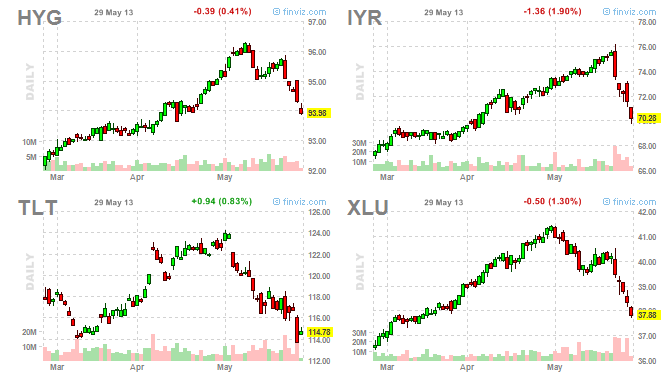

The most interest rate sensitive assets continue to be under pressure and deteriorate in an accelerated fashion, to a point that it won’t be a surprise if we see some snap-back mean-reversion later this week. The premise is that a potential QE tapering will lead to an increase in yields across the board. Notice that the FED might be months away from changing its policy, but it does not matter to the market. Financial markets live in the future and are forward looking by nature. They constantly discount events that have not happened yet. As a consequence, they will sometimes discount events that will never happen. When the expected events don’t occur, markets self-correct.

The element of speculation is an inherent part of the market and it is a major moving force. You better accept it and find a way to deal with it. Prices changes when expectations change and expectations could and often change much before fundamentals change. This is why price is considered a leading indicator – sometimes ends up being right, sometimes ends up being wrong, but it is leading nonetheless.