two lessons from this chart:

1) In October 2015 and in February 2016, the index made a new price low with a positive breadth divergence. NYA made new lows while NYMO didn’t. This marked a short-term bottom and the beginning of a powerful rally. Study any past correction and you will realize that bottoms are formed when there’s some form of positive breadth divergence and market breadth always bottoms before price.

2) In October 2015, NYA continued to advance even after breadth readings (NYMO) reached extremely overbought territory and started to pull back. Sector rotations and skeptics coming back on the long side kept the rally going until NYA reached its declining 200dma. It is still below its declining 200dma, but this is another discussion to have. Study any past correction and you will realize that market breadth (NYMO) always reaches super-overbought readings when indexes are recovering from a >10% decline. Those overbought readings don’t usually lead to an immediate decline in the indexes. On the contrary, in most cases the indexes continued to slowly climb higher. Those who were afraid to jump back in because of overbought breadth readings were in a way locked out of the rally. The market didn’t give them a chance to get back in. It is the nature of the market to surprise the majority.

I am not saying that overbought and oversold market breadth readings should be ignored. On the contrary, they are very useful indicators most of the time. Everything should be looked in context. There are always exceptions to the rule. Knowing when an indicator can be ignored is just as important as knowing when it could be trusted.