Prices don’t change when fundamentals change. Prices change when expectations change and the latter could change for various irrational reasons. By the time expectations are confirmed or disconfirmed by facts, most of the move might be already over. This is how financial markets often work. They price a future that hasn’t happened yet. As a result, they will sometimes price events that might never happen.

There is absolutely no need for Fed to raise interest rates in the next few months. Some say that Fed has to raise rates now, so it has some firing power when a recession comes. This sounds like a stupid marketing gimmick to me. It is like getting a patient sick, so you could treat him later.

Let’s look at the facts:

1. U.S. economy is not growing that fast to justify tightening. Q4 GDP in 2014 was 2.2%.

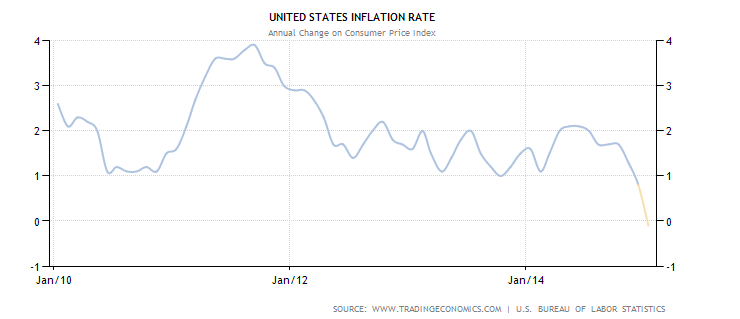

2. We are in a period of disinflation.

3. The incredible rise in U.S. Dollars will significantly slow economic growth and inflation down. The strengthening of the Dollar is a major tightening on its own.

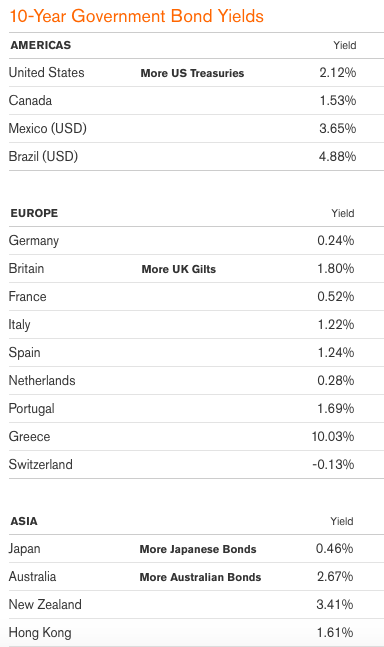

4. U.S government bonds’ yield might be low, but they are much higher than what the rest of the developed world currently offers. At these rates, there are plenty of buyers for U.S. Treasuries.

What does that mean for us as investors and traders? The notable spike in the U.S. Dollar is a major sting for multinationals, which derive a large portion of their revenue internationally. This is one of the reasons why large caps have been under so much pressure in the past few days. Many small caps are less dependent on Dollar’s fluctuations. The combination of a strong dollar and potentially not raising interest rates will create a favorable market environment for small caps, on a relative basis. In 2014, we saw a major market divergence – large caps substantially outperformed small caps. In 2015, we might see the opposite.